Blackstone Inc's Dividend Analysis

Delving into Blackstone Inc's Dividend Prospects

Blackstone Inc (NYSE:BX) recently announced a dividend of $0.83 per share, payable on 2024-05-06, with the ex-dividend date set for 2024-04-26. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Blackstone Inc's dividend performance and assess its sustainability.

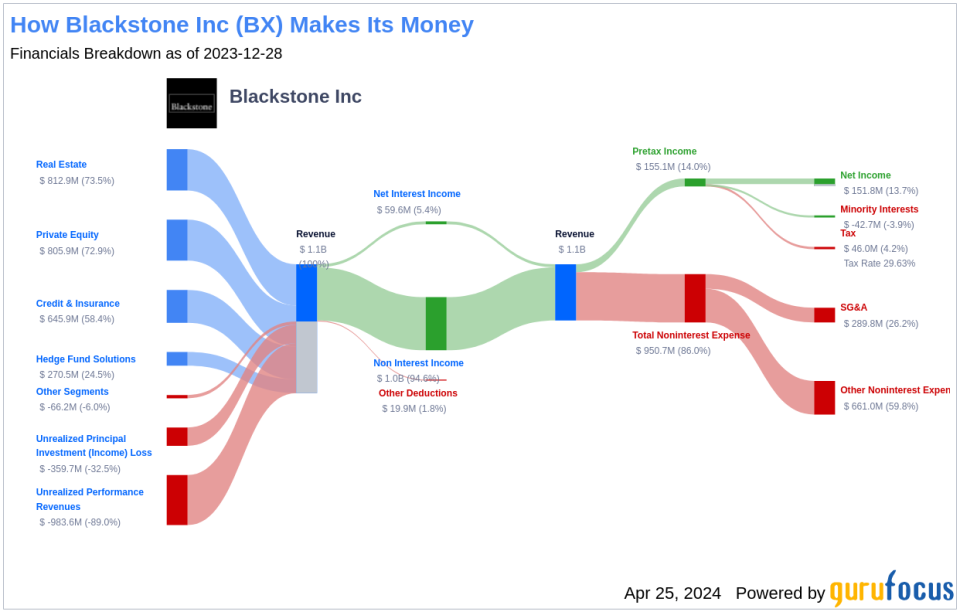

What Does Blackstone Inc Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Blackstone Inc is the world's largest alternative-asset manager with $1.040 trillion in total assets under management, including $762.6 billion in fee-earning assets under management, at the end of 2023. The company operates across four core business segments: private equity, real estate, credit and insurance, and hedge fund solutions. While catering predominantly to institutional investors, Blackstone Inc also serves high-net-worth clients across its 25 global offices. This diverse and expansive operation underlines the company's robust financial foundation.

A Glimpse at Blackstone Inc's Dividend History

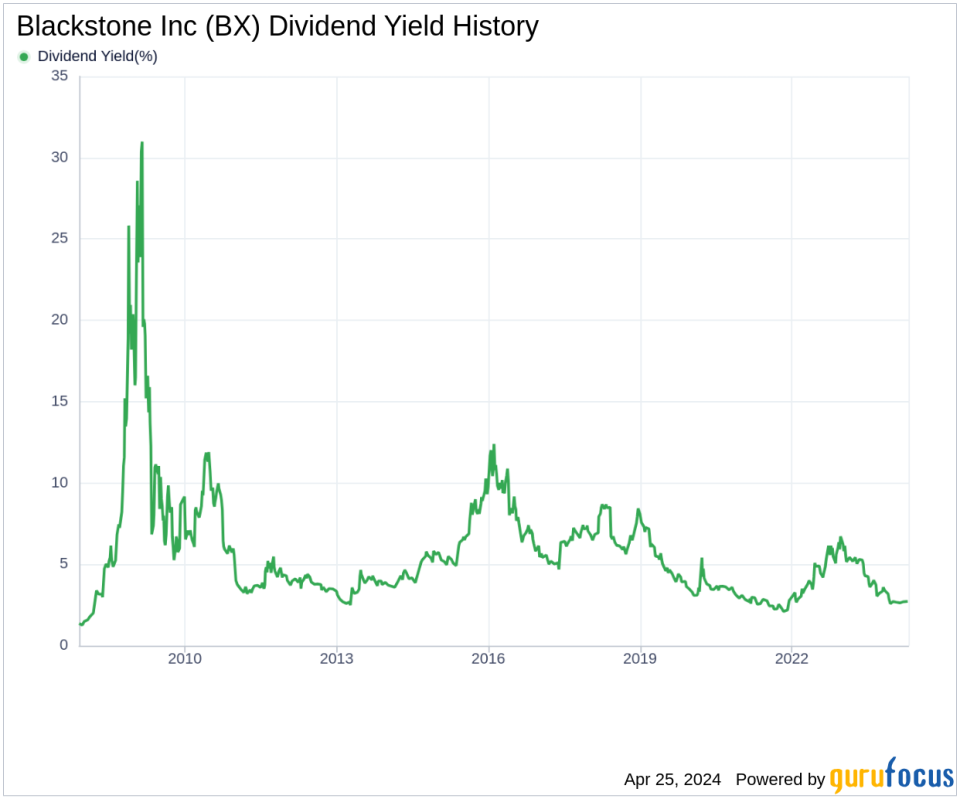

Since 2007, Blackstone Inc has upheld a steady track record of dividend payments, with distributions occurring on a quarterly basis. This consistency highlights the company's commitment to returning value to shareholders. Below is a chart showcasing the annual Dividends Per Share for Blackstone Inc, illustrating historical trends in dividend payments.

Breaking Down Blackstone Inc's Dividend Yield and Growth

Blackstone Inc currently boasts a trailing dividend yield of 2.71% and a forward dividend yield of 2.72%, indicating anticipated dividend growth in the next 12 months. The company's dividend growth rate over the past three years has been impressive at 20.20%, although this figure moderates to 15.50% over a five-year span, and further to 9.20% over the past decade. Today, the 5-year yield on cost for Blackstone Inc stock is approximately 5.57%, a testament to its growing dividend returns.

The Sustainability Question: Payout Ratio and Profitability

When evaluating dividend sustainability, the dividend payout ratio is crucial. As of December 31, 2023, Blackstone Inc's dividend payout ratio stands at 1.81, which may raise concerns about the long-term sustainability of its dividends. In terms of profitability, Blackstone Inc has a profitability rank of 5 out of 10, indicating fair profitability. The company has consistently reported positive net income annually for the past decade, reinforcing its profitability status.

Growth Metrics: The Future Outlook

Future dividend sustainability is also dependent on growth metrics. Blackstone Inc's growth rank is 5 out of 10, reflecting a fair growth outlook. However, its 3-year revenue growth rate of 7.30% per year underperforms approximately 50.23% of global competitors. Similarly, the 3-year EPS growth rate of 7.00% per year underperforms about 51.18% of global competitors. Additionally, the 5-year EBITDA growth rate of -0.30% underperforms roughly 66.48% of global competitors, suggesting room for improvement in these areas.

Next Steps

In conclusion, Blackstone Inc's dividend payments and growth rate present an attractive proposition for value investors, but the payout ratio and mixed growth metrics warrant a closer examination. The company's consistent dividend history and fair profitability rank suggest a foundation for continued dividend payments. However, investors should monitor the growth metrics closely, as these will play a significant role in the company's ability to sustain and grow dividends in the future. For those seeking high-dividend yield stocks, GuruFocus Premium offers a High Dividend Yield Screener to discover similar investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance