Century Communities Inc Surpasses Analyst Estimates with Strong Q1 2024 Performance

Net Income: $64.3 million, a 93% increase year-over-year, surpassing the estimated $44.80 million.

Earnings Per Share (EPS): Reported at $2.00 per diluted share, significantly exceeding the estimated $1.39.

Revenue: Total revenue reached $948.5 million, up 26% year-over-year, exceeding estimates of $784.47 million.

Home Deliveries: Increased by 23% year-over-year to 2,358 homes, indicating strong demand and operational efficiency.

Adjusted Net Income: Grew by 114% year-over-year to $71.4 million, reflecting robust financial health and effective cost management.

Community Count: Increased to a record 253 communities, up 8% year-over-year, expanding market presence.

Dividend and Share Repurchase: Quarterly cash dividend increased by 13% to $0.26 per share, and 186,887 shares repurchased, signaling strong shareholder returns.

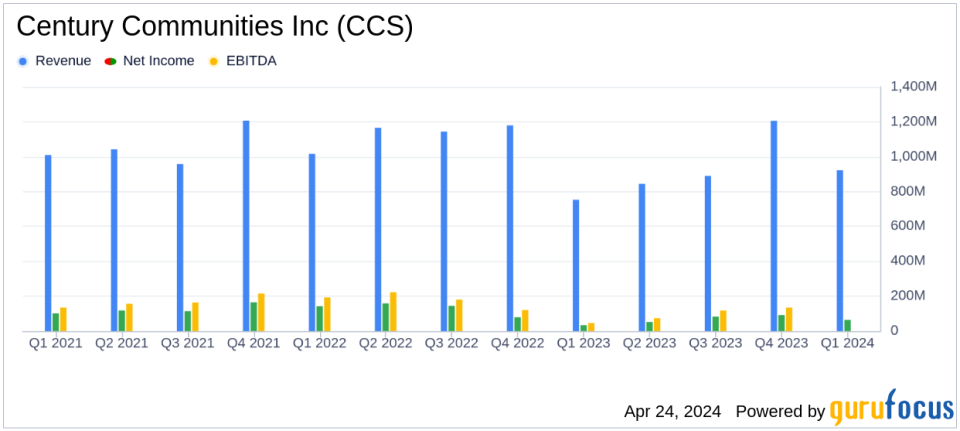

On April 24, 2024, Century Communities Inc (NYSE:CCS) released its 8-K filing, announcing robust financial results for the first quarter ended March 31, 2024. The company reported a substantial year-over-year increase in net income and revenue, significantly surpassing analyst expectations.

Company Overview

Century Communities Inc, a prominent player in the residential construction sector, operates across five homebuilding segments: West, Mountain, Texas, Southeast, and Century Complete, with its primary revenue generated from the Mountain segment. The company also provides financial services, including mortgage, title, and insurance services, enhancing its comprehensive real estate solutions.

Financial Performance

The first quarter results were impressive with net income soaring to $64.3 million, or $2.00 per diluted share, up 93% from the previous year. Adjusted net income also saw a remarkable increase, reaching $71.4 million, or $2.22 per diluted share. This performance significantly exceeded the analyst estimates of $1.39 earnings per share and a net income of $44.80 million.

Total revenue for the quarter reached $948.5 million, driven by home sales revenues of $922.4 million, marking a 25% increase from the previous year. This result also surpassed the estimated revenue of $784.47 million. The company delivered 2,358 homes during the quarter, reflecting a robust 23% increase year-over-year.

Operational Highlights

Century Communities achieved several operational milestones in the first quarter of 2024. The company reported a record community count of 253, an 8% increase year-over-year. The total lot inventory stood at 75,089, with controlled lots making up 58% of this total. The net new home contracts rose to 2,866 homes, a 42% increase from the previous year, showcasing strong market demand.

The company's financial health remains strong, with $2.4 billion in stockholders equity and $1.0 billion in liquidity. The balance sheet strength is further highlighted by a net homebuilding debt to net capital ratio of 24.9%, demonstrating prudent financial management.

Strategic Developments and Outlook

Century Communities' strategic initiatives include a 13% increase in its quarterly cash dividend to $0.26 per share and the repurchase of 186,887 shares of common stock for $16.1 million. Looking forward, the company anticipates continued growth, projecting full-year 2024 deliveries to be between 10,000 to 11,000 homes, with home sales revenues expected to range from $3.8 billion to $4.2 billion.

Management Commentary

Dale Francescon, Co-Chief Executive Officer, expressed optimism about the company's trajectory, citing strong demand and effective cost management as key drivers of the quarter's success. Rob Francescon, Co-CEO and President, emphasized the strategic expansion of their lot inventory and community count, which positions the company well for sustained growth.

Conclusion

Century Communities Inc's first-quarter performance in 2024 sets a positive tone for the year. With strong financial results and strategic management, the company is well-positioned to capitalize on the ongoing demand in the residential construction market. Investors and stakeholders may look forward to continued growth and profitability as the company executes its operational strategies effectively.

For detailed financial figures and future updates, visit the Investors section at www.centurycommunities.com.

Explore the complete 8-K earnings release (here) from Century Communities Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance