CEVA Inc (CEVA) Q1 2024 Earnings: Misses Revenue and Earnings Expectations Amid Challenges

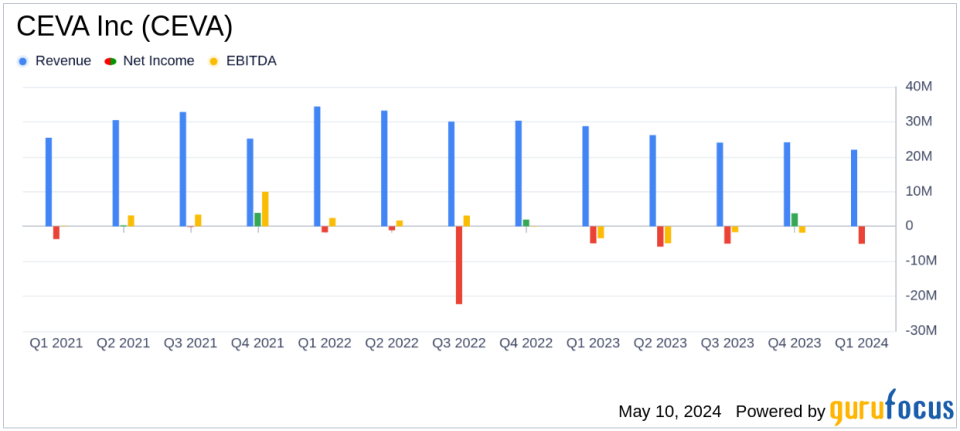

Total Revenue: Reported at $22.1 million, falling short of estimates of $23.13 million.

Net Loss: Increased to $5.4 million from $2.7 million in the previous year, indicating a deeper financial deficit.

GAAP Diluted Loss Per Share: Worsened to $0.23, compared to $0.12 in the prior year.

Royalty Revenue: Grew by 33% year-over-year to $10.7 million, showing strong performance in this segment.

Licensing Revenue: Decreased to $11.4 million from $18.2 million, reflecting challenges in closing deals within the quarter.

GAAP Gross Margin: Improved slightly to 89% from 87%, indicating better cost management relative to revenues.

Non-GAAP Adjustments: Excluded items such as equity-based compensation and amortization of acquired intangibles, affecting both operating loss and net loss calculations.

On May 9, 2024, CEVA Inc (NASDAQ:CEVA), a prominent licensor of signal-processing intellectual property, released its financial results for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a total revenue of $22.1 million for the quarter, which is below the analyst estimates of $23.13 million and represents a decrease from $26.3 million in the same quarter the previous year.

Company Overview

CEVA Inc is at the forefront of technology, providing cutting-edge solutions that power devices across wireless, consumer, automotive, and IoT sectors. The company primarily earns through licensing fees and royalties from products that incorporate its intellectual properties.

Financial Performance Insights

The first quarter saw CEVA grappling with several challenges. Licensing and related revenue significantly dropped to $11.4 million from $18.2 million year-over-year. However, royalty revenue showed a promising increase, climbing to $10.7 million from $8.0 million in the prior year's quarter. This growth in royalty revenue, attributed to a 33% increase in year-over-year volume shipments, highlights CEVA's expanding influence across various markets despite the overall revenue shortfall.

CEVA's GAAP gross margin improved slightly to 89% from 87% in Q1 2023. However, the company experienced a widening operating loss, reporting a GAAP operating loss of $5.0 million compared to a loss of $2.6 million in the first quarter of 2023. The GAAP net loss also worsened, standing at $5.4 million, or $0.23 per diluted share, compared to a net loss of $2.7 million, or $0.12 per diluted share, in the previous year.

Management Commentary

Amir Panush, CEO of CEVA, expressed optimism despite the revenue shortfall, citing solid trends across the business and significant growth in royalty revenue. He acknowledged the delays in licensing revenue but noted strategic deals that were concluded early in Q2, which are expected to positively impact future earnings.

Balance Sheet and Future Outlook

As of March 31, 2024, CEVA reported a strong balance sheet with approximately $159 million in cash, cash equivalents, and marketable securities. This financial stability is crucial as the company continues to invest in next-generation IPs and seeks to expand its market reach.

Looking ahead, CEVA's management remains confident in achieving its total revenue target for the year, driven by a healthy deal backlog and ongoing demand for its innovative product offerings. The company's strategic focus on enhancing its IP solutions and penetrating new application areas is expected to foster long-term growth.

Conclusion

While CEVA Inc faced a challenging first quarter in 2024 with declines in total revenue and increased losses, the growth in royalty revenue and strategic positioning for future deals provide a basis for cautious optimism. Investors will be watching closely to see if the initiatives outlined by the management will translate into improved financial performance in the upcoming quarters.

For detailed financial figures and further information, refer to CEVA's official 8-K filing.

Explore the complete 8-K earnings release (here) from CEVA Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance