Cantaloupe, Inc. Just Recorded A 43% EPS Beat: Here's What Analysts Are Forecasting Next

It's been a pretty great week for Cantaloupe, Inc. (NASDAQ:CTLP) shareholders, with its shares surging 14% to US$6.74 in the week since its latest third-quarter results. Revenues of US$68m fell slightly short of expectations, but earnings were a definite bright spot, with statutory per-share profits of US$0.06 an impressive 43% ahead of estimates. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

See our latest analysis for Cantaloupe

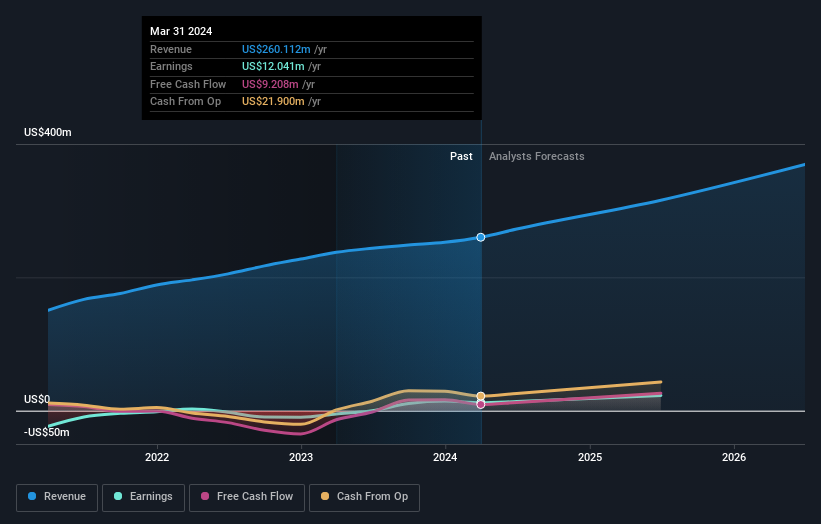

Taking into account the latest results, the current consensus from Cantaloupe's six analysts is for revenues of US$315.7m in 2025. This would reflect a huge 21% increase on its revenue over the past 12 months. Statutory earnings per share are predicted to surge 55% to US$0.26. In the lead-up to this report, the analysts had been modelling revenues of US$316.3m and earnings per share (EPS) of US$0.26 in 2025. The analysts seem to have become a little more negative on the business after the latest results, given the minor downgrade to their earnings per share numbers for next year.

Despite cutting their earnings forecasts,the analysts have lifted their price target 8.4% to US$10.70, suggesting that these impacts are not expected to weigh on the stock's value in the long term. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Cantaloupe analyst has a price target of US$13.00 per share, while the most pessimistic values it at US$10.00. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or thatthe analysts have a strong view on its prospects.

Of course, another way to look at these forecasts is to place them into context against the industry itself. The analysts are definitely expecting Cantaloupe's growth to accelerate, with the forecast 17% annualised growth to the end of 2025 ranking favourably alongside historical growth of 13% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 3.7% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Cantaloupe is expected to grow much faster than its industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Cantaloupe. Fortunately, they also reconfirmed their revenue numbers, suggesting that it's tracking in line with expectations. Additionally, our data suggests that revenue is expected to grow faster than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Cantaloupe going out to 2026, and you can see them free on our platform here..

We also provide an overview of the Cantaloupe Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance