Biotech stocks are up 560pc in a decade - and this is how to play the sector for more

Biotechnology is a buzzword that has been exciting investors for decades, but while some have multiplied their money many times over, others have suffered painful losses.

Between 2015 and 2016 the entire sector fell heavily, thanks to concerns about the prospect of a more draconian US approach to drug price regulation.

From July 2015 to the following February, the US-focused Nasdaq Biotechnology index fell by more than 30pc and the MSCI World Biotechnology index by 20pc. Some individual funds fell even more heavily.

The sector has now recovered and excitement is building once more – but should investors pay attention?

Biotech companies are mainly involved in developing new drug treatments, tests and other medical technologies.

The sector is notoriously volatile, in large part because investors are often banking on a firm’s latest drug or treatment receiving regulatory approval, where the chances of success are low.

Individual companies can, and do, go bust or suffer huge share price falls, and the sector is heavily sensitive to the actions of regulators.

For instance, biotech company Prothena – the top holding in famed investor Neil Woodford’s Patient Capital trust – has recently come under attack from an American hedge fund, which is betting against the stock as it expects its flagship drug to fail. The shares fell by 9pc when the assault became public.

Gary Potter, of BMO Global Asset Management, said he had never invested in biotech.

“On a risk scale of one to 10, biotech has to come in at a nine or a 10. You could lose 50pc in a bad market – people have done, and will do again. It’s an easy story to sell, and I’ve heard it for 20 years,” he said.

“The chance of success is there, but there’s a big health warning.”

However, a company that gains approval for a new treatment can deliver spectacular returns, and many long-term investors have been handsomely rewarded. Over the past 10 years the total return of the MSCI index has been 560pc, while the Nasdaq index has returned 530pc.

Peter Hughes, a healthcare analyst at Axa Investment Managers, said that at the point companies became available for public investment they were typically at the “development” stage, which comes after the initial discovery behind a new drug.

“Only one in every 10 drugs that reaches the first stage of clinical trials gets approved, so the attrition rate is still high,” he said.

However, he added that, compared with 10 years ago, more companies are focusing on rare diseases, where success rates are higher, and there are now larger firms which are less reliant on the success of a single product.

The biotech sector also views the new head of the US regulator, Scott Gottlieb, as more flexible, allowing unique trial designs and more willingly approving therapies. The US market is by far the largest for biotech firms.

However, Mr Hughes added: “It remains a volatile sector. In October the Nasdaq index fell 5.8pc in US dollar terms, compared to a 2.2pc rise in the S&P 500."

How to invest

A “generalist” fund that has decent exposure to biotech firms is likely to be the best option for most investors.

Philippa Gee, of Philippa Gee Wealth Management, said: “This is such a niche sector, you need to be prepared to time both when you go in and when you come out, and prepare to hold for the very long term.

“Any investment in biotech should account for no more than 2pc of your portfolio and has to be with money that you do not need – money that you can leave for decades and watch for sudden price gains.”

She suggested a US smaller companies fund with a biotech tilt, which “could warrant slightly higher exposure than 2pc”. Top picks include Schroder US Smaller Companies, JPM US Smaller Companies and Artemis US Smaller Companies. These charge 0.91pc, 0.93pc and 0.9pc a year respectively.

Ben Gutteridge, of wealth manager Brewin Dolphin, tipped the Legg Mason ClearBridge US Aggressive Growth fund, which has a third of its money in biotech, with the rest in growing technology businesses and energy services. It costs 1.14pc a year.

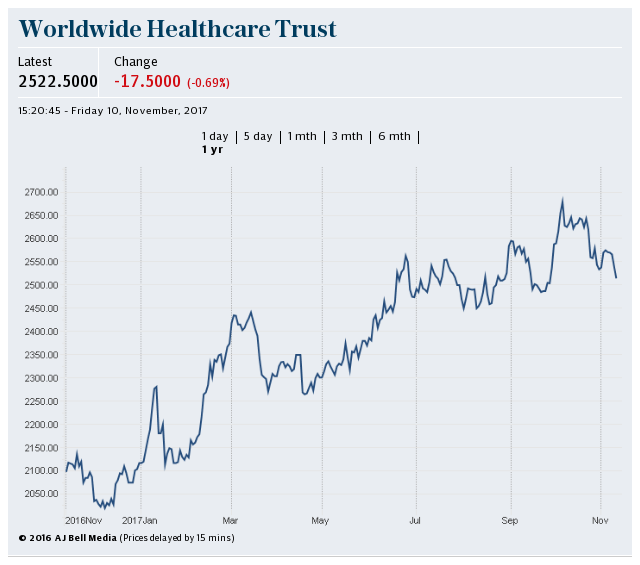

A general healthcare fund, which can invest in hospitals, pharmaceutical companies, biotech firms and more, offers a more targeted option. Top picks include Axa Framlington Health and the Worldwide Healthcare investment trust, which cost 0.82pc and 0.9pc respectively.

Ryan Hughes, head of fund selection at the investment shop AJ Bell, said Axa’s fund offered broad exposure to large pharmaceutical companies alongside smaller biotech firms, while Worldwide Healthcare is a higher-risk option, as the trust borrows money in an attempt to enhance returns.

For those who would rather invest via a tracker fund, L&G’s Global Healthcare & Pharmaceutical tracker follows a FTSE index of health firms for an annual charge of 0.31pc.

There are a number of specific biotech funds for those who do want direct exposure. The Biotech Growth Trust is in our Telegraph 25 list of favourite funds and charges 1.1pc.

Axa, Polar Capital, Pictet and Candriam all offer open-ended biotech funds, charging 0.82pc, 1.18pc, 1.22pc, and 1.88pc respectively.

Since October 2013, when it launched, Polar Capital's fund is the only one of these to have outperformed the Nasdaq and MSCI World biotechnology indices - a period that includes the sector wide downturn.

Alternatively, you could invest in the NASDAQ Biotechnology index itself via the US-listed iShares Nasdaq Biotechnology ETF for a charge of 0.47pc a year.

Yahoo Finance

Yahoo Finance