Clean Harbors Surpasses Q1 Revenue Forecasts with Strong Environmental Services Growth

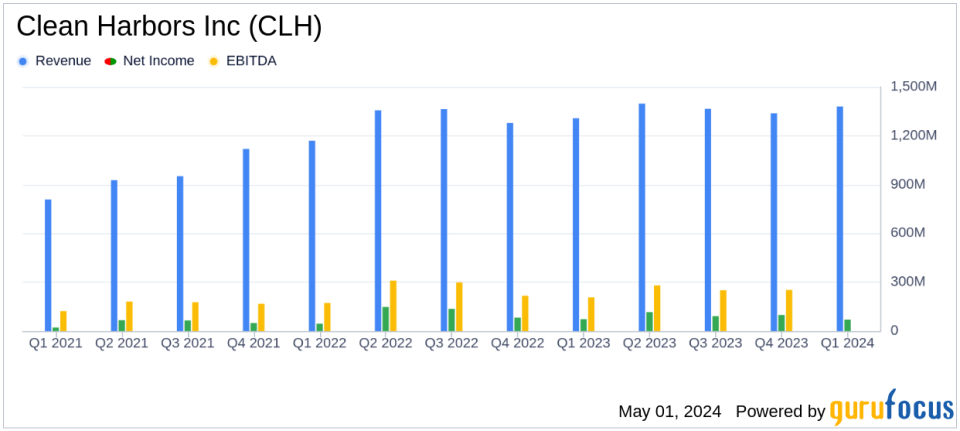

Revenue: Reached $1.38 billion in Q1, marking a 5% increase year-over-year, surpassing estimates of $1.336 billion.

Net Income: Reported at $69.8 million, slightly below the previous year's $72.4 million and exceeding estimates of $62.29 million.

Earnings Per Share (EPS): Achieved $1.29, compared to $1.33 in the prior year, exceeding the estimated $1.16.

Adjusted EBITDA: Grew by 7% to $230.1 million with a margin improvement to 16.7%, indicating operational efficiency.

Environmental Services Segment: Led revenue growth with a 10% increase, driven by high-value disposal and recycling waste streams.

Safety-Kleen Sustainability Solutions (SKSS) Segment: Showed recovery late in Q1 with improvements in base oil pricing and increased blended sales volumes by 36%.

Full-Year Guidance: Adjusted EBITDA forecast raised to between $1.1 billion and $1.15 billion, reflecting confidence in continued growth.

Clean Harbors Inc (NYSE:CLH) announced its first-quarter financial results for 2024, revealing a revenue increase and robust performance in its Environmental Services segment. The company released its 8-K filing on May 1, 2024, showcasing a 5% increase in revenue to $1.38 billion, surpassing the analyst's estimate of $1.336 billion.

Clean Harbors, a leading provider of environmental and industrial services in North America, operates primarily through two segments: Environmental Services and Safety-Kleen Sustainability Solutions. The company has been a pivotal player in offering comprehensive hazardous waste management, emergency spill response, and various recycling services.

Performance Overview

The Environmental Services (ES) segment was notably strong, with a 10% growth in revenue, led by a 16% increase in Adjusted EBITDA and a 130-basis point margin improvement. This growth was driven by high-value disposal and recycling waste streams, effective pricing execution, and an expanding project pipeline. Despite a slow start in the Safety-Kleen Sustainability Solutions (SKSS) segment, there was a late-quarter recovery in demand and pricing, particularly for base oil and lubricants.

Financial Metrics and Challenges

While the company posted a net income of $69.8 million, or $1.29 per diluted share, this was slightly below the previous year's $72.4 million, or $1.33 per diluted share. The Adjusted EBITDA for the quarter grew 7% to $230.1 million, with a margin of 16.7%. The company also raised its full-year 2024 Adjusted EBITDA guidance while maintaining its adjusted free cash flow guidance, reflecting confidence in continued operational efficiency and growth.

Strategic Developments and Outlook

Looking ahead, Clean Harbors anticipates continued strong demand driven by reshoring and favorable regulatory environments. The company is preparing for the commercial launch of its Kimball, Nebraska incinerator and expects significant growth from its recent HEPACO acquisition, focusing on cross-selling and synergy savings. Additionally, a partnership with Castrol on the MoreCircular program indicates strategic moves towards sustainability and value-added product offerings.

Adjusted Financial Measures

Clean Harbors utilizes certain non-GAAP financial measures such as Adjusted EBITDA to provide a clearer picture of operational performance and liquidity. The reconciliation of GAAP net income to Adjusted EBITDA for Q1 2024 shows an increase from the previous year, underscoring the company's ability to maintain profitability amidst varying market conditions.

In conclusion, Clean Harbors' first-quarter results for 2024 reflect a solid start to the year, with significant contributions from its Environmental Services segment and strategic initiatives setting the stage for sustained growth. The company's focus on enhancing service offerings and expanding its operational capacity bodes well for its long-term strategic goals.

For more detailed information and future updates, investors and interested parties are encouraged to visit the Investor Relations section of Clean Harbors' website.

Explore the complete 8-K earnings release (here) from Clean Harbors Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance