Celgene (CELG) Up on Deal With bluebird For CAR-T Candidate

Shares of Celgene Corporation CELG moved up 3% after the company announced a development and co-promotion agreement with bluebird bio, Inc. BLUE. Both companies have entered into a deal to co-develop and co-promote bb2121, an experimental anti-B-cell maturation antigen (BCMA) chimeric antigen receptor (CAR) T cell therapy for the potential treatment of patients with relapsed/refractory multiple myeloma in the United States.

We remind investors that both companies entered into a broad, global strategic research collaboration in 2013 to discover, develop and commercialize novel therapies in oncology. Currently, bluebird bio and Celgene are collaborating to develop CAR-T cell therapies targeting BCMA and the lead target of this program is bb2121 which is being evaluated for the treatment of relapsed and refractory multiple myeloma.

Celgene is upbeat on the potential of the bb2121 and believes that the candidate can revolutionize the treatment approach and outcomes for patients with multiple myeloma.

Per the terms of the latest agreement, both companies will share the costs and profits in the United States equally. bluebird and Celgene have joint responsibility for the development, manufacturing and commercialization of bb2121 in the United States. In addition, Celgene will assume sole responsibility for drug product manufacturing and commercialization outside the United States.

In addition, bluebird will also receive milestones and royalties on ex-U.S. sales.

Meanwhile, bluebird bio and Celgene are also working together on a second clinical-stage anti-BCMA CAR-T program, bb21217.

Our Take

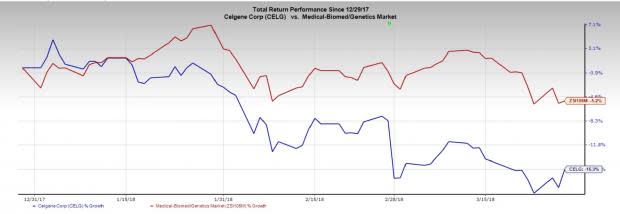

The news should somewhat relieve the wary investors as Celgene’s stock has lost 15.3% in the last three months, worse than the industry’s decline of 5.2%.

Celgene is making desperate attempts to revive its portfolio/pipeline after a series of pipeline setbacks in recent times.Things have been on the downturn for the company since last October after Celgene announced a phase III trial, REVOLVE, (CD-002) on pipeline candidate GED-0301 in Crohn’s disease and the extension trial, SUSTAIN (CD-004) have been discontinued following a recommendation from the Data Monitoring Committee, which assessed overall benefit/risk during a recent interim futility analysis. In December 2017, a late stage study on its lead cancer drug Revlimid in combination with Roche Holdings’ RHHBY Rituxan failed. Celgene suffered yet another setback when it received Refusal to File letter from the FDA regarding its New Drug Application for multiple sclerosis candidate ozanimod.

Celgene was on the look-out of new deals and acquisitions given a lacklustre 2017. The company recently acquired Juno Therapeutics and added JCAR017 (lisocabtagene maraleucel; liso-cel) to Celgene’s lymphoma pipeline. JCAR017 is a best-in-class CD19-directed CAR-T candidate, currently in a pivotal program for relapsed and/or refractory diffuse large B-cell lymphoma. The candidate is expected to obtain regulatory approval in the United States in 2019 and generate sales of approximately $3 billion.

Hence, the bluebird deal will further bolster Celgene’s presence in the CAR-T space.

Zacks Rank & Key Pick

Celgene currently carries a Zacks Rank #4 (Sell).

A better-ranked stock from the same space is Regeneron Pharmaceuticals REGN, which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Regeneron’s earnings per share estimates have moved up from $18.65 to $18.68 for 2018 in the last 30 days. The company pulled off a positive earnings surprise in three of the last four quarters, with an average beat of 9.15%.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Celgene Corporation (CELG) : Free Stock Analysis Report

bluebird bio, Inc. (BLUE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance