Should You Buy or Rent? 4 Factors to Consider

By Property Soul (guest contributor)

A friend recently moved from one rented home to another. The family of four is still staying in a condominium in the east side of Singapore, but this time a better one – it is newer, bigger, and at a lower rent too.

How to decide whether to buy or rent?

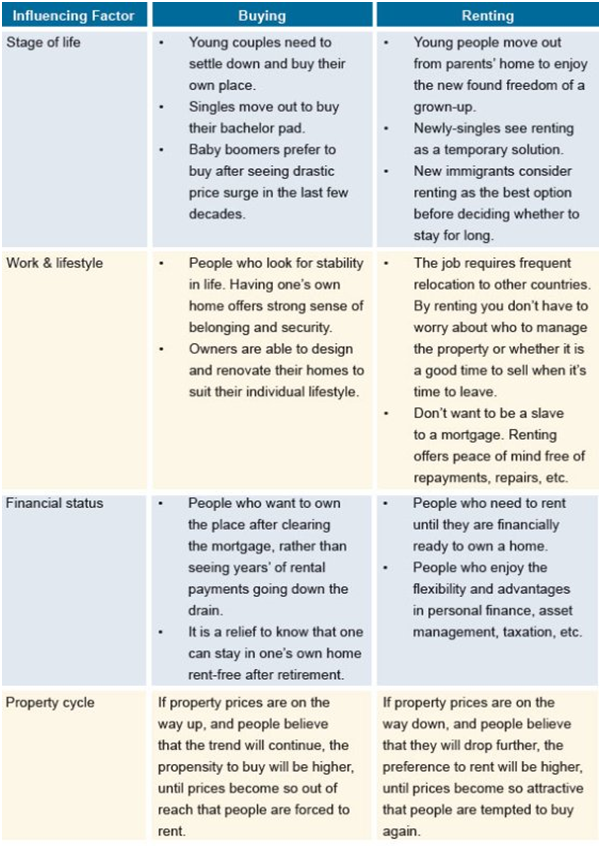

It is a never-ending debate whether one should buy or rent. It is very much an individual choice. As I have mentioned in my book No B.S. Guide to Property Investment, the rent or buy decision is often influenced by four factors: age, lifestyle, finances and the property cycle.

Where is the buy-rent breakeven point?

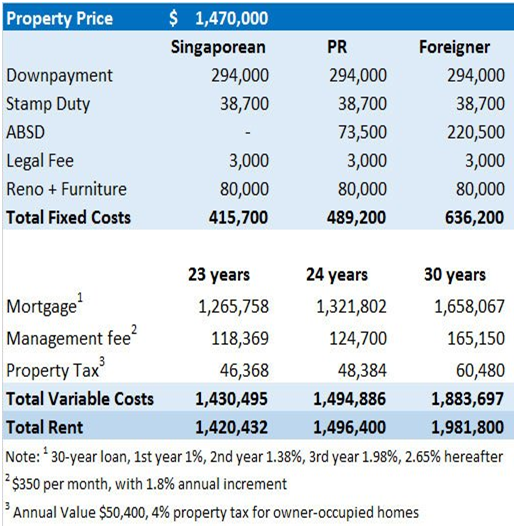

If you are a foreigner in Singapore, your rent or buy decision can be based on a comparison on the total costs of the two options. The buying option involves fixed and variable costs. The fixed costs of buying a home include the initial downpayment, buyer stamp duties, legal fee, renovation, etc. Variable costs are housing mortgage, management fee, property tax, etc. On the other hand, renting a place implies only the monthly rental.

In Zillow Talk: The Rules of Real Estate, the authors Spencer Rascoff and Stan Humphries introduced a concept called the “buy-rent breakeven horizon” – the number of years it would take to make buying economically preferable to renting the same home.

The breakeven point will depend on where you choose to stay and how long you are planning to stay there.

Let’s look at a real-life scenario. You are renting a 958 sq ft 2-bedroom unit at Amaryllis Ville at $4,200 per month. The market price of the unit is now $1,470,000. This is your first purchase and you can borrow 80 percent (or $1,176,000) from the bank.

Assume that both the management fee and rent increase at an annual rate of 1.8 percent (the average inflation rate in Singapore for the last 25 years). As interest rates and property taxes fluctuate depending on the market situation, for this example let’s assume some reasonable figures for the ease of calculation.

As you can see from the table, even if we are comparing only the total variable costs with the total rent, the buy-rent breakeven horizon falls between the 23rd and 24th year. In other words, it will take 24 years to make buying more economical compared with renting the same place.

Even after 30 years, the total fixed and variable costs of owning the 2-bedroom unit ($2.3 million for a Singaporean) is still higher than renting it for 30 years ($1.98 million).

Of course, compared with renting, you own the place after you pay back the bank. But there is also the opportunity cost of the huge initial investment you put in to buy your home. Not to mention paying $482,067 in total interest to the bank over 30 years.

Property prices and rents can go up and down over the years. The question should be when you should buy and when you should rent. After all, the key to win the property game is to buy at the right time and the right price.

Why home purchase can’t be a rational decision?

For emotional matters like a relationship or marriage, you don’t do cost-benefit or breakeven analyses. You listen to your heart and make decisions based on what feels right. The same applies to buying a home.

It is part of the Asian culture to associate getting married with settling down and buying your own place. You need the feeling of home or sense of belonging. Nothing beats coming back to the same place that is renovated to your own taste. One day when you retire, you can go back to a place that is fully paid for.

Singapore is a property-obsessed nation. The Singapore dream is to upgrade and stay in a condominium. As Rascoff and Humphries pointed out in the book: “The upshot is that our homes are now much more than the places where we lay our heads at night. And they aren’t just where the heart is anymore, either. Homes are the object of our heart’s desire.”

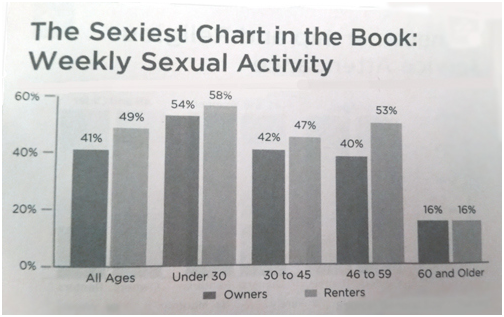

You may be very sure that you won’t be wasting money to rent no matter what. But wait. There is one last thing that Rascoff and Humphries highlighted in their book that might change your mind: A US survey showed that tenants have higher weekly sexual activity compared with owners across all age groups until they reach the age of 60. No?

By guest contributor Property Soul, a successful property investor, blogger, and author of the No B.S. Guide to Property Investment. Posted courtesy of www.Propwise.sg, a Singapore property blog dedicated to helping you understand the real estate market and make better decisions. Click here to get your free Property Beginner’s and Buyer’s Guide.

Related Articles

How to Choose Your HDB BTO Unit – 4 Critical Factors to Consider (at Propwise.sg)

4 Things Buyers Wish They Knew Before Buying a Property (at Propwise.sg)

Yahoo Finance

Yahoo Finance