CLSA upgrades CLAR and Keppel DC REIT, issues downgrades on seven other S-REITs

The recommendation changes come after factoring-in a higher risk free rate and borrowing costs, says CLSA.

Going into 2023, the Singapore REITs (S-REITs) sector may face growing scrutiny on their distribution per unit (DPU) resilience, say CLSA analysts Wong Yew Kiang and Mog Shi Xian. The sector may also see the possibility of asset write-downs from the expansion of cap rates, they add.

Earlier in November, the US Federal Reserve raised interest rates by 75 basis points, bringing the Fed funds corridor to 3.75% to 4%, which is in line with CLSA’s expectations, as well as that of the consensus.

According to Wong and Mog, CLSA’s economics team estimate that the US Fed is likely to see another tightening round past its meeting in February 2023. The economists’ estimates have also shifted CLSA’s central case to include two more 25-basis point hikes in March and May 2023, which brings the brokerage’s terminal rate to 5.25% from 4.75%.

On the back of this, CLSA’s risk free rate assumption has also been lifted to 3% from 2.1% previously, slightly higher than the 30-year average of 2.68% but in line with the spot rate of 3.03%.

Should a cap rate expansion take place, REITs such as Mapletree Pan Asia Commercial Trust (MPACT), Keppel REIT and Suntec REIT will be the most vulnerable, note Wong and Mog. Suntec REIT, especially, is the most likely to have its gearing breach the regulatory limit of 50%, they add.

Conversely, REITs such as SPH REIT, CapitaLand Ascott Trust (CLAS), Keppel DC REIT, Frasers Centrepoint Trust (FCT) and CapitaLand Ascendas REIT (CLAR) will remain “comfortably” below the gearing limit.

Wong and Mog add that their DPU sensitivity to rising interest costs suggest “highest erosion for Suntec REIT and Keppel REIT at 15.4% and 8.7% under a 200-basis point interest rate stress test”.

Among the REITs, Suntec REIT was the most exposed to the rising interest costs with only 58% of its debt hedged with fixed rates. Conversely, Mapletree Logistics Trust (MLT) had the highest percentage of debt hedged with fixed rates among the S-REITs.

Manulife US REIT (MUST) and ESR-LOGOS REIT (E-LOG) stood out as having the highest all-in cost of debt at 3.3% while CLAS and SPH REIT had the lowest all-in cost of debt at 1.7% and 1.8% respectively.

“The ability of REIT managers to top up DPU with capital distribution will also be a key differentiator in 2023 in our view, and Keppel REIT is one of the REITs with scope for this,” the analysts write.

With the recent spotlight on interest coverage rate (ICR), Suntec REIT and MUST are “technically most at risk in this respect mainly owing to their high gearing”, they add.

In the office S-REITs subsector, the analysts are expecting rent growth for Grade A offices to contract some 5% y-o-y to $11.21 psf per month in 2023, down from an expected growth of 7.5% y-o-y, or $12.48 psf per month.

Within the retail subsector, the analysts have upped their growth forecasts for prime retail rents from 0% to 1% in 2023 due to the recovering leasing demand. They have, however, lowered their y-o-y growth forecast for the overall subsector to 1% in 2023, down from 3% previously.

Among the industrial S-REITs subsector, the analysts see rental reversions remaining positive in 2023 “but at a moderate pace”.

Factoring-in a higher risk free rate from 2.1% to 3.0% as well as borrowing costs, the analysts have lowered their DPU forecasts on average by 6% for the calendar year (CY) 2023 and by 13% for 2024.

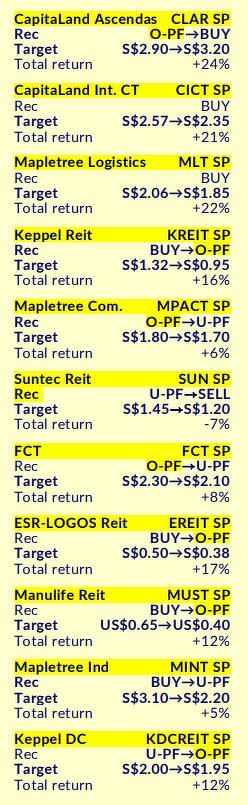

They have also downgraded their recommendations on seven REITs – E-LOG, FCT, Keppel REIT, MUST, MPACT, Mapletree Industrial Trust (MINT) and Suntec REIT – to “accumulate” or “O-PF”, “reduce” or “U-PF”, “accumulate”, “accumulate”, “reduce”, “reduce” and “sell” respectively.

Two REITs, CLAR and Keppel DC REIT, were upgraded to “buy” and “accumulate” respectively.

Refer to the table below for the full list of changes and the REITs’ target prices.

“With elevated costs of capital making acquisitions prohibitive, we prefer REITs with better organic DPU growth and strong balance sheets relative to peers,” the analysts write, identifying their new top picks as CLAR, CapitaLand Integrated Commercial Trust (CICT) and MLT. MINT has been removed from their previous list.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Broker's Digest: Nanofilm Technologies International, ESR-LOGOS REIT, Japan Foods Holding

CGS-CIMB ups Boustead Projects' TP on strong order book and stronger-than-expected 1HFY2023 earnings

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance