Capital One (COF) Q1 Earnings Miss, Provisions Decline Y/Y

Capital One’s COF first-quarter 2024 adjusted earnings of $3.21 per share lagged the Zacks Consensus Estimate of $3.25. In the prior-year quarter, earnings per share was $2.31. The reported quarter’s results exclude an FDIC special assessment charge of $42 million.

Results were adversely impacted by higher expenses. Also, loan balances witnessed a sequential decline in the quarter. Nevertheless, an increase in net interest income (NII), along with higher non-interest income, supported the results to some extent. Also, a decline in provisions was a tailwind.

After considering the non-recurring item, net income available to common shareholders was $1.2 billion, up 35% from the prior-year quarter. Our estimate for the metric was $1.1 billion.

Revenues Improve, Expenses Rise

Total net revenues were $9.40 billion, up 6% from the prior-year quarter. The top line marginally beat the Zacks Consensus Estimate of $9.35 billion.

NII increased 4% year over year to $7.49 billion. The NIM expanded 9 basis points (bps) to 6.69%. Our estimates for NII and NIM were $7.56 billion and 6.71%, respectively.

Non-interest income of $1.91 billion increased 11% from the prior-year quarter. The rise was driven by an increase in net interchange fees, service charges and other customer-related fees, and other income. Our estimate for non-interest income was $1.74 billion.

Non-interest expenses were $5.14 billion, up 4% year over year. The rise was due to an increase in almost all cost components, except for professional services costs. We expected the metric to be $5.11 billion.

The efficiency ratio was 54.64%, down from 55.54% in the year-ago quarter. A fall in the efficiency ratio indicates an improvement in profitability.

As of Mar 31, 2024, loans held for investment were $315.2 billion, down 2% from the prior-quarter end. Total deposits were $351 billion, which rose 1% sequentially.

Credit Quality: Mixed Bag

Provision for credit losses was $2.68 billion in the reported quarter, declining 4% from the prior-year quarter. We anticipated provisions of $2.64 billion.

The 30-plus-day-performing delinquency rate rose 52 bps year over year to 3.40%. Also, the net charge-off rate jumped 112 bps to 3.33%. Allowance, as a percentage of reported loans held for investment, was 4.88%, up 24 bps year over year.

Capital & Profitability Ratios Improve

As of Mar 31, 2024, the Tier 1 risk-based capital ratio was 14.4%, up from 13.9% a year ago. The common equity Tier 1 capital ratio was 13.1%, improving from 12.5%.

At the end of the first quarter, the return on average assets was 1.08%, up from 0.83% in the year-ago period. Return on average common equity was 9.03%, rising from 7.11%.

Our View

Capital One’s strategic acquisitions, decent demand for consumer loans, higher rates and steady improvement in the card business position it well for long-term growth. However, elevated expenses and a tough macroeconomic backdrop are major near-term concerns.

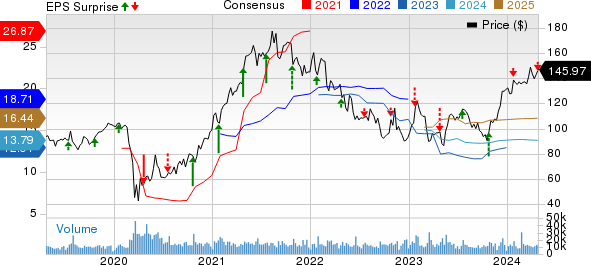

Capital One Financial Corporation Price, Consensus and EPS Surprise

Capital One Financial Corporation price-consensus-eps-surprise-chart | Capital One Financial Corporation Quote

Currently, Capital One carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Finance Stocks

Ally Financial’s ALLY first-quarter 2024 adjusted earnings of 45 cents per share surpassed the Zacks Consensus Estimate of 33 cents. However, the bottom line reflects a decline of 45.1% from the year-ago quarter.

ALLY’s results were primarily aided by an improvement in other revenues. However, a decline in net financing revenues, along with higher expenses and provisions, were the undermining factors.

Navient Corporation NAVI reported first-quarter 2024 adjusted earnings per share (excluding regulatory-related and restructuring expenses) of 63 cents, surpassing the Zacks Consensus Estimate of 58 cents. The company reported 86 cents in the prior-year quarter.

NAVI’s results were driven by a rise in total other income and a fall in expenses. However, a decline in NII affected the results.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Capital One Financial Corporation (COF) : Free Stock Analysis Report

Ally Financial Inc. (ALLY) : Free Stock Analysis Report

Navient Corporation (NAVI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance