BRC Inc. (BRCC) Q1 2024 Earnings Overview: Surpassing Revenue Forecasts with Strategic Growth ...

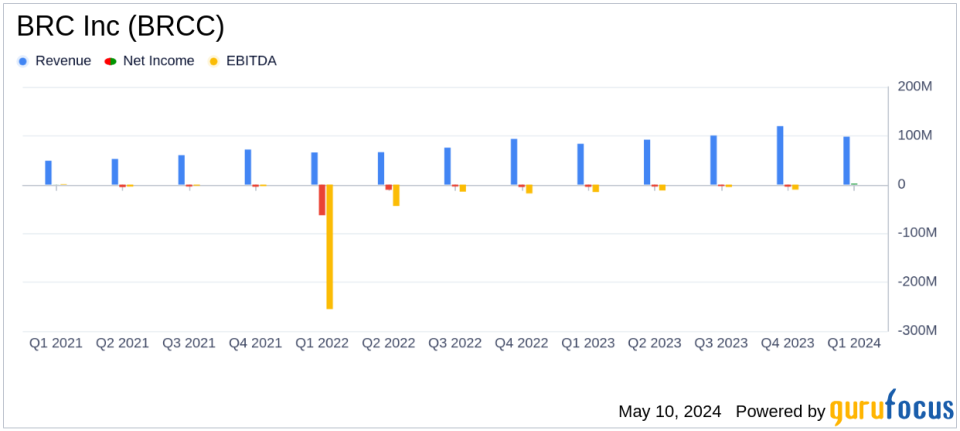

Revenue: Reached $98.4 million in Q1 2024, up 18% year-over-year, surpassing estimates of $97.13 million.

Net Income: Reported at $1.9 million, a significant improvement from a net loss of $17.3 million in Q1 2023, surpassing estimates of a $3.52 million loss.

Gross Margin: Increased to 42.9% in Q1 2024 from 33.0% in Q1 2023, driven by productivity improvements and lower costs.

Adjusted EBITDA: Turned positive at $14.1 million, compared to a loss of $5.2 million in the prior year, indicating strong operational efficiency gains.

Wholesale Revenue: Grew by 51% to $60.4 million, primarily due to expansion into the Food, Drug, and Mass market and growth in Ready-to-Drink products.

Strategic Partnerships: Entered into a partnership with Keurig Dr Pepper for K-Cup pod manufacturing and distribution, aiming to enhance product availability and quality.

2024 Financial Guidance: Adjusted EBITDA forecast increased to $32.0 million to $42.0 million, with gross margin expectations at the high end of 37% to 40%.

BRC Inc. (NYSE:BRCC), a veteran-founded company renowned for its premium coffee and strong community ties, disclosed its first quarter financial results for 2024 on May 8, 2024, through its 8-K filing. The company reported a substantial improvement in its financial performance, highlighted by an 18% increase in net revenue to $98.4 million, significantly surpassing the analyst's estimate of $97.13 million. This growth was primarily driven by a robust 51% increase in wholesale revenue.

Company Overview

BRC Inc. is committed to serving premium coffee and merchandise to active military, veterans, and first responders through its omnichannel distribution model. This includes direct-to-consumer sales, wholesale to intermediaries, and company-operated and franchised retail locations known as Outposts. The company's mission-driven approach not only focuses on delivering high-quality products but also on supporting the communities it serves.

Financial Highlights and Strategic Developments

The first quarter of 2024 marked a significant turnaround with a net income of $1.9 million, a stark contrast to the net loss of $17.3 million reported in the same quarter the previous year. This improvement was supported by a gross margin increase to 42.9%, up from 33.0% in Q1 2023, reflecting enhanced operational efficiencies and lower costs. Adjusted EBITDA also saw a dramatic rise to $14.1 million from a loss of $5.2 million year-over-year.

BRC Inc. has revised its 2024 guidance, now expecting Adjusted EBITDA to be between $32.0 million and $42.0 million, with a gross margin at the higher end of the 37% to 40% range. These adjustments reflect the company's strong Q1 performance and its positive outlook for the remainder of the year.

Operational and Market Performance

The substantial revenue growth in the wholesale segment was primarily due to increased penetration in the Food, Drug, and Mass (FDM) market and growth in Ready-to-Drink (RTD) products. Despite a decrease in Direct-to-Consumer and Outpost revenues, the company's strategic adjustments and focus on high-return segments have paid off. Additionally, BRC Inc. announced a strategic partnership with Keurig Dr Pepper for K-Cup pod manufacturing and distribution, which is expected to enhance product quality and availability.

Challenges and Forward-Looking Strategies

While BRC Inc. faces challenges such as fluctuating customer acquisition costs and paused expansion in its Outpost channel, the company's strategic realignment towards more profitable segments and operational efficiencies suggests a strong foundation for future growth. The partnership with Keurig Dr Pepper not only aims to bolster the top line but also streamline operations across sales, marketing, supply chain, and distribution.

Conclusion

BRC Inc.'s Q1 2024 results demonstrate a resilient and strategically agile company poised for continued growth. With a focus on operational excellence and strategic partnerships, BRC Inc. is well-positioned to build on its Q1 successes and uphold its commitment to its core community of veterans and first responders.

For detailed financial figures and future projections, investors and interested parties are encouraged to refer to the full earnings report and subsequent earnings call.

Explore the complete 8-K earnings release (here) from BRC Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance