Cheesecake Factory Inc (CAKE) Surpasses Analyst Revenue Forecasts with Strong Q1 Performance

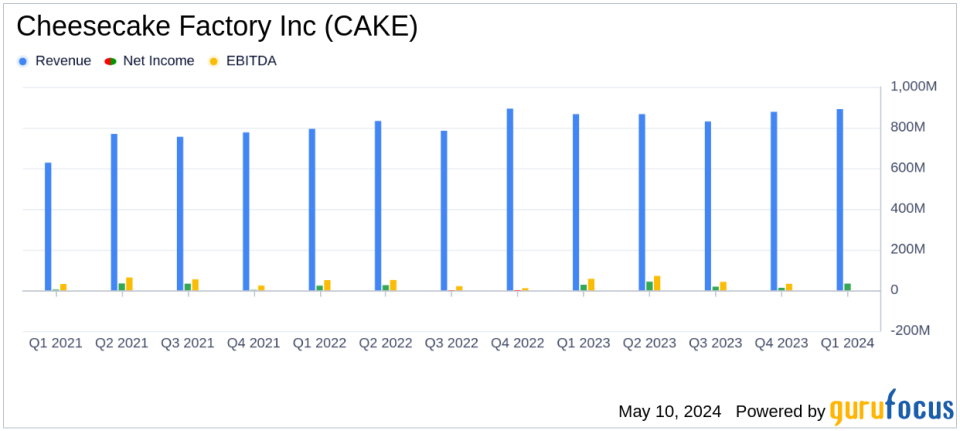

Revenue: $891.2M, up 2.9% year-over-year, slightly surpassing estimates of $890.87M.

Net Income: $33.2M, up 18.3% year-over-year, surpassed estimates of $30.8M.

Earnings Per Share (EPS): Reported at $0.68, surpassing the estimated $0.63.

Comparable Restaurant Sales: Declined by 0.6% year-over-year at The Cheesecake Factory restaurants.

New Store Openings: Opened five new restaurants during the quarter, with plans to open up to 22 new locations in fiscal 2024.

Liquidity and Capital Allocation: Total available liquidity stood at $296.7M, with a dividend of $0.27 per share declared for June 4, 2024.

Stock Repurchase: Repurchased approximately 359,400 shares at a cost of $12.5M during the quarter.

Cheesecake Factory Inc (NASDAQ:CAKE) released its 8-K filing on May 8, 2024, showcasing a robust financial performance for the first quarter of fiscal 2024, which ended on April 2, 2024. The company reported a notable increase in total revenues and net income, surpassing analyst expectations and demonstrating operational efficiency despite a slight decline in comparable restaurant sales.

Cheesecake Factory Inc, renowned for its distinctive range of restaurants including The Cheesecake Factory, North Italia, and various brands under the Fox Restaurant Concepts subsidiary, operates across the United States and Canada, with an international presence in the Middle East and Mexico through licensing agreements. The majority of the companys revenue is derived from The Cheesecake Factory restaurants segment.

Financial Highlights and Operational Achievements

The company reported an increase in total revenues to $891.2 million in Q1 2024 from $866.1 million in the same quarter the previous year. This growth aligns closely with analyst estimates of $890.87 million, slightly surpassing expectations. Net income also saw a healthy increase to $33.2 million, or $0.68 per diluted share, compared to $28.05 million, or $0.56 per diluted share, in Q1 2023. These figures exceeded the estimated earnings per share of $0.63.

Adjusted for specific one-time costs, adjusted net income reached $35.6 million, or $0.73 per diluted share, reflecting the companys effective management and operational adjustments. Despite a 0.6% decline in comparable restaurant sales at The Cheesecake Factory restaurants, the overall financial health of the company improved significantly.

Strategic Developments and Market Expansion

During the first quarter, Cheesecake Factory continued its expansion by opening five new restaurants, including locations under the North Italia and other Fox Restaurant Concepts brands. The company also marked its presence internationally with new openings under licensing agreements in Mexico and Asia. Looking ahead, Cheesecake Factory plans to open up to 22 new restaurants throughout fiscal 2024, indicating a strong growth trajectory.

Liquidity, Capital Allocation, and Shareholder Returns

As of April 2, 2024, Cheesecake Factory reported robust liquidity with total available funds of $296.7 million. The company actively returned value to shareholders, repurchasing approximately 359,400 shares for $12.5 million and declaring a quarterly dividend of $0.27 per share payable in June 2024.

Operational Challenges and Industry Outlook

The slight decline in comparable restaurant sales highlights ongoing challenges in the highly competitive restaurant industry. However, management remains optimistic about the brand's market position and its ability to outperform industry trends, as evidenced by the CEO David Overton's remarks on operational efficiency and high-quality dining experiences.

Conclusion

Cheesecake Factory Inc's first quarter of fiscal 2024 reflects a company that is not only meeting but exceeding financial expectations through strategic growth initiatives and efficient operations. The companys ability to navigate market challenges while expanding its footprint both domestically and internationally positions it well for sustained growth. Investors and stakeholders can look forward to Cheesecake Factorys continued performance with a focus on innovation and operational excellence in the competitive dining sector.

For more detailed insights and financial analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Cheesecake Factory Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance