Broker Recommendations Agree That It's Still Time to Buy These Big Tech Stocks

With such impeccable year-to-date performances, investors may continue to ponder if it’s still time to buy Meta Platforms (META) or Nvidia (NVDA) stock.

To that point, Nvidia stock has now skyrocketed +177% year to date and Meta shares have soared 132%, vastly outperforming the S&P 500’s +14% and the Nasdaq’s +27%.

Notably, broker recommendations indicate analysts still believe these tech giants will outperform the broader market with rising earnings estimates supportive as well.

Image Source: Zacks Investment Research

Broker Recommendations

Not surprisingly, Meta and Nvidia have moved past many analyst price targets but the number of brokers recommending their stocks remains high.

Out of the 38 broker recommendations covered by Zacks, 30 brokers still strongly recommend Meta's stock. Calculated based on the actual recommendations, Meta still has a compelling 1.38 Average Broker Recommendation (ABR) on a scale of 1 to 5 (Strong Buy to Strong Sell).

Image Source: Zacks Investment Research

Similarly, a high number of brokers continue to strongly recommend Nvidia’s stock. Twenty-seven brokers have a strong buy recommendation with Nvidia’s ABR at a very attractive 1.28.

Image Source: Zacks Investment Research

Earnings Estimates Still Offer Support

Perhaps more allusive to the notion that it’s still time to buy Meta and Nvidia stock is their earnings estimate revisions.

Although Meta’s fiscal 2023 earnings estimates are slightly down in the last 30 days they have remained 14% higher over the last quarter at $11.94 per share compared to $10.43 a share 90 days ago. Plus, FY24 earnings estimates are still ticking higher and have now risen 15% over the last three months.

Meta’s earnings are now forecasted to leap 21% this year and soar another 24% in FY24 at $14.81 per share.

Image Source: Zacks Investment Research

Looking at Nvidia, earnings estimates have continued to rise for the company’s current fiscal year 2024 and FY25. Over the last three months, FY24 and FY25 earnings estimates have now soared over 70% respectively.

Nvidia’s earnings are currently projected to soar 129% in FY24 at $7.66 per share compared to EPS of $3.34 in FY23. More impressive, FY25 earnings are expected to climb another 33% at $10.19 per share.

Image Source: Zacks Investment Research

P/E Valuations Remain Reasonable

Continuing to monitor Meta and Nvidia’s valuations, their P/E ratios are still reasonable especially relative to their past.

Trading at $278 a share, Meta‘s stock currently trades at 24.1X forward earnings which is very attractive considering the Zacks Internet-Software’s Industry average is at 40X. Being a leader in its space and trading at a discount to the industry average it’s also intriguing that Meta’s stock still trades near the S&P 500’s 20.3X

Furthermore, Meta stock trades 77% below its decade-long high of 105.1X and at a 17% discount to the median of 29.2X.

Image Source: Zacks Investment Research

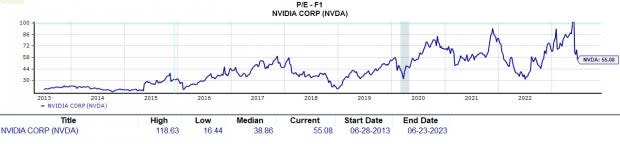

As for Nvidia and other companies that have immense growth potential surrounding AI capabilities they are rightfully commanding a premium right now.

With that being said, at $406 a share and 55X forward earnings it’s somewhat reassuring that Nvidia’s stock still trades well below its own decade-long high of 118.6X and closer to the median of 38.8X.

Image Source: Zacks Investment Research

Bottom Line

It’s not surprising that Meta and Nvidia stock continue to garnish favorable broker recommendations considering earnings estimates have remained much higher over the course of the last quarter. This makes both of these tech giants’ P/E valuations look more reasonable and for now, they covet a Zacks Rank #1 (Strong Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance