Bitcoin: More Tulips Than Gold

“We think that Bitcoin is a gold disruptor,” Winklevoss said in a telephone interview on Friday, predicting it may yet appreciate by 10 to 20 times its current value. “We think it’s just the beginning. We are definitely holders.” via Bloomberg

“Bitcoin is to me very much like gold,” Spencer said. “It’s mined, it has a fixed quality and the price is very volatile.” via Bloomberg

"Miller sees Bitcoin as a store of value rather than as a currency. Yes, Bitcoin “doesn’t have any intrinsic value, and it is not backed by anybody,” he says. “But what’s the intrinsic value of the painting The Scream that Leon Black bought for $120 million? It is just paint and canvas.” via Barron’s

Bitcoin articles are a dime a dozen so I can quote many more, but I was told that the attention span of reading posts like these are short, so I’ll cut to the point. Keep in mind these aren’t quotes from some Uber driver that just funded his Coinbase account with his credit card.

Gold, art, sport memorabilia are just some of the assets that don’t have cash flows, earnings, or pay their owners any tangible dividends or interest. They are still worth money. There is supposedly over $5 trillion of gold in the world and yet it has never produced anything for its owners.

Let’s talk about The Scream that Leon Black bought for $120 Million.

There’s clearly value in the painting. Not just some perceived value by Leon Black alone - or else he would not have had to pay $120 Million for it - he had to outbid other potential buyers to assure he won the auction.

Except for deriving some pleasure by hanging it on a wall, Mr. Black - as an investor - believes this painting will continue to increase in value and that he’ll be able to sell the painting to another buyer at a higher price some day in the future.

There are two key factors that are needed to anchor this belief.

#1. The belief that the investment community (art investors in this case) will retain and maintain this perceived value moving forward.

#2. Limited quantity.

Allow me amplify and demonstrate each of these factors because I think they’re real important.

#1. If I made a painting – just a single painting – and committed to never paint another one again, the painting will still not have any value. No right-minded art investor would assign any value to my artistry even it were limited in quantity. I’m not an artist.

#2. Assume there were 1,000 The Scream paintings, most (if not all) of the perceived value would dissipate. Think about air. It’s obviously the most important asset in the world, yet you don’t have people canning and selling it.

Of course, there are other variables such as liquidity, regulations and taxes that are important as well, but I think these are the two anchoring and crucial factors.

Let’s see how these two factors apply to gold.

#1. There is a strong belief (by billions of people) that gold will retain value well into the future. It has maintained some sort of value - through so many world macro changes - for thousands of years.

#2. While there is constantly more and more gold being mined, it is still a limited asset. Also, if the price were to fall a lot, the mining (and hence supply) would be curtailed as it wouldn’t be economical to mine more.

Bitcoin

Bitcoin obviously scores great on #2. Way better than Gold, it’s right up there with dead-man’s art. The supply of Bitcoin is going to be capped at 21 million.

The debate with Bitcoin is clearly about the merits on #1.

Just like gold and art there’s definitely no intrinsic value to Bitcoins, so we must revert to this notion of Bitcoin having some sort of a perceived value. A perceived value not just today, and not just because people are buying it, but something fundamental anchoring its value for the future as well.

What’s the perceived value of Bitcoin?

Bitcoin started its life with the hope of becoming a "better currency”. It was going to be more efficient than using cash. Transactions using Bitcoin were going to be cheaper, more seamless, and it was going to be great for micro-transactions. No clearing risk, anonymity, friction-less and many other benefits.

I have a friend that pitched me Bitcoin when it was just a couple hundred dollars a coin. He was a real enthusiast and believed in the concept. Nothing to do with value appreciation - he actually wasn't even sure if it would/should appreciate based on an increased usage as a currency. (Think about it, the Dollar, Euro or any other currency does not appreciate or depreciate based on how many times the currency is used.) He was pitching me the concept of Bitcoin - as an alternative currency. This was stage A.

Stage B was when some forward looking asset managers heard those same pitches and realized that if the enthusiasts were right, they could be investing on the ground floor of a huge opportunity. Demand for Bitcoins would increase if people would want to use it as a currency.

They didn’t know if it’ll work, but even based on a real small possibility, the risk-reward and potential gain was something they were willing to wager on.

Let’s pause here for a second. If we were still at this point, I think all would be okay. Enthusiasts would be working on getting Bitcoin accepted in more places and lowering the cost of transacting with it. If they would succeed those early investors would likely see a nice return as more people would need to acquire the currency and bid up the price.

The issue is that we already jumped to stage C, where other managers started allocating money to the asset without giving any thought to stage A and the value of Bitcoin actually becoming a currency.

Please scroll up and read the quotes at the start of this post.

Why in the world would Bitcoin be a store of value if it doesn’t become a currency?!

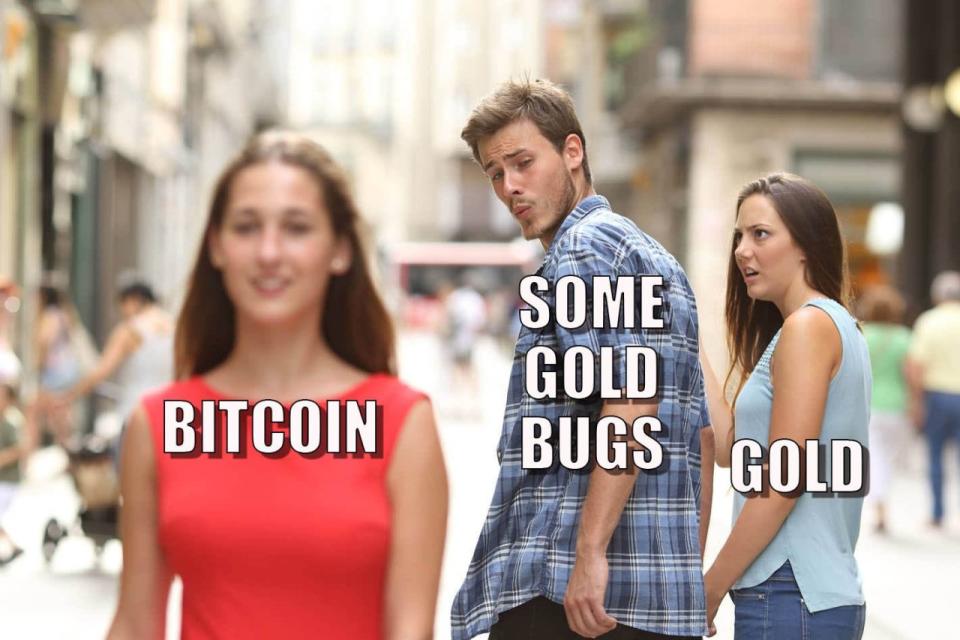

How can you say Bitcoin is like gold because "It’s mined, it has a fixed quality and the price is very volatile” and not mention anything about some sort of value or perceived value of it as an asset?

You can’t just have everybody in the world say: “At the count of three let’s all agree to believe that this new concept is true” and like magic a new asset is created just because it’s limited and costs money to mine. You’re missing the perceived value.

And to be honest, stage C wouldn’t surprise me at this point. Forget $TSLA and $NFLX for a second, we live in a world where there are trillions of dollars of bonds that trade at negative yields. I guess you’ll always have certain equities jump from Intrinsic Value Investing - calculating cash flows, earnings, dividends etc - to a Greater Fool type of “investing”, where investors would buy based on future hopes and dreams. But Bonds!? Bonds are typically an asset whose prices are driven entirely by math calculations based on discounted interest and principal payments. And yet, for the last couple of years we have investors buying bonds just so they can sell it to the next guy at a higher price. It’s truly amazing when you think about it. (I did.)

At his point though, we’re way past stage C, we’re probably past stage D, E, and F too. We have the “rational” speculators that believe Bitcoin’s a store of value because it’s a new asset (without any perceived value to back it up). But more and more I hear people highlighting all the media coverage and the new Futures contracts which prove and substantiate it as being “a real asset” which will obviously rise. As Matt Levine wrote: I continue to read and hear and nod sagely at the argument that “the reason people own bitcoin is because it’s a great store of value,” but I cannot yet distinguish that argument from “the reason people own bitcoin is because it keeps going up.”

The real increase of the price of Bitcoin has been driven by speculators that have ignored a key fundamental ingredient needed to anchor it as an asset that will retain its value. You need that future perceived value and not just because others bought it and saying that others will buy and need to own.

The case for Bitcoin becoming “gold, just better” (because of a fixed limited quantity), must be tied and intertwined to Bitcoin maintaining a perceived value. One is dependent on the other.

Of course, there still is a possibility (and not a tiny one) that Bitcoin does become a real currency that is utilized by many people, but I don’t see an increase in these odds recently, I’d argue it has actually weakened with all the hype. Has it become any easier to transact with Bitcoin?

I think the biggest question with Bitcoin retaining a perceived value is “Why Bitcoin over any other crypto-currency?” Aren’t most of the benefits of Bitcoin over USD also benefits of Ethereum, Litecoin and dozens of other crypto-currencies? And if one of the other ones, or perhaps one that has yet to be created, does become the go-to crytpo-currency, then again, just because Bitcoin is limited to 21 million, it’s still 20,999,999 more than my single unattractive painting!

To go back to The Scream painting to amplify the point, imagine people discovered that the painting that Mr. Black bought was not authentic. While it still is a limited painting (in quantity), the “true” perceived value was not real; the painting would crash in value.

This is what happened to tulips (yes, I said it). Any and all the perceived value was based on flawed beliefs. So while in the short-term supply and (more importantly) hype and demand drove prices higher, once people realized there was nothing to anchor the value, poof! (or pop!)

Bottom line: Let’s not lose sight of the key bull vs. bear case with Bitcoin. Will it become a main stream currency? Until this debate is won any conversation about it being an asset class and comparing it to gold is just fueling a bubble.

- Aron

Twitter: @MicroFundy

Photo credit: @IvanTheK

Related Article: Why this has become a “greater fool” market

Yahoo Finance

Yahoo Finance