Buying Property Overseas? Property Laws For Foreigners in Countries Like Malaysia, Australia & Thailand

There are certain limits to investing in property in Singapore. Even in a lacklustre property market, private property is still exorbitantly priced and comes with a whole bunch of inconveniences, like ABSD and not being able to rent to tourists on Airbnb for less than 3 months. And with all the rules surrounding HDB ownership, affluent investors are usually precluded anyway.

Whether you’re thinking of securing a retirement home overseas or simply looking out for investment opportunities in nearby Southeast Asia, Australia or the UK, you might be toying with the idea of buying properties overseas. So what are some of the things that you should be looking out for?

Can I buy overseas property if I own an HDB in Singapore?

If you own an HDB flat, you can buy overseas residential property only after you have fulfilled the Minimum Occupation Period (MOP), usually 5 years, on your HDB flat. If you’re buying overseas commercial property, you don’t need to wait until the MOP is up to buy.

Once your MOP is up, you can buy as many subsequent residential private properties (whether in Singapore or overseas) as you want.

When you have committed to an overseas property purchase, you will not be able to purchase an HDB flat if you do not already have one.

If you wish to buy an overseas property, you will need to sell your HDB flat within 6 months of the purchase of your flat.

Conversely, if you wish to buy an HDB resale flat after buying overseas property, you will need to sell additional private property (whether in Singapore or overseas) on hand within 6 months.

Obviously, you will not be able to use CPF savings to pay for overseas properties.

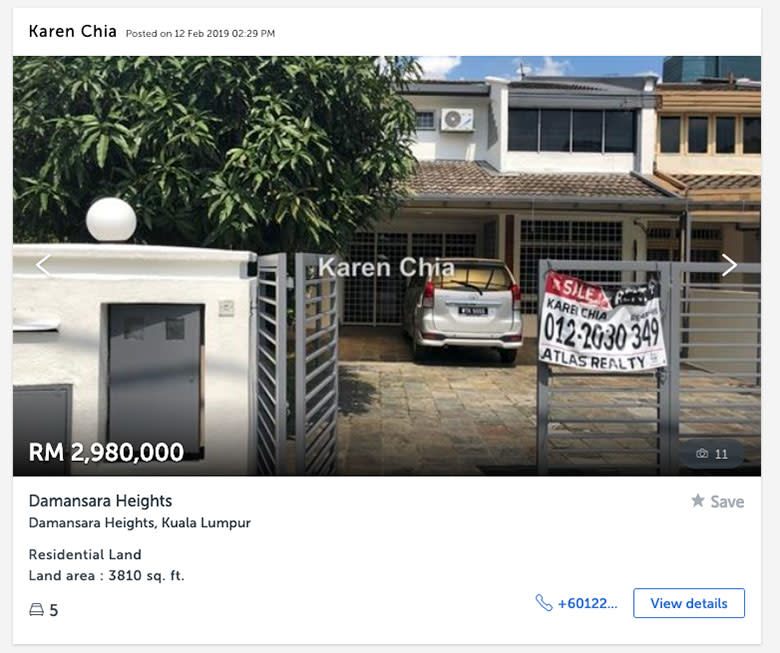

Buying property in Malaysia for foreigners

The good news for Singaporeans who wish to retire across the Causeway is that it is fairly easy for foreigners to own Malaysian property.

You are generally allowed full ownership of most property residential property types so long as they have a value of at least RM1 million ($331,090 SGD).

You are prohibited from buying certain residential units that the government has identified as low and medium cost, to be set aside for lower income Malaysians, as well as Bumiputera properties or those situated on Malay Reserved Land.

In practice, this means that you might end up looking at more luxurious property developments. There are no restrictions on ownership of landed property (except in the above mentioned cases), so if you’ve always wanted to own a house, or are already eyeing that spanking new JB property, this is your chance.

Buying property in Indonesia for foreigners

Foreigners are generally not allowed to purchase property in Indonesia unless they have some kind of link with the country, such as by being PRs in Indonesia, working there or owning a business there.

Ownership of property by eligible foreigners in Indonesia is generally restricted to non-subsidised houses, certain apartment units or vacant land on which you can build your own house. Actually, this “ownership” is a “right to use” title and generally lasts for only 25 years at a time, renewable for up to 70 years.

To get around the short duration of leasehold titles, you can get an Indonesian representative to buy property on your behalf through a legally binding contract. You might also be able to buy property through your business if you have one in Indonesia.

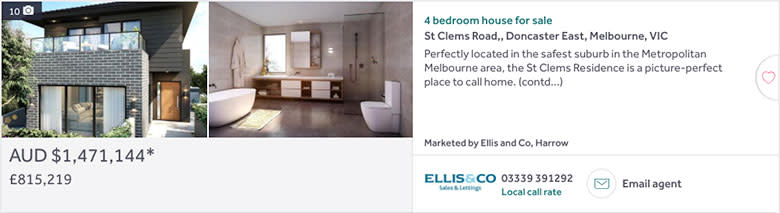

Buying property in Australia for foreigners

Due to an influx of Chinese buyers raising property prices, Australia recently tightened the rules and it is now harder for foreign buyers to buy property there.

As a non-resident foreigner, you can only buy brand new property, so you’ll need to look out for new launches rather than check out the resale market.

Before making a purchase, you will first need to obtain approval from the Foreign Investment Review Board and pay a fee of $5,000 for properties whose value is less than 1 million AUD or $10,000 for properties over $1 million, with the cost of the fee rising by $10,000 for each additional million.

The catch is that just because you pay the fee doesn’t mean you will necessarily get the property you desire. If the sale falls through, too bad.

Banks are also allowed to lend only a maximum of 60% of the value of the home, which means you’ll have to be prepared to fork out a deposit of at least 40%.

Finally, you’ll have to pay stamp duty, which in certain states like Victoria has risen for foreign purchasers.

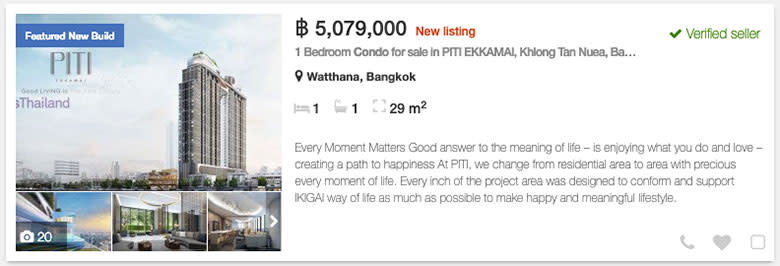

Buying property in Thailand for foreigners

Some property developers in Bangkok now hold launches in Singapore, which is a testament to the popularity of investing in Thai property.

Foreigners are technically only allowed to wholly-own apartment units rather than land. This is the route taken by most Singaporean investors who buy luxury condo units in Bangkok. Even then, 51% of each building must be owned by Thais. Once the quota has been reached, you won’t be able to buy a unit on the property unless another foreigner sells their share.

When it comes to buying landed property, the situation is trickier as foreigners are technically not allowed to own land. The available options for would-be landed property owners include getting a 30 year lease and setting up a Thai company that has at least 51% Thai ownership and then using the company to buy the property.

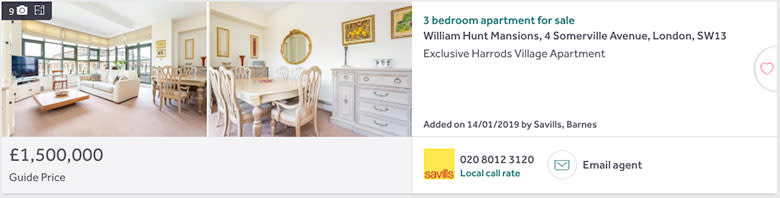

Buying property in UK for foreigners

There are few restrictions on foreign buyers in the UK, except when it comes to loans. So long as you have the cash, most residential property is free game. Landed property tends to be freehold, while condos and apartments are more likely to be leasehold.

The minimum deposit is 10%, but as a foreigner banks might only loan you as little as 60% of the property value.

Overseas property loans

You can opt to take out a property loan either in Singapore or in the country where you are buying property.

Don’t forget to consider the following:

Interest rates: Lower and more stable interest rates mean the mortgage will cost you less.

How much money you can borrow: If you take out a Singapore mortgage, the TDSR might limit how much you can borrow. The limits on overseas mortgages will depend on the rules in the foreign country.

Exchange rate: The future of the exchange rate will affect the overall cost of the mortgage to you.

Tips before you buy

Visit the launch, exhibition or actual property: If you’re investing in new or unbuilt property, visit the launch and try to get a feel for the actual unit instead of relying wholly on brochures or websites.

Visit the country: Inspect the area where the property is located. You don’t want to buy a property in a dodgy neighbourhood. For resale property, it’s obviously a good idea to inspect it in person.

Research the developer: Take extra care to research on the developer of your potential dream house. Check their reputation and past projects to avoid falling prey to an overseas property scam.

Research the market: Research the market, property type and area before you buy. For instance, in big cosmopolitan cities, a studio apartment in the city centre might be a better investment than a big house in the suburbs.

Are you thinking of buying property overseas? Share your plans and questions in the comments.

Related articles

Cheap Guide to Johor Bahru – Where to Go & Best Things to Do in JB

5 Affordable No-Flight Weekend Getaways That Aren’t Johor Bahru Or Batam

Retirement Planning in Singapore (2019) – A Starter Guide for Confused Millennials

The post Buying Property Overseas? Property Laws For Foreigners in Countries Like Malaysia, Australia & Thailand appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

More From MoneySmart

Yahoo Finance

Yahoo Finance