Citizens Financial Services Inc (CZFS) Q1 Earnings: A Close Look Compared to Analyst Estimates

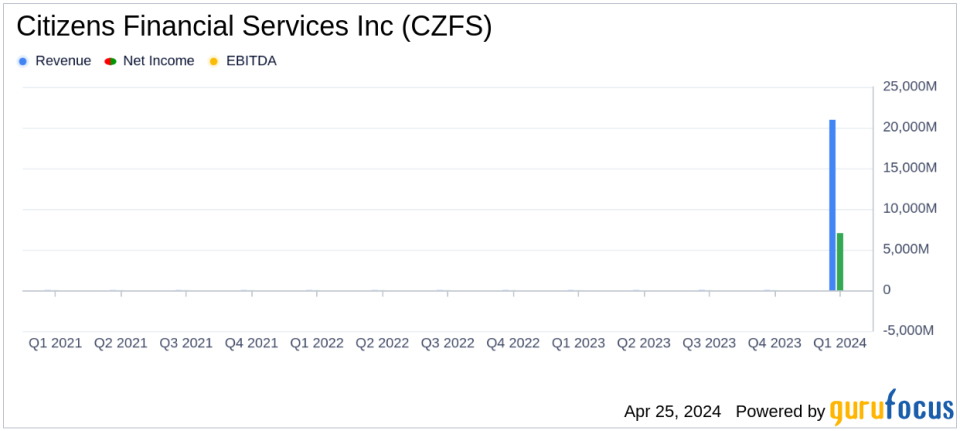

Net Income: Reported at $7.024 million for Q1 2024, slightly above the estimated $7.30 million.

Earnings Per Share (EPS): Basic and diluted EPS stood at $1.49, falling short of the estimated $1.55.

Revenue: Generated $20.958 million in net interest income, below the estimated revenue of $22.20 million.

Dividends: Declared a quarterly cash dividend of $0.49 per share, marking a 2.1% increase from the previous year.

Asset Quality: Non-performing assets increased to $15.713 million from $10.880 million in the previous year.

Market Capitalization: Experienced a significant decrease in market value per share to $49.20 from $83.55 year-over-year.

Operational Growth: Total assets grew to $2.921 billion as of March 31, 2024, up from $2.335 billion on the same date in 2023.

Citizens Financial Services Inc (NASDAQ:CZFS), a Pennsylvania-chartered bank and trust company, disclosed its unaudited financial results for the first quarter of 2024 on April 25, 2024. The detailed financial performance can be explored in their recent 8-K filing. This report provides insights into the company's earnings, comparing them with analyst estimates and highlighting significant financial movements and strategic decisions.

Company Overview

Citizens Financial Services Inc operates primarily through its subsidiary, First Citizens Community Bank. The bank offers a range of financial services including checking, savings accounts, and loans catering to individuals, businesses, and institutions. Additionally, its Trust and Investment division provides comprehensive investment and estate services.

Financial Performance Analysis

For Q1 2024, Citizens Financial Services Inc reported a net income of $7.024 million, slightly above the analyst's expectation of $7.3 million. Earnings per share (EPS) for the quarter stood at $1.49, marginally missing the estimated $1.55. The company's revenue for the quarter was not explicitly stated in the earnings report, but significant financial metrics such as net interest income and non-interest income were detailed, providing a comprehensive view of the income structure.

Key Financial Highlights and Challenges

The net interest margin saw a decrease to 3.05% from 3.30% year-over-year, indicating pressure on the profitability from core banking operations. Despite this, the bank has managed an increase in net income compared to the previous year, showcasing effective cost management and diversified income streams. The increase in non-performing assets to 0.70% from 0.63% poses a potential risk, reflecting a need for close monitoring of asset quality moving forward.

Strategic Dividend Decisions

The Board of Directors declared a quarterly cash dividend of $0.49 per share, marking a 2.1% increase from the previous year. This decision reflects the company's commitment to delivering shareholder value and confidence in its financial stability.

Operational and Market Challenges

Amid fluctuating interest rates and economic uncertainties, maintaining asset quality and interest margin will be crucial for Citizens Financial Services Inc. The bank's strategic focus on expanding its asset and wealth management capabilities could mitigate some impacts of these challenges.

Conclusion

While the earnings per share slightly missed analyst expectations, the overall financial health of Citizens Financial Services Inc remains robust, supported by strategic expansions and a strong focus on core banking operations. Investors and stakeholders will likely watch the bank's ability to manage interest rate changes and asset quality in upcoming quarters closely.

Looking Ahead

Citizens Financial Services Inc continues to adapt to the dynamic banking environment, focusing on strategic growth areas and maintaining financial resilience. The ongoing developments in its service offerings and market strategies will be pivotal in sustaining performance amidst economic shifts.

For a deeper dive into Citizens Financial Services Inc's financial details and strategic positioning, interested readers and investors are encouraged to view the full earnings report linked above.

Explore the complete 8-K earnings release (here) from Citizens Financial Services Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance