Cheesecake Factory (CAKE) Rises 57% in a Year: Here's Why

The Cheesecake Factory Incorporated CAKE is poised to benefit from robust comps growth, off-premise business and technological upgrades. Also, focus on Fox Restaurant Concepts bodes well.

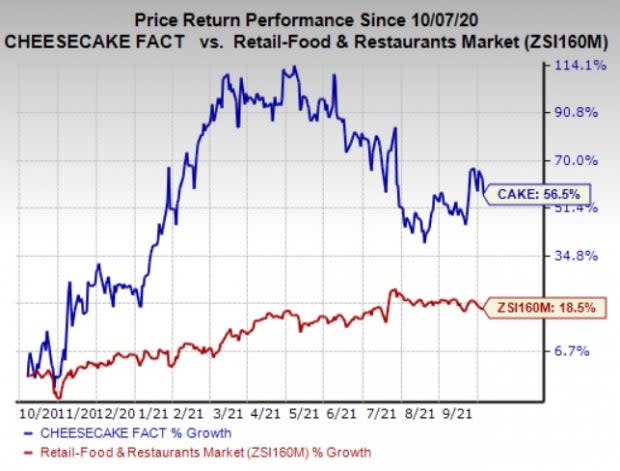

Shares of Cheesecake Factory have surged 56.5% in the past year compared with the industry’s 18.5% growth. The price performance was backed by a solid earnings surprise history. Earnings surpassed the Zacks Consensus Estimate in five of the trailing six quarters. Earnings estimates for full-year 2021 and 2022 have moved up 13.6% and 9.4%, respectively, in the past 90 days. This positive trend signifies bullish analysts’ sentiments and justifies the company’s Zacks Rank #2 (Buy). This indicates robust fundamentals and expectation of outperformance in the near term. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Major Growth Drivers

Robust Comps Growth: Cheesecake Factory continues to impress investors with robust comparable sales growth. During the first and the second quarter of 2021, comps at The Cheesecake Factory (across all operating models) increased approximately 220% and 150%, respectively, year over year. Comps in the first and the second quarter of 2021 rose 7% and 7.8%, respectively, from 2019 levels. The company stated that the momentum continued in the fiscal third quarter as well. Since the start of the fiscal third quarter to Jul 26, 2021, comps at Cheesecake Factory (across all operating models) increased approximately 61% year over year. Comps increased 10% from 2019 levels. Easing of pandemic-induced restrictions and solid off-premise sales have favored the company.

Off-premise Business a Driving Factor: Even though the company reopened the majority of dining rooms with limited capacity, off-premise operations continue to be a driving factor for overall sales. In the first and the second quarter of fiscal 2021, off-premise contributed approximately 43% and 27%, respectively, to Cheesecake Factory’s total restaurant sales. Off-premise average weekly sales have doubled from fiscal 2019 levels. It continues to perform well in the delivery channel.

Digitization Efforts: Cheesecake Factory’s focus on digitally-enabled initiatives and the implementation of technology are doing well according to feedbacks on its mobile payment app, CakePay. The company is also witnessing incremental sales from its delivery service, which continues to be rolled out nationwide. To boost consumers’ convenience, the company implemented operational changes and technology upgrades that include contactless menu and payment technology as well as text paging. Notably, the initiatives have contributed to the growth of the company’s off-premise sales channels.

Emphasis on Fox Restaurant Concepts (FRC): Nearly after a year of closing its acquisition, Fox Restaurant Concepts or FRC not only reinforced its confidence and strength amid the ongoing pandemic, but also paved the path for long-term growth. During the fiscal second quarter, FRC concept sales continued to increase and off-premise volumes remained solid. The in-restaurant kiosk technology enables a faster ordering experience and features artificial intelligence that learns individual guest behavior to provide an enhanced experience. Going forward, FRC plans to incorporate this technology at future Flower Child locations, complementing the traditional ordering mechanism.

Other Solid Restaurant Bets

Some other top-ranked stocks in the same space are Domino's Pizza, Inc. DPZ, Chipotle Mexican Grill, Inc. CMG and Jack in the Box Inc. JACK, each carrying a Zacks Rank #2.

Domino's has a three-five-year earnings per share growth rate of 12%.

Chipotle's 2021 earnings are expected to rise 137.3%.

Jack in the Box has a trailing four-quarter earnings surprise of 26.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Janus Henderson Sustainable & Impact Core Bond ETF (JACK) : Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

Dominos Pizza Inc (DPZ) : Free Stock Analysis Report

The Cheesecake Factory Incorporated (CAKE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance