Should You Buy Altria (MO) Ahead of Q1 Earnings Release?

As Altria Group, Inc. MO prepares to unveil its first-quarter 2024 earnings on Apr 25, investors are keenly observing the company's performance amidst a challenging landscape. With a projected decline in both top and bottom-line figures, the upcoming earnings release prompts a critical question: Should you buy Altria ahead of this event?

The Zacks Consensus Estimate for the to-be-reported quarter’s revenues is pegged at $4.7 billion, suggesting a drop of 1.1% from the prior year’s levels, however, indicating a deceleration from a 2.2% decline witnessed in the preceding quarter. The consensus mark for quarterly earnings has remained unchanged in the past 30 days at $1.15 per share, indicating a decline of 2.5% from the year-ago quarter’s reported figure. These projections underscore the challenges faced by Altria, including inflationary pressures and regulatory headwinds in the tobacco industry.

The company's performance is further complicated by evolving dynamics in the Adult Tobacco Consumers market and the enforcement of regulations on e-vapor products. These factors have likely impacted cigarette consumption and volume, adding to the uncertainty surrounding Altria's earnings outlook.

Amid these challenges, the company’s strategy to diversify its product portfolio and commitment to providing smokers with alternatives should help sustain growth and market share. This is pivotal in shaping investor sentiment and determining the trajectory of Altria's stock.

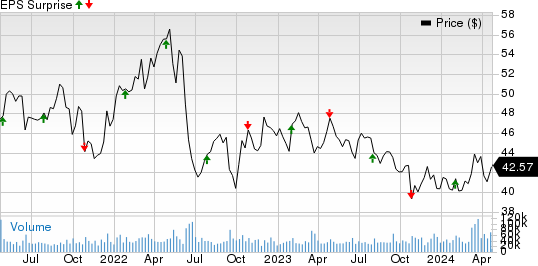

Altria Group, Inc. Price and EPS Surprise

Altria Group, Inc. price-eps-surprise | Altria Group, Inc. Quote

Poised for Success in the Big Picture

Despite facing challenges, we maintain our belief in the Zacks Rank #2 (Buy) stock’s strong fundamentals and its potential for growth. Altria's stock has seen a modest 5.5% increase year to date, when the overall industry has shown sluggishness, declining 0.9%.

In response to the shifting market landscape, the company is positioning itself for a smoke-free future. Management is gravitating toward reduced-risk products (RRPs) or smoke-free alternatives. Notably, its investment in on! is yielding promising results in this transition. Within the smoke-free category, management is exploring ways to best compete in the significant e-vapor category. In this respect, the acquisition of NJOY Holdings is noteworthy, with NJOY ACE being the only pod-based e-vapor product with marketing authorization from the Food and Drug Administration at present.

Despite declining cigarette shipments and increased taxes, Altria continues to demonstrate resilience thanks to its robust pricing power. This resilience enables the company to maintain stability and navigate through market fluctuations effectively.

From a valuation perspective, Altria shares present an attractive proposition, trading at a discount relative to historical and industry benchmarks. With a forward price-to-earnings ratio of 8.27X, below the five-year median of 9.23X and the Zacks Tobacco industry average of 9.50X, the stock offers compelling value for investors seeking exposure to the tobacco sector.

Looking ahead, analysts project a positive trajectory for Altria's financial performance, with annual earnings expected to increase 2.8% in 2024 to $5.09 per share, while total sales are forecast to improve 0.4% to $20.6 billion. These optimistic projections underscore confidence in Altria's ability to navigate challenges and capitalize on growth opportunities, making it a stock worth considering ahead of the Q1 earnings release.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Altria this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 or 3 (Hold) increases the odds of an earnings beat. This is the case here, as Altria has an Earnings ESP of +1.53% at present.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks With the Favorable Combination

Here are three other companies worth considering, as our model shows that these also have the correct combination to beat on earnings this time:

The Hershey Company HSY has an Earnings ESP of +0.90% and a Zacks Rank #3. The company is likely to witness top-line growth when it reports first-quarter 2024 results. The Zacks Consensus Estimate for Hershey’s quarterly revenues is pegged at $3.12 billion, which suggests a rise of 4.5% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Hershey’s quarterly EPS has risen by a cent in the past seven days to $2.73, which calls for a decrease of 7.8% from the year-ago quarter’s level. HSY has a trailing four-quarter earnings surprise of 6.5%, on average.

Church & Dwight CHD currently has an Earnings ESP of +2.37% and a Zacks Rank of 2. The company is likely to register top- and bottom-line increases when it reports first-quarter 2024 numbers. The Zacks Consensus Estimate for Church & Dwight’s quarterly revenues is pegged at $1.49 billion, indicating growth of 4.3% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Church & Dwight’s quarterly earnings of 86 cents suggests a rise of 1.2% from the year-ago quarter’s levels. CHD has a trailing four-quarter earnings surprise of 9.7%, on average.

Coty COTY currently has an Earnings ESP of +12.93% and a Zacks Rank #3. The company is expected to register top-line growth when it reports third-quarter fiscal 2024 numbers. The Zacks Consensus Estimate for COTY’s quarterly revenues is pegged at $1.37 billion, suggesting an increase of 6.4% from the prior-year quarter’s reported figure.

The Zacks Consensus Estimate for COTY’s quarterly earnings has been unchanged at 6 cents in the past 30 days, suggesting a 68.4% decline from the year-ago quarter’s reported number. COTY has delivered an earnings beat of 115.3%, on average, in the trailing four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company (The) (HSY) : Free Stock Analysis Report

Altria Group, Inc. (MO) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Coty (COTY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance