Bitcoin Tumbles as Wild Crypto Market Swing Causes $310M Losses From Liquidations

Join the most important conversation in crypto and web3! Secure your seat today

Crypto markets tumbled suddenly Wednesday afternoon, erasing gains from the previous 24 hours in less than an hour.

The CoinDesk Market Index (CMI), which tracks the performance of the broader crypto market, plummeted 5.6% in an hour, and has been currently trading 1.3% lower than 24 hours ago.

Bitcoin (BTC), the largest cryptocurrency by market capitalization, was recently trading at about $28,275, up a fraction of a percentage point but down from its peak early Wednesday above $30,000. BTC sank as low as $27,264 later in the day.

Ether (ETH) was recently trading at $1,855, down slightly. The second-largest crypto in market value soared as high as $1,984 before dipping to a low of $1,789 Wednesday afternoon – its lowest price since the first part of April.

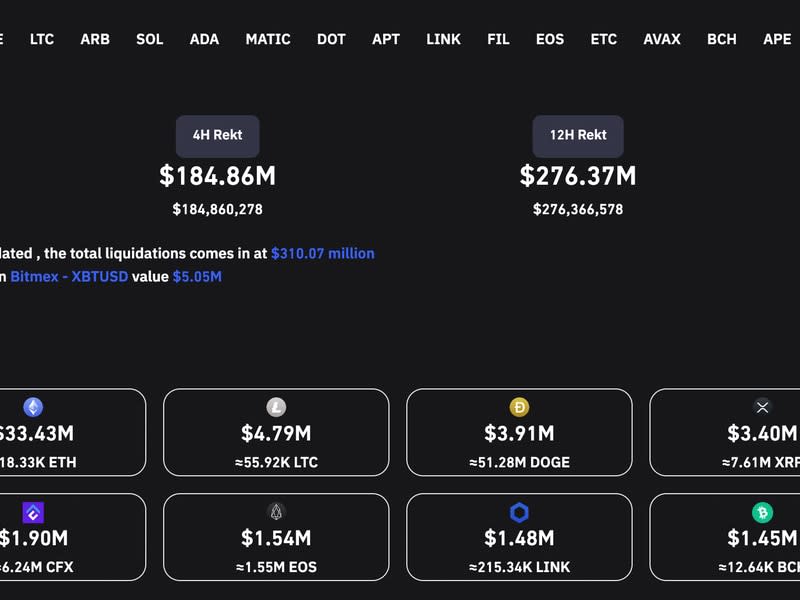

Traders endured some $310 million of losses from liquidations in the past 24 hours, according to Coinglass data, as the wild swing in crypto prices liquidated both long and short positions.

Blockchain analysis firm Arkham Intelligence noted that crypto trading giant Jump Trading deposited $26.6 million of BTC to exchanges before prices tumbled. Sending tokens to exchanges usually indicates an intention to sell.

Yahoo Finance

Yahoo Finance