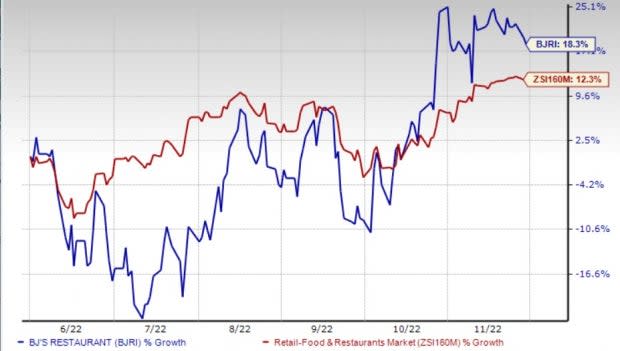

BJ's Restaurants (BJRI) Up 18% in 6 Months: More Room to Run?

Shares of BJ's Restaurants, Inc. BJRI have gained 18.3% in the past six months, compared with the industry’s increase of 12.3%. The company is benefiting from robust off-premise sales, expansion efforts and comps growth. However, higher food inflationary costs, marketing expenses and costs related to sales-boosting initiatives continues to dent the company’s performance.

Let’s delve deeper.

Growth Drivers

The company’s off-premise sales continue to drive growth and have increased more than double in comparison to the pre-pandemic level. In 2021, average weekly off-premise sales stood at approximately $20,000 per restaurant, reflecting twice the growth from that of pre-pandemic levels. The company stated that the momentum persisted in 2022 as well, on account of favorable guest behavior with respect to the idea of enjoying meals at home. In third-quarter 2022, the company’s off-premise weekly sales average came in at the low $20,000s.

The company is benefiting from expansion efforts as well. As of Sep 27, BJ’s Restaurants owned and operated 214 casual dining restaurants (in 29 states). Last week, the company opened its newest restaurant in Las Vegas,NV.

The two restaurants, which were scheduled to open in 2022 are now scheduled to open in the fiscal first quarter of 2023 due to construction delay. The company remains steadfast in its commitment to expand its presence to at least 425 restaurants domestically.

On the other hand, this Zacks Rank #3 (Hold) company is gaining from robust comps growth. During the third quarter of fiscal 2022, comparable restaurant sales increased 8.9% year over year compared with 41.8% growth reported in the prior-year quarter. Also, it increased 8.2% from 2019 levels. The company is expecting the positive momentum to continue in the fiscal fourth quarter, with period-to-date comps growth increasing by nearly 8% and 6% compared to the same periods in 2021 and 2019, respectively.

Robust digital initiatives are aiding the company. BJ’s Restaurants is also investing heavily in technology-driven initiatives, like digital ordering, to boost sales. The company’s app and digital platforms are allowing it to offer promotions more effectively and efficiently.

Image Source: Zacks Investment Research

Concerns

BJ’s Restaurants is consistently bearing increased expenses, which have been affecting margins of late. Higher food inflationary costs, marketing expenses and costs related to sales-boosting initiatives are weighing on the company’s margins. For the fiscal third quarter, labor costs — as a percentage of sales — came in at 37.7%, up 50 basis points year over year.

Occupancy and operating costs (as a percentage of sales) came in at 24.7%, up from 24.4% reported in the year-ago quarter. General and administrative expenses (as a percentage of sales) came in at 6.1% in the quarter, flat year over year. During the quarter, restaurant-level operating margin came in at 10.3% compared with 11.2% reported in the year-ago quarter.

Key Picks

Some better-ranked stocks in the Zacks Retail – Restaurants industry are Wingstop Inc. WING, Chuy's Holdings, Inc. CHUY and Chipotle Mexican Grill, Inc. CMG.

Wingstop sports a Zacks Rank #1 (Strong Buy). WING has a long-term earnings growth rate of 11%. Shares of WING have declined 6.1% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Wingstop’s 2023 sales and EPS suggests growth of 18.1% and 16.4%, respectively, from the comparable year-ago period’s levels.

Chuy’s Holdings currently carries a Zacks Rank #2 (Buy). CHUY has a trailing four-quarter earnings surprise of 18.6%, on average. Shares of CHUY have decreased 1.7% in the past year.

The Zacks Consensus Estimate for Chuy’s Holdings’ 2023 sales and EPS suggests growth of 8.6% and 11.7%, respectively, from the corresponding year-ago period’s levels.

Chipotle currently carries a Zacks Rank #2. CMG has a trailing four-quarter earnings surprise of 4.1%, on average. The stock has declined 11.8% in the past year.

The Zacks Consensus Estimate for Chipotle’s 2022 sales and EPS suggests growth of 15.1% and 31%, respectively, from the corresponding year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

Chuy's Holdings, Inc. (CHUY) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance