Bruker Corp (BRKR) Q1 2024 Earnings: Mixed Results Amidst Strategic Acquisitions

Q1 2024 Revenue: $721.7 million, an increase of 5.3% year-over-year, falling short beneath the estimated $729.88 million.

Q1 2024 GAAP EPS: Reported at $0.35, below the estimated $0.46.

Q1 2024 Non-GAAP EPS: Reported at $0.53, surpassing the estimated $0.46.

Organic Revenue Growth: Reported a 1.6% increase year-over-year.

Updated FY 2024 Revenue Guidance: Increased to $3.29 to $3.35 billion, reflecting an expected growth of 11% to 13% year-over-year.

Updated FY 2024 Non-GAAP EPS Guidance: Increased to $2.79 to $2.84, up from the prior guidance of $2.71 to $2.76.

Acquisitions Impact: Included the closed Chemspeed and ELITech acquisitions in the updated FY 2024 guidance.

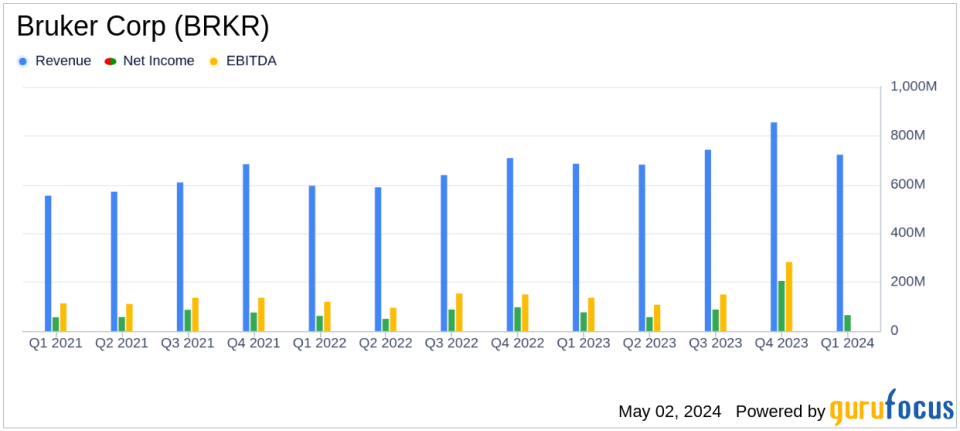

On May 2, 2024, Bruker Corp (NASDAQ:BRKR) released its 8-K filing, announcing the financial outcomes for the first quarter ended March 31, 2024. The company, a prominent player in scientific instruments and diagnostic tests, reported a revenue of $721.7 million, marking a 5.3% increase year-over-year (YoY). This growth, however, fell slightly short of analyst expectations of $729.88 million.

Company Overview

Bruker Corp operates primarily through four segments: Bruker Scientific Instruments (BSI) BioSpin, BSI CALID, BSI Nano, and Bruker Energy and Supercon Technologies (BEST). The BSI CALID segment is the largest revenue contributor, with significant earnings derived from the Asia Pacific region.

Financial Performance Analysis

The reported revenue increase was driven by a combination of organic growth and recent acquisitions, including Chemspeed and ELITech. Organic growth for the quarter was modest at 1.6% YoY. The BEST segment notably outperformed with an 18.9% organic revenue increase. Despite these gains, the GAAP earnings per share (EPS) for Q1 2024 stood at $0.35, a decrease from $0.52 in Q1 2023, and below the estimated EPS of $0.46. The non-GAAP EPS was $0.53, also lower than the previous year's $0.64.

The quarter witnessed a decline in GAAP operating income to $64.8 million from $122.7 million in Q1 2023, with non-GAAP operating income also reducing to $100.7 million from $139.4 million in the previous year. This reduction reflects a decrease in operational efficiency, with the non-GAAP operating margin dropping to 14.0% from 20.3%.

Strategic Acquisitions and Financial Outlook

Bruker's recent acquisitions, including the strategic purchase of ELITech, are expected to enhance its diagnostics business by adding specialty molecular diagnostics capabilities. Looking ahead, Bruker has raised its FY 2024 revenue guidance to between $3.29 billion and $3.35 billion, reflecting an anticipated 11% to 13% growth YoY. The company also adjusted its FY 2024 non-GAAP EPS guidance to $2.79 to $2.84, up from the previous range of $2.71 to $2.76.

Balance Sheet and Cash Flow Insights

As of March 31, 2024, Bruker reported total assets of $4.51 billion, with a notable increase in inventories to $1.06 billion from $968.3 million at the end of 2023. The company's cash and cash equivalents stood at $340.1 million, a decrease from $488.3 million at the end of the previous year. This financial position reflects significant investments in acquisitions and strategic initiatives.

Conclusion

While Bruker's revenue growth and strategic acquisitions paint a promising picture for expansion and market penetration, the decline in EPS and operating margins highlight challenges in maintaining profitability amidst these expansions. The company's forward-looking adjustments to revenue and EPS forecasts suggest a strategic optimism about the integration and performance impact of its recent acquisitions.

Bruker will host a conference call and webcast today, May 2, 2024, at 8:30 am EST to discuss these results and provide further insights into its operations and strategy. Investors and stakeholders are encouraged to join to gain a deeper understanding of the company's trajectory and market positioning.

For more detailed financial analysis and future updates on Bruker Corp, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Bruker Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance