Charles Brandes Amplifies Stake in CAE Inc, Marking a Strategic Portfolio Adjustment

Insight into Brandes' First Quarter Moves and Strategic Decisions in 2024

Charles Brandes (Trades, Portfolio), the founder and former chairman of Brandes Investment Partners, has recently disclosed his 13F filings for the first quarter of 2024. Brandes, a staunch disciple of Benjamin Graham, established his firm in 1974, focusing on global value investing. His investment philosophy revolves around purchasing undervalued securities and holding them until their market value is fully recognized. This approach has been consistently applied across various portfolios managed by his firm, which specializes in both global equity and fixed-income assets.

Summary of New Buys

During the first quarter, Charles Brandes (Trades, Portfolio) expanded his portfolio by adding a total of 7 new stocks. Noteworthy new acquisitions include:

America Movil SAB de CV (NYSE:AMX), with 1,180,418 shares, making up 0.28% of the portfolio and valued at $22.03 million.

Spire Inc (NYSE:SR), comprising 39,258 shares, which represents about 0.03% of the portfolio, with a total value of $2.41 million.

Kenvue Inc (NYSE:KVUE), with 43,428 shares, accounting for 0.01% of the portfolio and valued at $931,960.

Key Position Increases

Charles Brandes (Trades, Portfolio) also significantly increased his stakes in 143 stocks. The most notable increases include:

CAE Inc (NYSE:CAE), with an additional 5,381,850 shares, bringing the total to 5,431,216 shares. This adjustment represents a staggering 10,901.94% increase in share count and a 1.43% impact on the current portfolio, valued at $112.10 million.

Corteva Inc (NYSE:CTVA), with an additional 670,488 shares, bringing the total to 2,603,324. This adjustment represents a 34.69% increase in share count, valued at $150.13 million.

Summary of Sold Out Positions

In the first quarter of 2024, Charles Brandes (Trades, Portfolio) completely exited 9 holdings, including:

Applied Materials Inc (NASDAQ:AMAT), where he sold all 399,108 shares, impacting the portfolio by -0.98%.

Key Position Reductions

Furthermore, Brandes reduced his positions in 31 stocks. Significant reductions include:

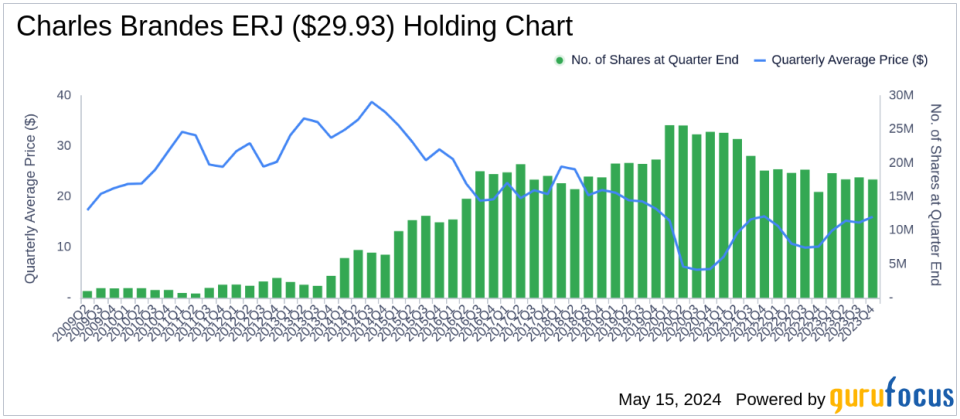

Embraer SA (NYSE:ERJ) by 1,883,281 shares, resulting in a -10.72% decrease in shares and a -0.53% impact on the portfolio. The stock traded at an average price of $19.85 during the quarter and has returned 63.82% over the past 3 months and 62.22% year-to-date.

Cemex SAB de CV (NYSE:CX) by 4,065,878 shares, resulting in a -22.71% reduction in shares and a -0.48% impact on the portfolio. The stock traded at an average price of $8.01 during the quarter and has returned 4.88% over the past 3 months and 3.94% year-to-date.

Portfolio Overview

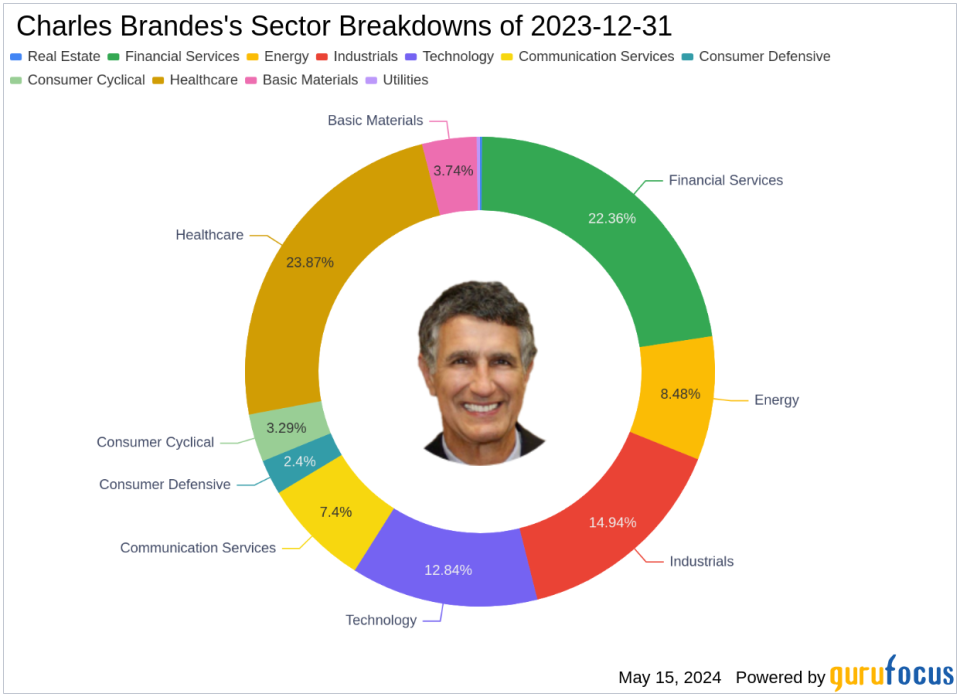

As of the first quarter of 2024, Charles Brandes (Trades, Portfolio)'s portfolio included 185 stocks. The top holdings were 5.37% in Embraer SA (NYSE:ERJ), 3.32% in Wells Fargo & Co (NYSE:WFC), 2.47% in Bank of America Corp (NYSE:BAC), 2.36% in Comcast Corp (NASDAQ:CMCSA), and 2.31% in Citigroup Inc (NYSE:C). The holdings are mainly concentrated across 11 industries, including Healthcare, Financial Services, Industrials, and Technology.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance