CAC 40 Prices Trade in Range to Close Week

DailyFX.com -

Talking Points

CAC 40 Opens Modestly Higher Up +0.86%

Bearish Breakouts for the CAC 40 begin under 4,143.14

If you are looking for more trading ideas for equities markets, check out our Trading Guides

The CAC 40 is trading marginally higher this morning, and is up +0.86% on today’s session. Currently prices are trading just through S1 pivot support found at 4,189.52. If prices continue to move lower, it opens up the CAC 40 to test range support found at the S3 pivot at a price of 4,170.97. So far, price action has yet to breakout below this point. If the S3 pivot holds, it may suggest further range bound market conditions for the CAC 40.

CAC 40, 30 Minute Chart with Pivots

(Created using Marketscope 2.0 Charts)

Traders looking for a breakout should continue to monitor both the R4 and S4 pivot. Today’s R4 pivot is located at 4,254.46. A move to this point would be significant as it would be the first bullish breakout of the trading week. Alternatively, bearish breakouts begin beneath the S4 pivot at a price of 4,143.14. A breakout below this point would suggest a resumption of the CAC 40’s current downtrend. Initial bearish profit targets may be found near 4087.48 by extrapolating a 1X extension of the previously identified trading range.

Find out real time sentiment data with the DailyFX’s sentiment page.

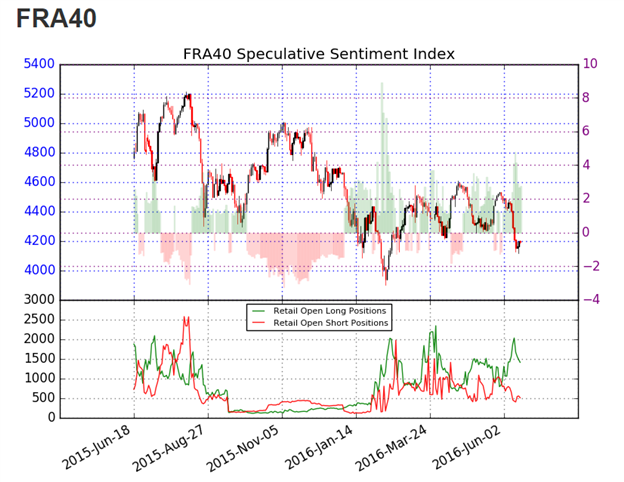

Sentiment for the CAC 40 (Ticker: FRA40) remains extremely positive with SSI (speculative sentiment index) reading at +2.80. This value has increased from yesterday’s reading of +2.70. 74$ of positioning is long, which suggests that the CAC 40 may be poised for a further decline. In the event that the Index finds support, traders should look for SSI to neutralize as prices advance.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Contact and Follow Walker on Twitter @WEnglandFX.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance