Bowlero’s Latest Strike Was No Luck: M&A Strategy Builds Momentum

Bowlero Corp. (NYSE: BOWL) announces acquisition of #4 operator Lucky Strike

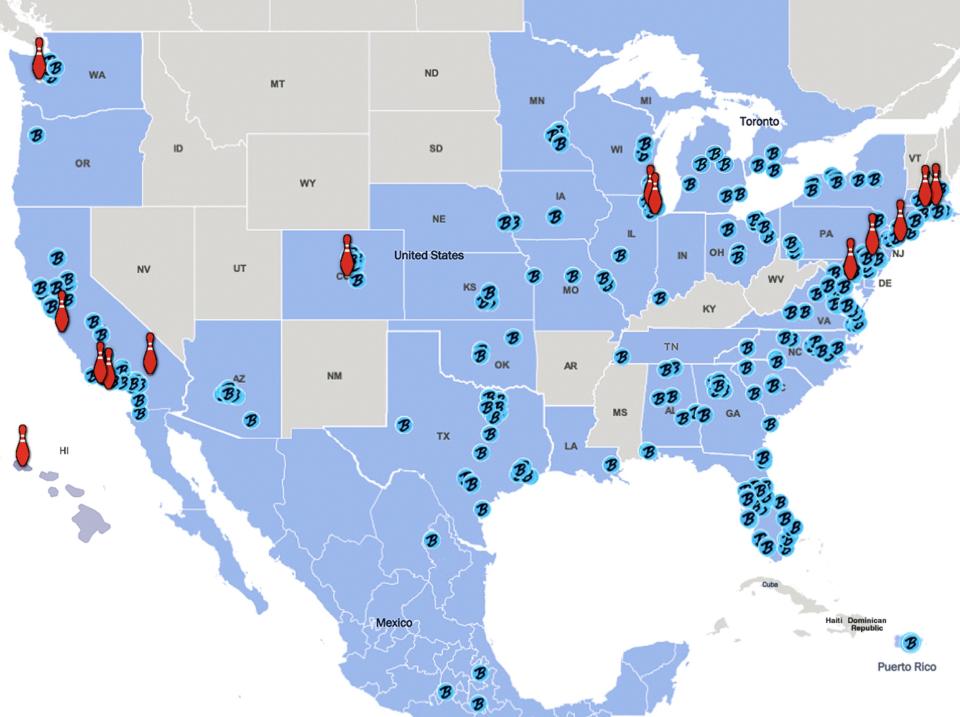

Extends lead as #1 bowling center with 343 centers in 35 states after deal

#2 operator is a fraction of Bowlero’s size with just 52 centers spread across 17 states

Bowlero still only had about 8.2% market share before the deal, according to Jefferies

Bowlero buys Lucky Strike at a reasonable 8x Ebitda, should be far lower after integration

Bowlero trades at a mere 5.6x June 2024 Ebitda, sharp discount to Vail Resorts, Inc. other leisure peers

Next year’s sales should get big boost from remodels, with M&A an extra kicker

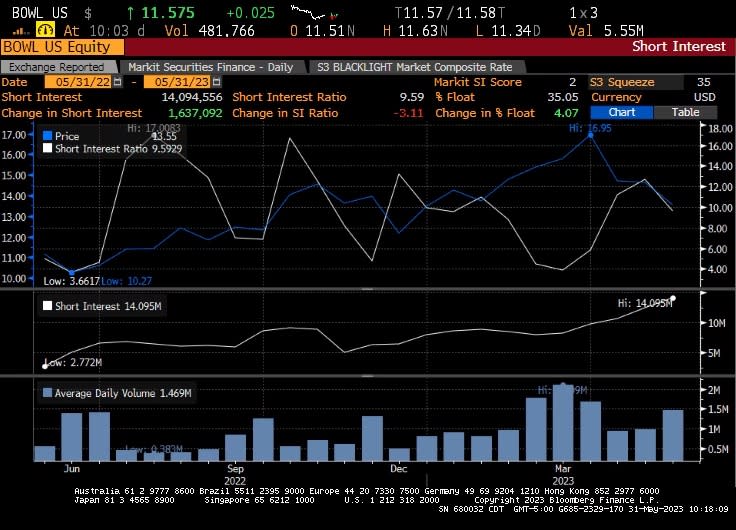

News comes as shares have slid in recent months thanks partly to short selling

Shorted shares have surged in the last year, making Bowlero ripe for a squeeze

Bowlero Corp.’s (NYSE: BOWL) latest deal proves once again that it operates in a league of its own. Savvy investors should expect the acquisition strategy to continue for years – and to spin off plenty of financial rewards.

The nation’s leading bowling center said Wednesday it would acquire Lucky Strike Entertainment, adding 14 bowling centers to its portfolio and extending its lead as number one with 343 centers in 35 states. Lucky Strike is a coveted asset adding a presence for Bowlero in big cities including Boston, Denver, Chicago, Los Angeles, Philadelphia and San Francisco.

Bowlero’s national footprint to reach 343 centers in 35 states upon completion of the Lucky Strike acquisition

The transaction proves that Bowlero has multiple unique qualities that set it apart from the pack. First, it had the financial muscle to buy Lucky Strike in cash rather than shares, given its profitability and robust balance sheet (net debt of just over 2x trailing Ebitda as of the March quarter end). It’s about 8x the size of the next largest operator and almost all others have only a few bowling centers. Such players, especially on the smaller end, can be very dependent on loans that have become increasingly expensive thanks to recent rate hikes.

What’s more, Bowlero has a strong brand that it can bring to new locations. Any bowling center Bowlero acquires, particularly a sleepy one that hasn’t been kept in great shape, can transform into a sparkling new venue with all of the technology, food, drink and non-bowling games that customers flock to.

Even with all that upside for Bowlero when it comes to M&A, it still is able to execute deals on very favorable terms. According to Bowlero’s announcement, the $90 million price tag on Lucky Strike implies a multiple of about 8x trailing consolidated Ebitda and a mere 5x bowling-center level Ebitda.

Such a deal looks right out of the Bowlero playbook. In a note to clients dated May 18, J.P. Morgan analyst Matthew Boss pointed out that Bowlero typically pays a 5-9x multiple on a trailing Ebitda basis, which is later halved 90-120 days out.

Before the deal, Bowlero had just 8.2% of the domestic bowling center market, according to Jefferies analyst Randal J. Konik. That not only leaves many years of consolidation opportunity but the chance for Bowlero to be choosy on which assets it acquires.

Meanwhile, Bowlero just posted a spectacular March quarter, setting a new record with $316 million in revenue. It topped consensus estimates across the board, including revenue and Ebitda, according to Sentieo, an AI-enabled research platform.

Setting M&A aside, there’s also good reason to expect organic growth momentum to continue. Again, thanks to a strong balance sheet, Bowlero can very comfortably invest in renovations. J.P. Morgan’s Mr. Boss sees 35 renovations in the June 2024 year that alone should boost same-store sales by 2 percentage points. He also notes that the company’s bundling strategy provides more value to consumers while also boosting spend per visit.

Bowlero would also be in the catbird seat if a recession creeps in. People are eager as ever to leave their homes for recreation post COVID, but many options like theme parks require costly transportation and tickets that are multiple the price of a Bowlero experience.

That makes it an ideal venue for families or groups of friends seeking an affordable night out. And remember: There’s plenty do to at Bowlero besides bowl such as billiards, various arcade-style games and a premium bar that can be a destination in its own right.

Of course, there are naysayers betting against Bowlero. The stock has pulled back from its highs in recent months thanks partly to a dramatic increase in shares of the stock sold short. Over the last 12 months, the number of sales sold short has increased 5x to about 14 million shares, according to Bloomberg.

Source: Bloomberg

But there’s reason for those short sellers to be wary of a squeeze. First, Bowlero may yet still be unfairly lumped in with many other companies that went public via SPAC and saw their financials quickly deteriorate.

Bowlero, however, could easily have gone public via a regular-way IPO given its extended track record of successful operations and profitability. Unlike many other SPAC companies that are struggling to stay alive while seeking cash injections, Bowlero remains flush and is a cash machine.

One other short-term frustration: The company recently attracted media buzz in a so-called news report, featuring accusations of unfair employment practices that are likely questionable and almost certainly repetitive. The report surfaced after the same writer published on the same employment topic a few years ago at The New York Post, a tabloid where she was previously employed. Bowlero, which has made consistent regulatory filings on the matter since it first arose, denied the claims in the latest article as “entirely false” two weeks ago in an investor call.

Bowlero, at around $11.50 a share, trades at just 5.6x consensus June 2024 Ebitda, according to Sentieo. Vail Resorts, meanwhile trades at 12.3x and isn’t expected to grow as fast as Bowlero next fiscal year. J.P. Morgan has a price target for Bowlero of $21 a share and Jefferies sees $25 a share.

In a stock picker’s market like this one, investors should be on the lookout for well-capitalized companies like Bowlero that are making all the right moves. And with the shares at this price, Bowlero should shine for years to come.

IPO-Edge.com

Twitter: @IPOEdge

Instagram: @IPOEdge

Yahoo Finance

Yahoo Finance