Bitcoin Defies Skeptics, Breaks $30,000

Bitcoin Reclaims $30,000

The road to redemption for the world’s oldest and most popular cryptocurrency has been a rough one (to say the least) and has had plenty of skeptics. However, last night, Bitcoin breached the $30,000 mark for the first time since June 2022. Against all odds, BTC is up ~80% year-to-date. Here are a few important things you should know:

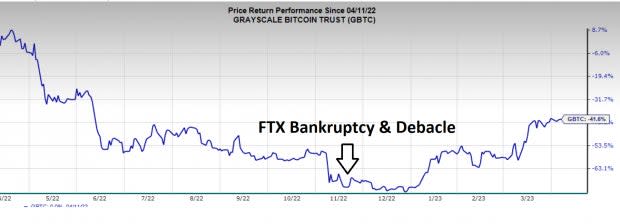

“Buy when there’s blood in the streets”: More times than not, the best time to buy a market is when the news is the worst. Indeed, this turned out to be the case for BTC and various BTC proxies such as the Grayscale Bitcoin Trust (GBTC) and the ProShares Bitcoin ETF (BITO). In November 2022, doomed crypto exchange FTX filed for bankruptcy (after committing the largest fraud since Madoff’s Ponzi scheme), shaking crypto markets. Over that short time, BTC has doubled.

Image Source: Zacks Investment Research

Safe Haven Asset: For months in 2022, Bitcoin was closely correlated to equities, specifically tech, and the Nasdaq. However, in the past few months, Bitcoin has been trading more in sync with gold. Finally, it appears that “Bitcoin Maximalists” that believe BTC is a safe haven asset and not just a “yolo” product of easy money central bank policies have something to hang their hats on.

Bitcoin Behemoth is Back Onside: In 2020, MicroStrategy (MSTR), a public software company in business since the late 1990s, took the bold and unorthodox step to move to the “Bitcoin Standard”. Led by its outspoken and eccentric founder Michael Saylor, MSTR has purchased nearly $4 billion worth of Bitcoin, which translates to roughly 130,000 BTC! In a show of conviction or unfounded confidence (you decide), Saylor and MSTR have dollar cost averaged into BTC the entire way down is finally back to their cost basis of around $30,000 per coin.

Image Source: Zacks Investment Research

Bitcoin Halving is Slated for Early 2024: Roughly one year from now, Bitcoin will experience its next “Halving”. Bitcoin halvings occur every four years and refers to when the reward for Bitcoin miners (network validators) is cut in half. Each halving event means that the number of new Bitcoin being let out into circulation is slashed in half. Remember, unlike central bank currencies, Bitcoin is finite – there will only ever be 21 million in existence. Past halving events have led to dramatic bull markets in BTC’s price.

Miners are on Fire: Year-to-date, the Valkyrie Bitcoin Miners ETF (WGMI) is up 97%, making it one of the top-performing ETFs in the entire market. The ETF’s top three holdings include Marathon Digital Holdings (MARA), HIVE Blockchain Technologies (HIVE), and Riot Platforms (RIOT).

Long-Term Technical Picture is Improving: While it is hard to chase Bitcoin into a large round number like $30,000 after a rapid short-term move, BTC and BTC proxies like the Grayscale Bitcoin Trust (GBTC) are showing improving longer-term technical. GBTC just triggered a bullish golden cross – a bullish technical signal that occurs when the 50-day moving average crosses over the 200-day from below. While the signal failed the last time, when it happened in 2020, GBTC shot higher from $10 to $60 is rapid order fashion.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MicroStrategy Incorporated (MSTR) : Free Stock Analysis Report

HIVE Blockchain Technologies Ltd. (HIVE) : Free Stock Analysis Report

Marathon Digital Holdings, Inc. (MARA) : Free Stock Analysis Report

Grayscale Bitcoin Trust (GBTC): ETF Research Reports

Riot Platforms, Inc. (RIOT) : Free Stock Analysis Report

ProShares Bitcoin Strategy ETF (BITO): ETF Research Reports

Valkyrie Bitcoin Miners ETF (WGMI): ETF Research Reports

Yahoo Finance

Yahoo Finance