British Pound Unmoved on Best BRC Retail Sales Data in 6 Months

DailyFX.com -

Talking Points

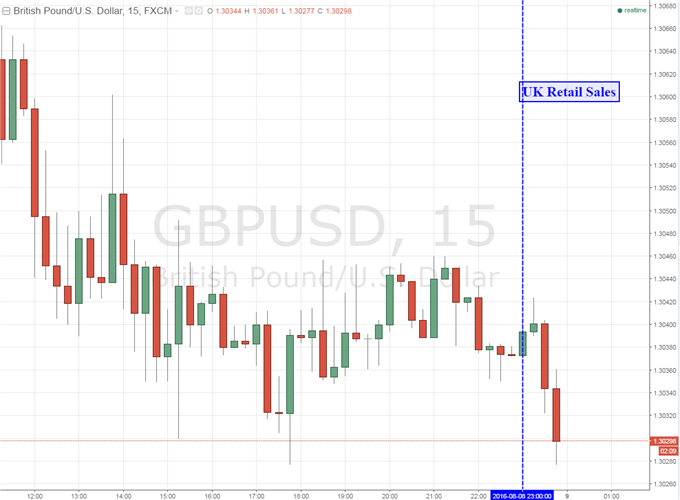

The British Pound was little changed against its major peers

BRC retail sales gained 1.1% (YoY) in July versus -0.7% seen

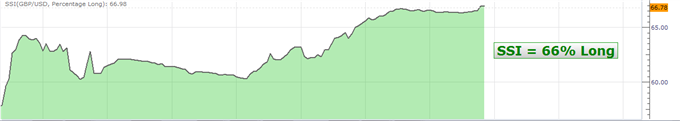

SSI shows that 66 percent of GBP/USD traders are net long

Keep an eye on short-term trends for British Pound Crosses using the Grid Sight Index (GSI) here.

The British Pound showed a reserved response against its major counterparts after British Retail Consortium Sales crossed the wires. The data was released less than one week after a highly anticipated Bank of England rate decision. In this monetary policy announcement, the central bank appears to have downplayed the threat of a near term recession due to their newly enacted accommodative measures.

In July, BRC sales increased 1.1 percent (YoY) versus -0.7 percent expected and -0.5 percent in June. Meanwhile, total sales improved 1.9 percent (YoY) from 0.2% in June. Both of the consumer spending measurements marked their largest gains since January 2016, a six month high.

Perhaps the better than expected data releasing against the backdrop of a dovish central bank does not have much scope to impact policy easing bets. It could be possible to get a stronger lead from next week’s higher profile releases such as UK’s consumer price inflation report. In addition, a singular piece of economic data does not necessarily imply that a trend has reversed.

Meanwhile, the DailyFX Speculative Sentiment Index (SSI) is showing a reading that roughly 66 percent of open positions in GBP/USD are long. The SSI is a contrarian indicator at extreme levels, implying further GBP/USDweakness ahead.

Want to learn more about the DailyFX SSI indicator? Click here to watch a tutorial.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance