CarParts.com Inc (PRTS) Reports Record Fiscal Year Sales Despite Net Loss Widening

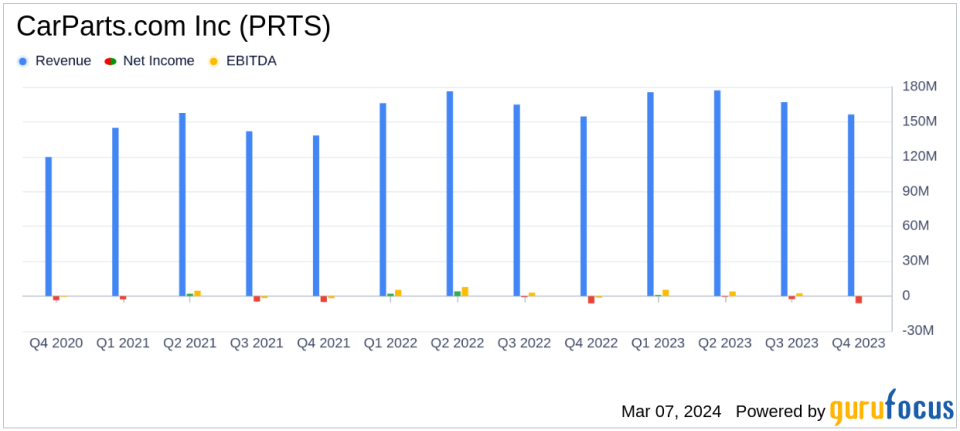

Fiscal Year Sales: Achieved highest sales in company history at $675.7 million, a 2% increase year-over-year.

Gross Margin: Slight decrease in gross profit with a 100 basis points drop in gross margin due to higher transportation costs and product mix shift.

Net Loss: Fiscal year net loss widened to ($8.2) million from ($1.0) million in the previous year.

Adjusted EBITDA: Declined to $19.7 million in fiscal year 2023 from $26.1 million in fiscal year 2022.

Cost Structure: Announced reduction including the elimination of 150 global roles to align with current economic conditions.

Balance Sheet Strength: Ended the year with a strong cash balance of $51.0 million and no long-term debt.

2024 Outlook: Expects comparable net sales ranging from negative two percent to positive two percent, with gross margin between 30% to 32%.

On March 7th, 2024, CarParts.com Inc (NASDAQ:PRTS) released its 8-K filing, announcing its financial results for the fourth quarter and fiscal year ended December 30, 2023. The company, a leading online provider of automotive aftermarket parts and repair information, reported the highest fiscal year sales in its history, despite facing a challenging macroeconomic environment and reporting a wider net loss compared to the previous year.

Financial Performance and Challenges

CarParts.com Inc (NASDAQ:PRTS) experienced a year of mixed financial results. While the company achieved a record $675.7 million in net sales, representing a modest 2% increase from the previous fiscal year, it faced a decrease in gross profit and a widened net loss. The gross margin contracted by 100 basis points to 33.9%, primarily due to increased outbound transportation costs and a shift in product mix. The net loss for the fiscal year expanded to ($8.2) million from ($1.0) million in the prior year, reflecting increased operating expenses from investments in the business and higher advertising costs.

The company's CEO, David Meniane, acknowledged the strong unit growth and market share gains but also noted the slow start to 2024 and the ongoing difficult macro environment. In response, CarParts.com Inc (NASDAQ:PRTS) has taken significant cost reduction measures, including the elimination of 150 global roles, to maintain agility and protect shareholder value.

Financial Achievements and Importance

Despite the challenges, CarParts.com Inc (NASDAQ:PRTS) ended the fiscal year with a strong balance sheet, highlighted by a cash balance of $51.0 million, an increase from $18.8 million at the end of the prior fiscal year. The company has no revolver debt and no long-term debt, positioning it well to navigate the current economic conditions and invest in long-term growth. This financial stability is particularly important in the Retail - Cyclical industry, where companies must manage inventory and cash flow carefully to respond to market demands and economic cycles.

Key Financial Metrics

Important metrics from the financial statements include:

"We continued to see strong unit growth of approximately 8% in the fourth quarter. We believe we are taking share from other online players and as consumer confidence rebounds, we are well positioned to support the $389 billion automotive aftermarket and deliver long-term growth." - David Meniane, CEO.

Adjusted EBITDA, a key measure of profitability, decreased to $19.7 million in fiscal year 2023 from $26.1 million in the previous year. The company's focus on maintaining a robust cash position and a debt-free balance sheet is essential for sustaining operations and funding growth initiatives.

Analysis of Company's Performance

CarParts.com Inc (NASDAQ:PRTS) has demonstrated resilience by achieving record sales in a tough economic climate. However, the company's profitability has been squeezed by external pressures such as increased transportation costs. The strategic decision to reduce costs and streamline operations reflects a proactive approach to managing these challenges. Looking ahead, the company's conservative outlook for 2024, with flat to slightly variable net sales and a lower gross margin, suggests a cautious approach in an uncertain market.

The company's commitment to innovation and customer service, combined with its strong balance sheet, provides a foundation for future growth. However, investors and stakeholders will be closely monitoring the company's ability to control costs and improve profitability in the coming year.

For detailed insights and further information, investors are encouraged to review the full 8-K filing and listen to the earnings call webcast available on the company's investor relations website.

Explore the complete 8-K earnings release (here) from CarParts.com Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance