China Telecom Leads Three Key Dividend Stocks In Hong Kong

Amidst a turbulent global backdrop, the Hong Kong market has shown resilience, with investors closely monitoring sectors that promise stable returns. As markets navigate through uncertainties such as interest rate speculations and economic slowdowns, dividend stocks like China Telecom have become a focal point for those seeking reliable investment avenues in Hong Kong.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.10% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.66% | ★★★★★★ |

Consun Pharmaceutical Group (SEHK:1681) | 8.86% | ★★★★★☆ |

China Construction Bank (SEHK:939) | 7.38% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 9.00% | ★★★★★☆ |

China Electronics Huada Technology (SEHK:85) | 7.66% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.60% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.43% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.13% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.62% | ★★★★★☆ |

Click here to see the full list of 93 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

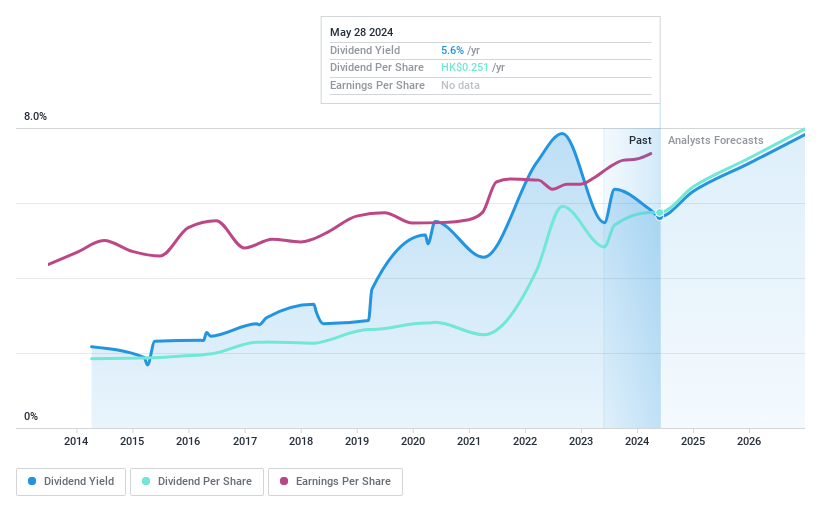

China Telecom

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Telecom Corporation Limited operates primarily in the People's Republic of China, offering wireline and mobile telecommunications services through its subsidiaries, with a market capitalization of approximately HK$559.72 billion.

Operations: China Telecom Corporation Limited generates CN¥512.75 billion from its integrated telecommunications business.

Dividend Yield: 5.6%

China Telecom, while trading at 66.9% below its estimated fair value, shows a mixed performance in dividend reliability with a history of volatility over the past decade. Despite this, its dividends are well-covered by both earnings and cash flows, with payout ratios of 68.7% and 52.9%, respectively. However, its dividend yield of 5.64% is lower than the top quartile in Hong Kong's market at 7.45%. Recent corporate changes include the retirement of executive director Mr. Shao Guanglu as announced on May 23, 2024.

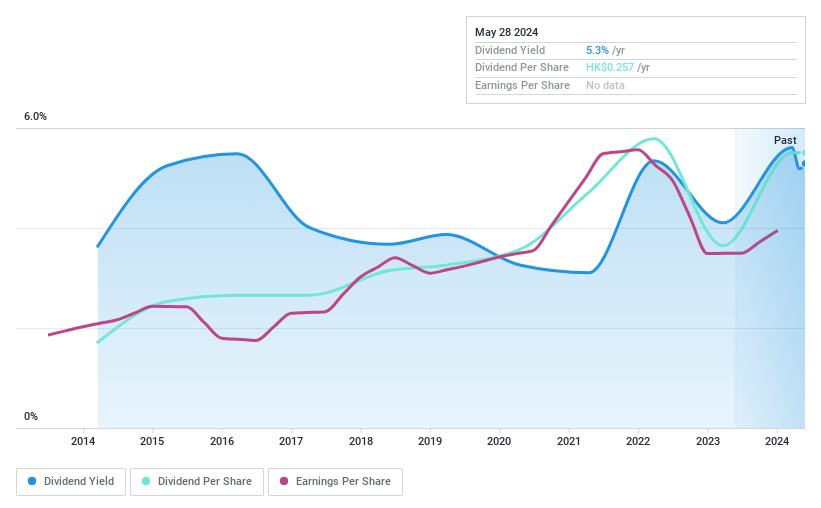

VSTECS Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: VSTECS Holdings Limited operates in North Asia and Southeast Asia, focusing on developing IT product channels and providing technical solution integration services, with a market capitalization of approximately HK$6.98 billion.

Operations: VSTECS Holdings Limited generates revenue primarily through three segments: Cloud Computing (HK$3.08 billion), Enterprise Systems (HK$40.41 billion), and Consumer Electronics (HK$30.39 billion).

Dividend Yield: 5.3%

VSTECS Holdings Limited, despite a lower than average dividend yield of 5.29% compared to Hong Kong's top dividend payers at 7.45%, has shown financial resilience with an increase in net income from HK$823.07 million to HK$922.03 million and a rise in basic EPS from HK$0.5815 to HK$0.6562 year-over-year as of December 2023. The company recently proposed a final dividend of HK$0.257 per share, maintaining its record of increasing dividends despite past volatility and coverage concerns with both earnings and cash flows supporting payouts at ratios of 39.2% and 61.4%, respectively.

Navigate through the intricacies of VSTECS Holdings with our comprehensive dividend report here.

Our valuation report here indicates VSTECS Holdings may be overvalued.

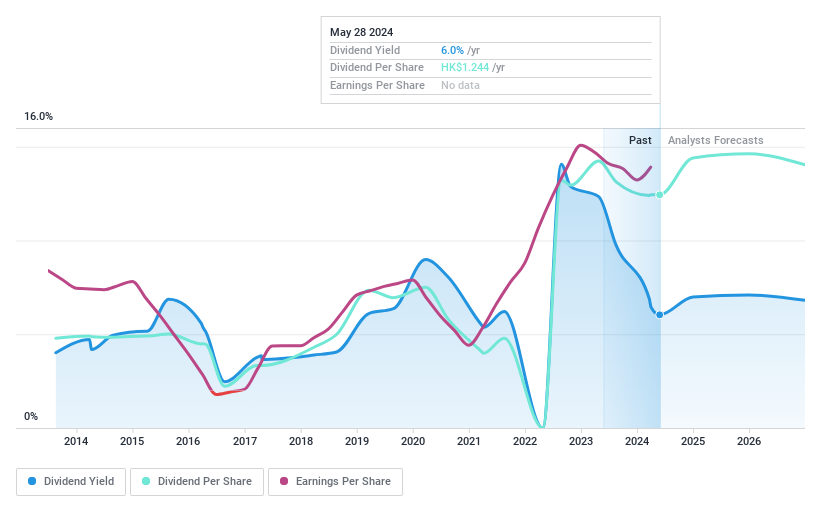

CNOOC

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CNOOC Limited operates as an investment holding company primarily focused on the exploration, development, production, and sale of crude oil and natural gas with a market capitalization of approximately HK$1.01 trillion.

Operations: CNOOC Limited generates its revenue primarily from the exploration, development, production, and sale of crude oil and natural gas.

Dividend Yield: 6%

CNOOC Limited, with a dividend yield of 6.04%, falls below Hong Kong's top quartile average of 7.45%. Despite this, the company has a sustainable payout with a low earnings payout ratio of 41.1% and cash payout ratio at 59.3%. Dividend payments have increased over the past decade but have shown volatility in the same period. Recent significant amendments to corporate communication methods were proposed on May 8, 2024, potentially impacting shareholder engagement and operational flexibility.

Dive into the specifics of CNOOC here with our thorough dividend report.

Our expertly prepared valuation report CNOOC implies its share price may be lower than expected.

Make It Happen

Explore the 93 names from our Top Dividend Stocks screener here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:728SEHK:856 SEHK:883

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance