Charter Hall Group And Two More Australian Dividend Stocks To Consider

Amidst a challenging day on the ASX200, where consumer discretionary sectors notably struggled and only energy showed modest gains, investors may be looking for stability and potential income through dividend stocks. In uncertain times, companies with a history of stable dividends can provide a semblance of security and predictability in an otherwise volatile market environment.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Lindsay Australia (ASX:LAU) | 6.19% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.04% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 4.76% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 6.78% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.64% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.70% | ★★★★★☆ |

Fortescue (ASX:FMG) | 7.67% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.20% | ★★★★★☆ |

Ricegrowers (ASX:SGLLV) | 8.09% | ★★★★☆☆ |

New Hope (ASX:NHC) | 9.29% | ★★★★☆☆ |

Click here to see the full list of 29 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

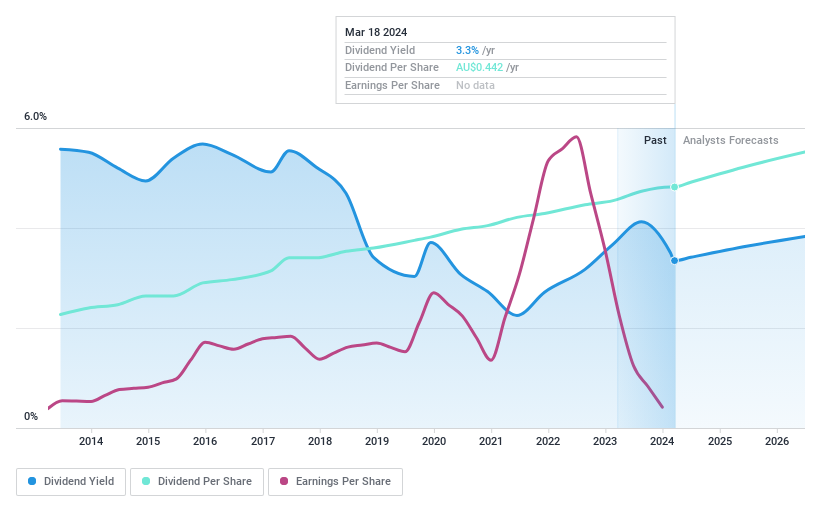

Charter Hall Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Charter Hall Group, operating as a prominent property investment and funds management group in Australia, has a market capitalization of approximately A$5.78 billion.

Operations: Charter Hall Group generates its revenue primarily through funds management, which contributes A$515.60 million, and property investments, adding A$142.20 million.

Dividend Yield: 3.6%

Charter Hall Group's recent financial performance shows a significant drop in net income and revenue for the half year ended December 31, 2023, with sales falling to A$311.4 million from A$539.3 million the previous year, and net income decreasing to A$48.9 million from A$179.3 million. Despite this downturn, Charter Hall maintains a stable dividend history over the past decade and covers its dividends effectively with earnings and cash flows, having payout ratios of 43.8% and 45.3% respectively. However, its dividend yield of 3.61% is below the top quartile of Australian dividend stocks at 6.25%.

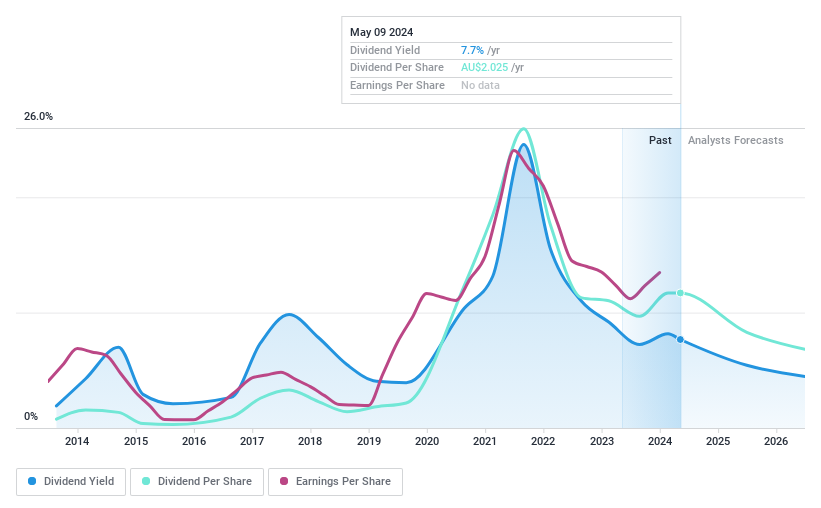

Fortescue

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fortescue Ltd is a global iron ore company based in Australia, involved in the exploration, development, production, and processing of iron ore, with a market capitalization of approximately A$81.94 billion.

Operations: Fortescue Ltd generates revenue primarily from its metals segment, which brought in $18.47 billion, and a smaller contribution from its energy operations at $79 million.

Dividend Yield: 7.7%

Fortescue's recent declaration of a fully franked interim dividend of A$1.08 per share, with a 65% payout from first-half net profits, emphasizes its commitment to shareholder returns. Despite this, the company's dividend history has been marked by volatility over the past decade. For H1 2024, Fortescue reported significant growth in sales and net income, reaching US$9.51 billion and US$3.34 billion respectively. However, its dividends are only moderately covered by earnings and cash flows with payout ratios of 74.2% and 73.1%, indicating potential concerns about sustainability amidst forecasted earnings decline over the next three years.

Get an in-depth perspective on Fortescue's performance by reading our dividend report here.

Our expertly prepared valuation report Fortescue implies its share price may be lower than expected.

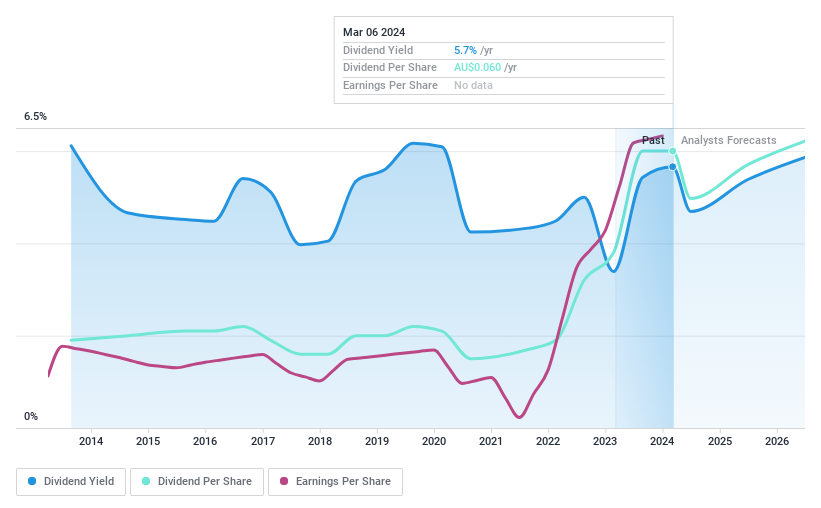

Lindsay Australia

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lindsay Australia Limited operates in Australia, offering integrated transport, logistics, and rural supply services primarily to sectors such as food processing, food services, fresh produce, and horticulture, with a market capitalization of approximately A$288.99 million.

Operations: Lindsay Australia Limited generates revenue primarily through its transport and rural supply segments, with A$571.38 million from transport services and A$158.73 million from rural supplies.

Dividend Yield: 6.2%

Lindsay Australia Limited has shown a mixed track record in dividend reliability, with payments fluctuating over the past decade. Despite this, both earnings and cash flow coverage ratios (43.7% and 38.9%, respectively) suggest dividends are well-supported currently. The company's stock is trading at a 10.7% discount to its estimated fair value, providing an attractive entry point relative to market valuation. Recent financials confirm growth, with sales rising to A$417.93 million and net income increasing to A$18.08 million for the half-year ended December 31, 2023.

Where To Now?

Unlock our comprehensive list of 29 Top Dividend Stocks by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:CHC ASX:FMG and ASX:LAU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance