Do You Have a Business Contingency Plan?

What would you do if several of your employees resigned, your equipment/data was stolen, or your business caught fire? If your answer is a silent, blank stare you need to think about getting a business contingency plan! Otherwise, you might end up like the majority of businesses who never recover from a serious disaster.

As a famous mayor once said, “Hope is not a strategy.” It’s good to stay optimistic about overcoming obstacles, but if you’re facing a crisis without a good business contingency plan, the odds of recovery won’t be in your favour.

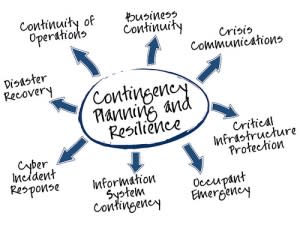

What Is a Business Contingency Plan?

In essence, this is what a business contingency plan is.

A business contingency plan is a comprehensive set of backup procedures to follow in case your company experiences a crisis such as an office fire, public criticism over the actions of one of your employees, or theft of key equipment.

In effect, it’s a “Plan B” for your company to follow when emergencies threaten the stability and productivity of your business. If you don’t have a business contingency plan yet, consider this simple fact – most business affected by a major disaster don’t survive long without one.

Why Does Your Business Need a Contingency Plan?

Do you have a plan in place for dealing with this kind of disaster?

Having a business contingency plan not only minimizes confusion and boosts confidence in your company when disaster strikes – it also ensures that your company can get back to work as quickly as possible.

Whether you’re in the first year of running a startup, or have operated a company for several years, one thing you should never go without is a business contingency plan. That’s because it only takes one unforeseen emergency to put your company’s survival in jeopardy.

Here are several major business risks that make contingency planning necessary:

Physical Contingencies: Dealing with physical emergencies such as fire, theft, and civil emergencies (strikes/riots/etc.) can literally destroy your business.

Windfall Contingencies: Dealing with a huge product/service order or agreeing to complete a big project can put your business at risk if you don’t have the capacity to manage the workload.

Market Contingencies: Dealing with changes in customer buying habits, technology, government regulations, and even culture directly affects the productivity and survivability of your business.

Succession Contingencies: Dealing with the loss of key employees (retirement/resignation/death) can lead to a leadership/innovation gap that can bring your company down. However, this can apply to any key member of staff, not just management.

However, these aren’t the only contingencies your business will need to plan for. Depending on the size and nature of your company, your business contingency plan can range from a few pages to hundreds of pages.

Creating Your Own Business Contingency Plan

Here’s one way to get the big picture when it comes to contingency planning.

Your business contingency plan depends on many factors, such as the size of your business, your business location, the product/service you sell, and most importantly – the potential emergencies your business will face. In fact, the contingencies facing one company might be completely different from those facing another.

For example, a printing company’s biggest challenges might include finding suitable replacements for retiring managers and rising paper costs. But the challenges facing a book selling business might be changing buyer habits and diminishing demand because of a growing preference for e-Books.

When creating your own business contingency plan, include the following:

Include Employee Contact Details: Include the contact details of all of your staff (mobile number, email, address) so that you can communicate with your staff in the event of an emergency. That way, it’s easier to communicate and warn/advise employees during a crisis.

Include Key Customer/Vendor/Partners/Supplier Contact Details: Even if you have a Customer Relationship Management (CRM) system, it’s always a good idea to document the contact details (mobile number, email, address) of your most important customers, vendors, and suppliers.

Designate Business Contingency Coordinators: Designate individuals who will be responsible for putting the business continuity plan into action once disaster strikes. If your business has several departments, designate one coordinator and a backup just in case.

Develop an Emergency Communications Plan: Create a communications plan that identifies which contingency coordinators will communicate with the company’s employees, customers, and vendors. That way, you can continue to manage customer relationships while ensuring your employees have direction during an emergency.

Identify an Alternative Work Site: Establish an alternate location for your employees to meet at in case there’s an emergency. It’s not possible for every company to relocate and continue business as usual. But if your company isn’t limited by heavy industrial equipment or your product storeroom is at another location, it’s much easier to relocate.

Divide the Coordination Responsibilities: Divide the responsibilities for re-establishing the daily business routine with your coordinators. That means delegating actions such as relocation (business, staff, and equipment), purchasing of resources (office/business equipment, utilities), communication (employees/clients/vendors), and service delivery (customer satisfaction level).

Identify Off Site Data: Document any off-site data storage service your company is using, whether it’s a cloud computing service to hold your digital data or a bank safety deposit box holding physical documents.

List Your Insurance Policies: Document insurance provider information and list the coverage dates for any insurance policy taken out on your business and employees. If you haven’t purchased an insurance policy to protect your business from disasters such as fire or flooding, get one.

Create Action Plans For Company Challenges: Evaluate every major challenge facing your business and come up with action plans that help your company recover as fast as possible. This means not only coming up with solutions to manmade or natural disasters, but planning for contingencies such as outdated technology, employee resignations , theft of equipment/data, public backlash from employee actions, and systems/equipment failure.

Once you’ve created your business contingency plan, it’s critical that you test it to find and correct any faults in your planning strategies. But even if you’ve come up with a perfect plan, today’s changing business atmosphere alone is enough to warrant updating it at least every year.

If you need a help creating a business continuity plan, you can hire a consultant, or apply for National Business Continuity Management Programme funding to get your business BCM certified. If you want to know more, you can contact the Singapore Business Federation here.

Image Credits:

smokeshowing, marsmet548, greg.lazou

Get more Personal Finance tips and tricks on www.MoneySmart.sg

Click to Compare Singapore Home Loans, Car Insurance and Credit Cards on our other sites.

More From MoneySmart

Yahoo Finance

Yahoo Finance