Church & Dwight (CHD) Q4 Earnings Top Estimates, Decline Y/Y

Church & Dwight Co., Inc. CHD reported fourth-quarter 2022 results, wherein the top and bottom lines exceeded the Zacks Consensus Estimate, but the latter declined year over year. Results were partially affected by soft consumption in discretionary categories and cost inflation.

Quarter in Detail

Church & Dwight posted adjusted earnings of 62 cents per share, beating the Zacks Consensus Estimate of 60 cents. However, the metric declined from the year-ago quarter’s figure of 64 cents.

The bottom line includes a 12-cent adverse impact due to the increased tax rate (compared with the fourth quarter of 2021). Management highlighted that quarterly earnings per share or EPS came ahead of its expectation due to better-than-expected revenues in the consumer domestic business.

Net sales of $1,436 million advanced 4.9% year over year and beat the Zacks Consensus Estimate of $1,395 million. Net sales included a 1% impact of unfavorable currency rates.

Organic sales climbed 4% due to favorable pricing to the tune of 4.2%, partly negated by a volume decline of 3.8%. The company’s U.S. portfolio saw consumption growth in 13 of 17 categories in the fourth quarter. Global online sales, as a percentage of total sales, increased to 16% in the full-year 2022 (compared with 15% in 2021).

The gross margin shrunk 50 basis points (bps) to 42% due to increased material, component and manufacturing costs, partly made up by pricing and productivity. Marketing expenses declined by $11.4 million year over year to $189.7 million. As a percentage of sales, the figure decreased 150 bps to 13.2%. Adjusted SG&A expenses, as a percentage of sales, contracted by 140 bps to 13.5%.

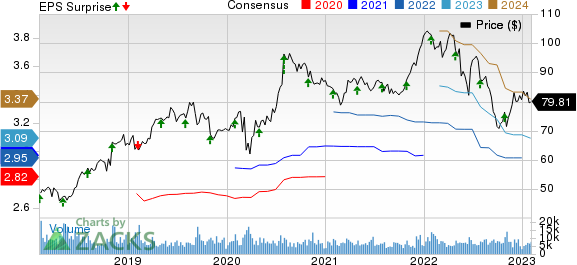

Church & Dwight Co., Inc. Price, Consensus and EPS Surprise

Church & Dwight Co., Inc. price-consensus-eps-surprise-chart | Church & Dwight Co., Inc. Quote

Segmental Details

Consumer Domestic: Net sales in the segment increased 7.6% to $1,120.8 million due to the HERO acquisition. Further, household and personal care brand sales growth countered softness in the company’s discretionary business (such as WATERPIK and FLAWLESS).

Organic sales inched up 0.4% on a favorable price and product mix, partly hurt by lower volumes (mainly in the discretionary business). Consumption growth was backed by strength in the ARM & HAMMER liquid detergent, ARM & HAMMER clumping cat litter, ZICAM supplements and BATISTE dry shampoo.

The company witnessed market share gains in 7 out of 14 power brands in the domestic business. It anticipates witnessing accelerated market share gains in 2023 due to increased marketing.

Consumer International: Net sales in the segment fell 4.4% to $231.3 million, mainly due to currency headwinds. Organic sales were up 1.3%, with a higher price and mix, partly countered by a volume decline. The solid performance at International subsidiaries was countered by Global Markets Group, which witnessed supply-chain challenges.

Specialty Products: Sales in the segment dipped 1.3% to $83.9 million. Organic sales fell 1.3% on soft volumes, partly offset by better pricing. Volumes were hurt by softness in the animal and food production segment.

Other Updates

CHD ended the quarter with cash on hand of $270.3 million and total debt of $2.7 billion. In the full year 2022, cash from operating activities was $885.2 million. Capital expenditures amounted to $178.8 million in the same period.

The company expects about $250 million in capital expenditures for 2023. For 2023, Church & Dwight anticipates cash flow from operations of around $925 million.

Management announced a 4% hike in its quarterly dividend, taking it to 27.25 cents per share. This takes the company’s annual payment from $255 million to about $265 million. The raised dividend is payable on Mar 1, 2023.

Guidance

Church & Dwight ended 2022 with increased consumption in many of its categories. The company remains cautiously positive about 2023 amid volatility surrounding inflation, commodities, interest rates, currency changes, the situation in China and consumer confidence. Management remains committed to product innovation, which remains a major growth engine. It has a solid pipeline of product launches for 2023.

Church & Dwight remains focused on delivering on its Evergreen model over the long term. This includes organic net sales growth of 3%, gross margin expansion and an EPS increase of 8%.

For 2023, management expects reported sales growth of nearly 5-7%. The company anticipates organic sales growth of roughly 2-4%. Organic sales are likely to be backed by pricing growth, while volumes are expected to remain stable. Management expects volumes to decline year over year in the first half due to continued softness in discretionary categories. Volumes are likely to revert to growth in the second half.

Church & Dwight expects the 2023 reported gross margin to expand 100-120 bps as it envisions inflation to be outpaced by pricing and productivity. The company expects additional inflation headwinds of $125 million due to escalated commodity and material costs.

Management stated that inflation is moderating, and it is also witnessing an improvement in supply-chain fill levels. The company expects the adjusted operating profit margin to remain relatively flat year over year due to elevated investments in marketing and considerably higher SG&A.

CHD anticipates year-over-year adjusted EPS growth of 0-4% in 2023. This reflects organic growth, gross margin increase, marketing investments and growth in the operating income.

Management expects to raise marketing as a percentage of sales to about 10.5% in 2023 (from 10% in 2022) to sustain the current consumption momentum. It also expects a rise in the incentive compensation, tax rate and interest expense in 2023. These are likely to impact the adjusted EPS.

Q1 View

For the first quarter of 2023, Church & Dwight expects a roughly 4% increase in reported sales. Organic sales are estimated to rise nearly 1%. Management expects to witness gross margin expansion in the quarter, alongside expecting greater marketing and SG&A spending.

The company expects adjusted EPS of 75 cents, down 10% compared with the year-ago quarter’s adjusted EPS. First-quarter revenues and profits are likely to bear the adverse impacts of softness in discretionary brands.

In the past three months, this Zacks Rank #3 (Hold) stock has rallied 11.7% compared with the industry’s growth of 6.9%.

Solid Consumer Staple Picks

Some better-ranked consumer staple stocks are Conagra Brands CAG, Lamb Weston LW and Post Holdings POST.

Conagra, a consumer-packaged goods food company, currently sports a Zacks Rank #1 (Strong Buy). CAG has a trailing four-quarter earnings surprise of 8.9%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Conagra’s current fiscal-year sales and earnings suggests growth of 6.8% and 11.9%, respectively, from the corresponding year-ago reported figures.

Lamb Weston, which is a frozen potato product company, currently sports a Zacks Rank #1. LW has a trailing four-quarter earnings surprise of 52.6%, on average.

The Zacks Consensus Estimate for Lamb Weston’s current fiscal-year sales and EPS suggests an increase of 19.5% and 89.9%, respectively, from the year-ago reported number.

Post Holdings, which operates as a consumer-packaged goods company, currently sports a Zacks Rank #1. POST has a trailing four-quarter earnings surprise of 9.6%, on average.

The Zacks Consensus Estimate for Post Holdings’ current fiscal-year EPS suggests an increase of 70.8% from the year-ago reported number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Conagra Brands (CAG) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance