BlackRock (BLK) Launches Investment Platform in Saudi Arabia

BlackRock Inc. BLK enters into an agreement with Public Investment Fund (PIF) to establish a Riyadh-based multi-asset class investment platform. The platform will be backed by an initial cash injection of up to $5 billion by the PIF, subject to certain milestones achieved.

BlackRock Saudi Arabia intends to establish BlackRock Riyadh Investment Management (BRIM) in collaboration with PIF to encompass investment strategies across a diverse range of asset classes, which would be managed by a Riyadh-based portfolio management team.

Per a Reuters report, the platform would be focused on Saudi Arabia, while the investments would span across the Middle East and North Africa (MENA) region, including public equities and infrastructure and credit investments in private markets.

Blackrock’s move aligns with the strategic shift toward MENA by other financial services firms with an aim to expand their footprint in the booming market.

In March 2024, Morgan Stanley MS announced the opening of a new office in Abu Dhabi with the aim of enhancing its presence in the region.

Since 2006, MS has been operating in Dubai, which is recognized as the Gulf’s financial hub, alongside Saudi Arabia and Qatar. Hence, the current move signifies the company’s long-term commitment to the MENA region.

Similarly, in November 2023, JPMorgan Chase & Co. JPM announced it would begin offering deposit-taking and payment-processing services to wholesale banking clients from Abu Dabhi Global Market. The Financial Services Regulatory Authority granted approval to JPM to upgrade its license to category one, which allows it to offer the abovementioned services.

BRIM will work on bringing foreign institutional investments to Saudi Arabia to accelerate the growth of the local asset management industry, broaden local capital markets and diversify through through asset classes.

Larry Fink, chairman and CEO of BlackRock, said, “The continued growth of the Kingdom’s capital markets and diversification of its financial sector will contribute to future prosperity for its citizens, the competitiveness of its companies and the resilience of its economy. Saudi Arabia has become an increasingly attractive destination for international investment as Vision 2030 comes to life, and we are pleased to offer investors from around the world the opportunity to take part in this exciting, long-term opportunity.”

BRIM’s integration with BlackRock’s investment capabilities and operational platform would allow it to leverage BLK’s global market expertise, thought leadership and technology alongside knowledge sharing and further enhancement of local investment capabilities.

Moreover, BlackRock’s Financial Markets Advisory group intends to provide support for initiatives that aim to deepen capital markets and improve market structure. This assistance may include capital market and risk analytics advisory.

Furthermore, BRIM plans to invest in infrastructure and investment research capabilities in order to improve insights through local recruitment and relocation of experienced investment professionals.

BLK has been expanding through strategic buyouts in both domestic and overseas markets. In March 2024, the company announced plans to acquire the remaining 75% stake in SpiderRock to enhance separately managed accounts offerings, while in January, the company agreed to acquire Global Infrastructure Partners (“GIP”). In 2023, the company acquired London-based Kreos Capital. Also, it agreed to form a joint venture with Jio Financial Services Limited, named Jio BlackRock, which is set to revolutionize India's asset management industry.

These efforts are expected to keep supporting BlackRock’s efforts to diversify revenues and footprint.

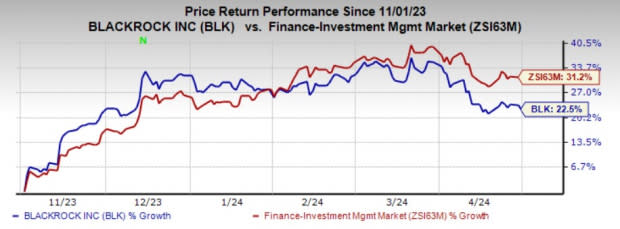

BlackRock’s shares have gained 22.5% in the past six months compared with the industry’s 31.2% growth.

Image Source: Zacks Investment Research

BLK presently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Morgan Stanley (MS) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance