Buy Soaring Meta Stock Before Earnings and Hold Forever?

Meta Platforms, Inc. (META) shares have skyrocketed 130% in the last year and 40% YTD heading into its Q1 FY24 earnings release on April 24.

Wall Street is in love with Meta again because of its commitment to efficiency and profits—it even started paying a dividend—along with the fact it reaches roughly half of the global population.

Meta’s Bull Case

Rising rates and Wall Street’s huge pushback on its metaverse bet forced Mark Zuckerberg to quickly pivot to its core competencies, cut costs, and focus on the bottom line.

Meta’s various apps serve different pockets of social media and digital communication. The firm stands to benefit from digital advertising spending in a world of smartphone addicts. The owner of Facebook, Instagram, and WhatsApp grew its daily active users by 8% in Q4 to 3.19 billion, with monthly users up 6% to 3.98 billion.

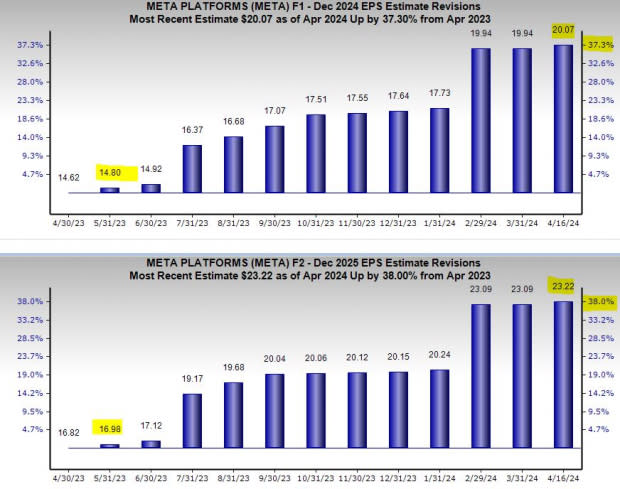

Image Source: Zacks Investment Research

On top of reaching half of the globe, Meta is investing in its AI future, recently introducing its own new generation of AI chips to compete alongside the likes of Nvidia (NVDA) and others. Plus, Meta could benefit from an entirely new lane of growth if its metaverse dreams becomes a reality down the road.

Other Fundamentals

Meta is a digital advertising titan, dwarfing its competitors such as Snap and Pinterest. Meta’s revenue is projected to jump 18% in FY24 and 13% next year to $180 billion (up from $135 billion in 2023).

Meta is projected to grow its adjusted EPS by 35% in FY24 and 16% in FY25, following 73% earnings expansion in 2023. Its Zacks consensus estimates for FY24 and FY25 earnings have surged 38% over the past 12 months and Meta crushed our estimates in the trailing four quarters.

The tech giant’s balance sheet is stellar, helping it pursue new growth areas such as AI. Meta confirmed its commitment to shareholders earlier this year when it initiated a quarterly dividend. Wall Street is very high on the stock, with 40 of the 46 brokerage recommendations that Zacks has at “Strong Buys.”

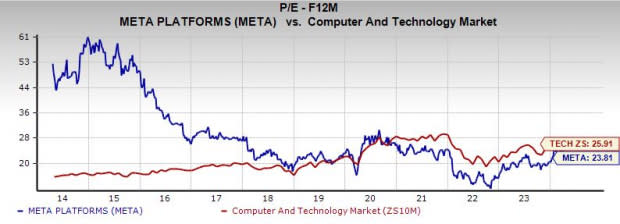

Image Source: Zacks Investment Research

Meta stock has soared 125% in the last year and 450% off its 2022 lows, including a 40% YTD surge. The stock has pulled back off its early April records, slipping below its 50-day moving average recently for the first time this year alongside the S&P 500 and the Nasdaq. Meta might face selling pressure down to its 200-day or 21-week moving averages. But it has already cooled off from heavily overbought RSI levels to below neutral.

Despite its rebound and its 735% climb in the last 10 years to easily double Tech, its valuation is impressive. Meta trades at an 8% discount to the Zacks tech sector and 60% below its highs at 23.8X forward 12-month earnings.

Image Source: Zacks Investment Research

Bottom Line

Meta’s positive EPS revisions help it land a Zacks Rank #2 (Buy). Meta’s recent cooldown alongside the market makes the stock a potentially more appealing long-term buy-and-hold candidate for investors who can weather potential near-term volatility.

Others might want to wait until after Meta reports or a larger pullback, though the market-timing game is notoriously difficult.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance