A Cautious Perspective of Nintendo

Nintendo Co. Ltd. (TSE:7974) (NTDOY) has worked to re-establish itself in the video game industry over the past several years. The company boasts a valuable portfolio of intellectual property and great expertise. This, combined with a dedicated fanbase cultivated over generations, creates a powerful competitive advantage that translates into consistent growth, robust profitability and strong cash generation.

However, despite its strengths, investors must carefully consider Nintendo's current valuation and growth prospects. While the company continues to be a cash cow, its price-earnings ratio might suggest a potentially stretched valuation. Additionally, with the gaming landscape constantly shifting, the question remains: Can the company maintain its edge and deliver the kind of growth that will justify its current price?

Nintendo's business model

Nintendo relies heavily on its intellectual property as the cornerstone of its business model. These iconic franchises, which include Mario, Zelda and Pokemon, have sustained remarkable success over several decades. Notably, Pokemon stands out as one of the most valuable media franchises in the world.

Over the years, Nintendo has adeptly leveraged these brands, particularly within the video game industry, to create both captivating games and innovative consoles. Its current hardware is the Switch, which in 2023 accounted for more than 96% of total revenue (hardware and software sales combined).

Classic characters like Mario and Link consistently top the sales chart on Switch and other Nintendo consoles. This advantage is two-fold. First, it sets Nintendo apart by offering exclusive titles unavailable on Microsoft's (NASDAQ:MSFT) Xbox or Sony's (NYSE:SONY) PlayStation. Second, these franchises translate to better profit margins, as evidenced by the data in the table below.

Source: GuruFocus

Another factor that increases its margin is that the Nintendo Switch's hardware is inferior to that of the Xbox and PlayStation. It is estimated that a few years ago the Switch's production cost was around $257 and although the margin is not huge (given the price was around $299), it is already a major highlight compared to Microsoft, which lost up to $200 on each Xbox sold, and Sony, which, until a few years ago, was also losing money on the sale of its consoles.

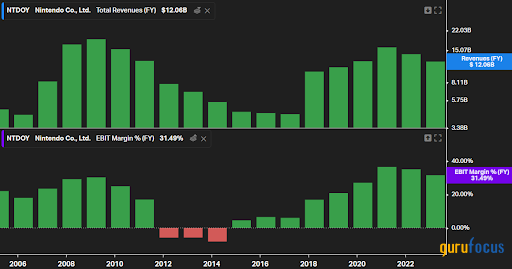

But this advantage has not always ensured robust sales and margins. At times, the company sold the Nintendo 3DS at a loss, as well as the Wii U. Between 2012 and 2014, the company recorded negative Ebit margins and a slowdown in revenue, only recovering with the launch of the Switch in 2017, which was boosted by games such as "The Legend of Zelda: Breath of the Wild."

Source: Koyfin

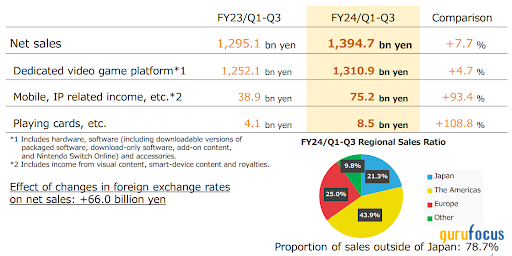

In the last three fiscal quarters (April to December 2023) Nintendo showed a significant increase in revenue of 7.70% consolidated, explained by a 4.70% boost in the sale of video games, and a 93.40% increase in the sale of mobile and other IP-related income (such as "The Super Mario Bros. Movie" and other royalties). As a result, video game revenue slightly lost representation, reaching around 94% (all comparisons in Japanese yen).

The image below shows another important division of its revenue, which is geographical. Although Nintendo is a Japanese company and part of its culture, almost 80% of sales come from other parts of the world, which mitigates some of the exchange rate risk. Of course, this risk still exists.

Source: Nintendo's financial results presentation

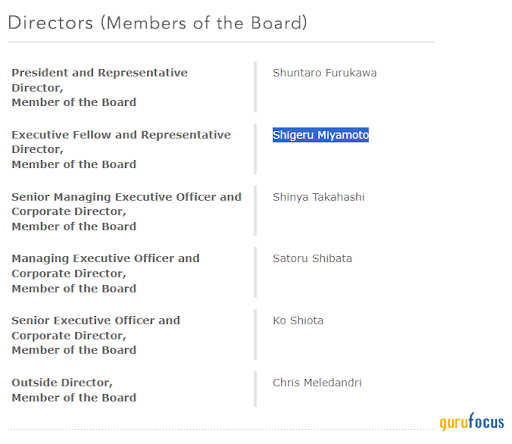

As a Japanese company, Nintendo embodies a unique blend of tradition and innovation. The company culture, known for lifetime employment and a strong sense of hierarchy, fosters a long-term vision. This is evident in the continued influence of legendary game creator Shigeru Miyamoto. His active role on the board and involvement in projects like "The Super Mario Bros. Movie" and Super Nintendo World theme park showcases the company's commitment to both its heritage and future.

Source: Nintendo IR Website

Nintendo's financial health further strengthens its investment potential. The company boasts a robust capital structure, with a net cash position exceeding $14 billion. This translates to a lower enterprise value compared to its market capitalization, as traditional metrics like the price-earnings ratio might be skewed by not considering this significant cash hoard.

This financial strength offers multiple advantages. First, it provides ample resources for developing new products and fueling future growth. Second, Nintendo's low debt level serves as a crucial safety net during economic downturns or similar challenges faced between 2012 and 2014. This financial resilience helps to safeguard the company's stability in the face of unforeseen circumstances. Finally, the strong financial position empowers Nintendo to consistently distribute dividends to its shareholders, as reflected in its current dividend yield of approximately 2.20%.

Source: Koyfin

In short, Nintendo has important differentiators in the gaming market, which can often be summed up by its franchises with a very loyal audience, but also by its expertise in bringing out good games and reinventing itself. This enduring moat and long-term vision puts Nintendo on a different level (in a good way) in the gaming segment.

Growth triggers and some risks to the thesis

As mentioned previously, much of Nintendo's moat is based on its intellectual property. In my view, both the growth triggers and the risks are strictly linked to the success the company will have in continuing to take advantage of this strength.

There is no denying the Nintendo Switch's success. A confluence of factors likely fueled this, including its innovative hybrid design and competitive price point. However, the consistent delivery of acclaimed Zelda titles like "Breath of the Wild" and the recent "Tears of the Kingdom" have arguably been the most significant driver. Both of these games have sold very well, with the most recent one having sold over 20 million copies, and also acting as a draw for the console (given the exclusivity).

But it turns out that the Nintendo Switch is already in its final phase of life, and there are expectations that the company will announce the next console (with speculation of a "Nintendo Switch 2"). While details about this upcoming console are scarce, rumors suggest it may debut in 2025 with hardware that falls short of some expectations.

The uncertainty surrounding Nintendo's future console releases could significantly impact the stock performance. Whether the company can sustain or even exceed the success of the Switch with its successor remains uncertain, but it is a crucial factor for investors to monitor closely.

That is why I also think the main risk is a loss of revenue or margins in its main market due to not being able to sustain the high level that the Nintendo Switch has brought.

To mention a few optionalities that I find interesting, it is the growth of revenues in other media formats, such as new films (there are plans for a Zelda movie), series, mobile games and the like.

My view is neutral for now

As mentioned, I think Nintendo has an excellent business model with strong moats and can continue to grow if it succeeds in its initiatives. However, my view is cautious due mainly to two factors: the not-very-encouraging margin of safety and the still cloudy outlook for growth.

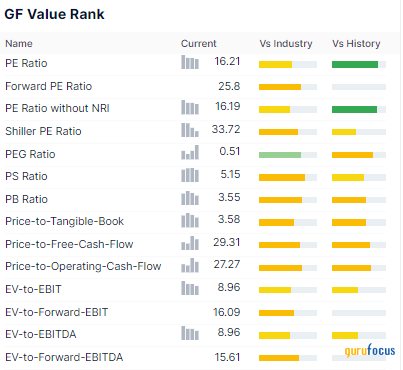

In terms of the margin of safety, the company's multiples illustrate this well. Its price-earnings ratio of 16.20 and its enterprise value-to-Ebitda ratio of 9 seem low at first glance compared to other peers in the industry (such as Electronic Arts (NASDAQ:EA), Take-Two (NASDAQ:TTWO), Microsoft and others) and considering the company's premium quality. But considering all the uncertainties regarding the maintenance of its earnings in the coming years, they do not seem very attractive to me.

Source: GuruFocus

This makes analysts foresee a downturn in revenue over the next couple of years, estimating a drop from $12.06 billion in 2023 to $10.50 billion in 2025. This market pessimism might just open up avenues for the company to surpass expectations in the foreseeable future. Success in launching new games, consoles and optionalities could position the company to surprise the market.

While Nintendo remains a company I admire for its strong competitive advantages, the current valuation, coupled with some uncertainty around future performance, makes me cautious. To feel more confident about this investment, I need a clearer picture of Nintendo's potential for significant revenue and profitability growth in the next few years. Additionally, a wider margin of safety would be reassuring, as I currently view it as somewhat narrow. That said, Nintendo remains on my radar and I'm eager to see how the next few quarters unfold.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance