Cencora (COR) to Report Q2 Earnings: What's in the Cards?

Cencora COR is scheduled to release second-quarter fiscal 2024 results on May 1, before the opening bell.

In the last reported quarter, the company delivered an earnings surprise of 14.69%. Its earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 6.69%.

Q2 Estimates

The Zacks Consensus Estimate for revenues is pegged at $70.35 billion, indicating an improvement of 10.9% from the top line reported in the prior-year quarter. The consensus mark for earnings is pinned at $3.65 per share, implying growth of 4.3% from the year-ago quarter’s reported number.

Factors to Note

Sustained strong growth in specialty product sales, coupled with broad-based solid performance and utilization trends across the portfolio in the U.S. Healthcare Solutions segment, might have favored COR’s fiscal second-quarter performance. High demand for the recently-approved GLP-1 drugs for diabetes and/or weight loss is likely to have boosted growth. Moreover, the new distribution center in California should continue to support its scale of supply.

The commercial COVID-19 treatments recorded lower sales in the past two quarters. This trend is likely to have continued in the soon-to-be-reported quarter. The company raised its fiscal 2024 revenue growth guidance for the U.S. Healthcare Solutions segment from 7-10% to 11-13%. This may be reflected in the fiscal second-quarter results as well. Our model expects second-quarter revenues for this segment to be $62.2 billion.

Operating income at the aforementioned segment is anticipated to grow 9-11% in fiscal 2024. This is likely to be reflected in the fiscal second-quarter results. Our model predicts the segment’s adjusted operating income to be $781.5 million.

Apart from this, the International Healthcare Solutions segment’s World Courier unit is expected to have exhibited solid performance in the quarter under review. In fact, the unit’s impressive track record as an international leader in specialty logistics has enabled Cencora to serve customers globally. The company was able to do so despite a challenging COVID-induced environment and additional operational challenges. The addition of PharmaLex in 2023 is also likely to have brought additional revenues.

Per the fiscal 2024 guidance, revenues and operating income at the International Healthcare Solutions segment are estimated to grow 4-8% and 5-8%, respectively. This is likely to be reflected in the upcoming quarterly results. Our model expects the segment’s adjusted operating income and revenues to be $187.5 million and $7 billion, respectively.

Although revenues and operating income are likely to have been on the higher side, gross margin is anticipated to have been hurt during the soon-to-be-reported quarter. This is due to higher volumes of low-margin GLP-1 products, coupled with lower volumes of high-margin government-owned COVID treatments.

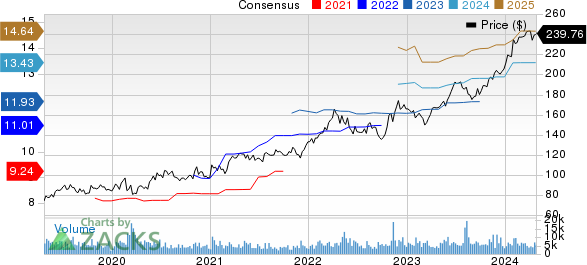

Cencora, Inc. Price and Consensus

Cencora, Inc. price-consensus-chart | Cencora, Inc. Quote

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Cencora this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is not the case here, as you will see below.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate is 0.00% for COR at present. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Zacks Rank: The company carries a Zacks Rank #3 at present.

Stocks Worth a Look

Here are some medical stocks worth considering as these have the right combination of elements to post an earnings beat this reporting cycle.

NovoCure Limited NVCR has an Earnings ESP of +13.15% and a Zacks Rank of 3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company’s shares have surged 12.7% year to date. NVCR’s earnings beat estimates in the last reported quarter. It delivered a trailing four-quarter average negative earnings surprise of 5.07%.

SiBone SIBN has an Earnings ESP of +0.69% and a Zacks Rank of 3 at present.

Its shares have lost 26.6% year to date. SIBN’s earnings beat estimates in the last reported quarter. SiBone has a trailing four-quarter average earnings surprise of 19.98%.

Cardinal Health CAH has an Earnings ESP of +1.11% and a Zacks Rank of 3 at present.

The stock has risen 7.4% year to date. CAH’s earnings beat estimates in the last reported quarter. Cardinal Health has a trailing four-quarter average earnings surprise of 15.64%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

NovoCure Limited (NVCR) : Free Stock Analysis Report

SiBone (SIBN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance