Boyd Gaming (BYD) Q1 Earnings Lag Estimates, Stock Down

Boyd Gaming Corporation BYD reported mixed first-quarter 2024 results, with earnings missing the Zacks Consensus Estimate and revenues beating the same. The top and the bottom line declined on a year-over-year basis.

During the quarter, the company’s performance was impacted by January's severe winter weather in the Midwest and South and a softer Las Vegas locals market. The combined effect of these challenges fell within the anticipated range, aligning with earlier projections of $20-$25 million in EBITDAR for 2024.

Following the results, the company’s shares fell 7.6% during the after-hours trading session on Apr 25.

Earnings and Revenues

In the quarter under review, adjusted earnings per share (EPS) were $1.51, missing the Zacks Consensus Estimate of $1.57 by 3.8%. In the prior-year quarter, the company reported an adjusted EPS of $1.71.

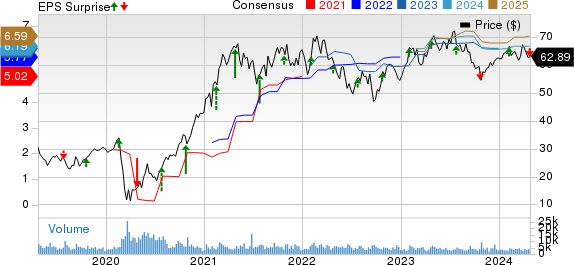

Boyd Gaming Corporation Price, Consensus and EPS Surprise

Boyd Gaming Corporation price-consensus-eps-surprise-chart | Boyd Gaming Corporation Quote

Total revenues of $960.5 million beat the consensus mark of $947 million by 1.4%. The top line fell 0.4% on a year-over-year basis.

Total adjusted EBITDAR in the reported quarter amounted to $303.3 million compared with $340.3 million reported in the prior-year quarter.

Segmental Detail

Las Vegas Locals

During first-quarter 2024, the segment’s revenues amounted to $225.6 million, down 6.1% from the prior-year quarter’s levels. The segment’s adjusted EBITDAR totaled $110.4 million compared with $126.2 million reported in the year-ago quarter.

Downtown Las Vegas

Revenues in the segment fell 5.4% year over year to $53.5 million. Adjusted EBITDAR was $17.8 million compared with $22.4 million reported in the year-ago quarter.

Midwest and South Segment

During the quarter, the segment’s revenues came in at $500.8 million compared with $512.2 million reported in the prior-year quarter. The segment’s adjusted EBITDAR totaled $181 million compared with $198.7 million reported in the year-ago quarter.

Operating Highlights

During first-quarter 2024, the company’s total operating costs and expenses were $741.1 million, up 9.1% year over year. Selling, general and administrative expenses during the quarter came in at $108.2 million compared with $100.3 million reported in the prior-year quarter.

Balance Sheet

As of Mar 31, 2024, the company had cash on hand of $283.5 million compared with $304.3 million as of Dec 31, 2023. Total debt during first-quarter 2024 amounted to $2.9 billion, flat on a sequential basis.

During the quarter, the company repurchased shares of its common stock worth approximately $105 million. As of Mar 31, 2024, the company stated the availability of approximately $221 million under its repurchase program.

Zacks Rank & Key Picks

Boyd Gaming currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Consumer Discretionary sector include:

Trip.com Group Limited TCOM sports a Zacks Rank #1 (Strong Buy) at present. TCOM has a trailing four-quarter earnings surprise of 53.1%, on average. Shares of TCOM have gained 44% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TCOM’s 2024 sales and EPS indicates a rise of 18% and 8%, respectively, from the year-ago levels.

JAKKS Pacific, Inc. JAKK sports a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 42.6%, on average. Shares of JAKK have declined 9.8% in the past year.

The Zacks Consensus Estimate for JAKK’s 2025 sales and EPS indicates a rise of 3.5% and 8.1%, respectively, from the year-ago levels.

Strategic Education, Inc. STRA sports a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 17.2%, on average. Shares of STRA have rallied 30.1% in the past year.

The Zacks Consensus Estimate for STRA’s 2024 sales and EPS indicates a rise of 5% and 23.9%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

JAKKS Pacific, Inc. (JAKK) : Free Stock Analysis Report

Boyd Gaming Corporation (BYD) : Free Stock Analysis Report

Trip.com Group Limited Sponsored ADR (TCOM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance