Churchill Downs Inc (CHDN) Reports Mixed Q1 2024 Results: Surpasses Revenue but Misses on Net ...

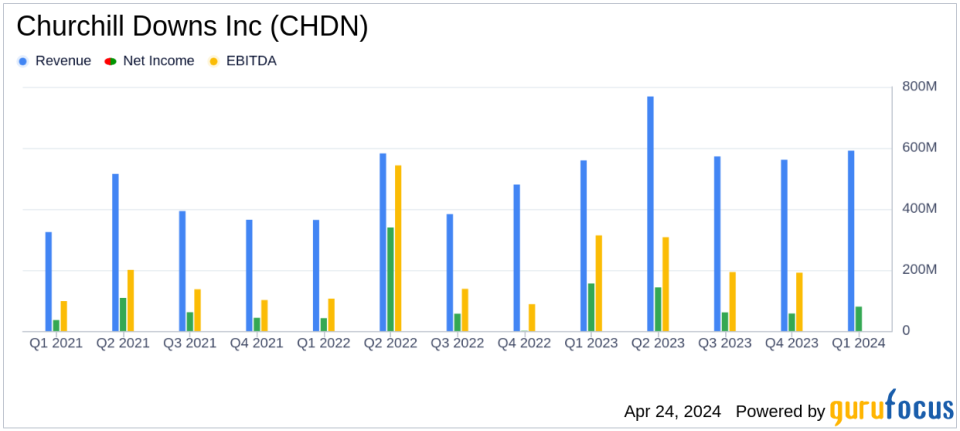

Revenue: $590.9M, up 6% year-over-year, surpassing estimates of $564.2M.

Net Income: $80.4M, down 48% compared to the prior year, falling short of estimates of $62.04M.

Earnings Per Share (EPS): $1.08, exceeded the estimated $0.82.

Adjusted EBITDA: Reached a record $242.5M, an increase of 9% year-over-year.

Segment Performance: Live and Historical segment revenue rose 15% to $248.9M; TwinSpires revenue increased 18% to $114.1M.

Capital Return: Repurchased $22.0M of shares and paid a $0.382 per share dividend, marking the thirteenth consecutive year of dividend increase.

Future Developments: Announced the Rose Gaming Resort opening in late September 2024 and Owensboro Racing & Gaming set for early 2025.

On April 24, 2024, Churchill Downs Inc (NASDAQ:CHDN) released its 8-K filing, unveiling a complex financial landscape for the first quarter of the year. The company reported a record net revenue of $590.9 million, surpassing the estimated $564.20 million and marking a 6% increase from the previous year. However, net income significantly declined to $80.4 million, a 48% decrease compared to the prior year, and fell short of the estimated $62.04 million.

Churchill Downs Inc, a prominent player in gaming entertainment, online wagering, and racing, operates through three segments: Live and Historical Racing, TwinSpires, and Gaming. The company's performance this quarter reflects robust growth in the Live and Historical Racing and TwinSpires segments, with notable revenue and Adjusted EBITDA improvements. Conversely, the Gaming segment experienced a downturn, primarily due to external factors like inclement weather impacting operations.

Segment Performance and Strategic Moves

The Live and Historical Racing segment saw a revenue increase of $33.1 million, driven by growth at Kentucky and Virginia properties. Adjusted EBITDA in this segment rose by $18.7 million. The TwinSpires segment also showed strong performance with an $18.8 million revenue increase and a $10.2 million rise in Adjusted EBITDA, benefiting from the Exacta Transaction and expansion in sports betting.

On the strategic front, Churchill Downs announced significant developments including the opening of The Rose Gaming Resort and plans for Owensboro Racing & Gaming. These expansions indicate the company's ongoing commitment to growth and diversification of its entertainment offerings.

Financial Health and Shareholder Returns

Despite the mixed earnings performance, Churchill Downs demonstrated solid financial management. The company maintained a net bank leverage of 4.1x and continued its shareholder return programs, repurchasing $22.0 million of shares in Q1 2024. Additionally, it marked the thirteenth consecutive year of increased dividends, underscoring its commitment to shareholder value.

Challenges and Outlook

The significant drop in net income this quarter primarily resulted from non-recurring gains in the previous year and increased expenses associated with new and ongoing projects. Looking ahead, the company's ability to manage these expenses and navigate external challenges will be crucial in maintaining its growth trajectory and financial stability.

Churchill Downs Inc's strategic investments and robust segment performance, particularly in Live and Historical Racing and TwinSpires, highlight its strengths in a competitive market. However, the challenges faced in the Gaming segment and the broader financial impacts require careful management. As the company continues to expand and innovate, these developments will be critical to watch for stakeholders and investors interested in the gaming and entertainment industry.

For detailed financial figures and further information, please refer to the full earnings report on the SEC website.

Explore the complete 8-K earnings release (here) from Churchill Downs Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance