BioMarin (BMRN) Provides FDA Filing Update for Gene Therapies

BioMarin BMRN announced multiple regulatory updates pertaining to its regulatory filings for its gene therapies with the FDA.

Management announced that the FDA had accepted the supplemental New Drug Application (sNDA), seeking label expansion for Voxzogo (vosoritide) injection to treat children under five years with achondroplasia, the most common form of dwarfism.

Voxzogo is currently approved in the United States for treating achondroplasia in children five years and older with open epiphyses (bone growth plates).

Earlier in January, management had announced that the European Medicines Agency (EMA) had validated the filing seeking label expansion for Voxzogo to treat children under two years with achondroplasia. The therapy is already approved in Europe to treat achondroplasia in children aged two years and older.

If the therapy were to be approved for these two age groups in the United States and Europe, more than a thousand children suffering from achondroplasia would be eligible for treatment. This will likely boost BioMarin’s topline.

Since its launch, Voxzogo has seen rapid uptake driven by strong prescription demand. BioMarin is seeking approvals for the drug across multiple new markets, which can boost drug sales. Following its approval, Voxzogo became the first medicine to treat achondroplasia. During 2022, Voxzogo generated sales worth $169 million, mainly driven by new patient initiations, which is encouraging for a newly launched drug. For 2023, management expects to record Voxzogo sales in the range of $330 million to $380 million, representing over 100% growth from the midpoint compared with the 2022 figure.

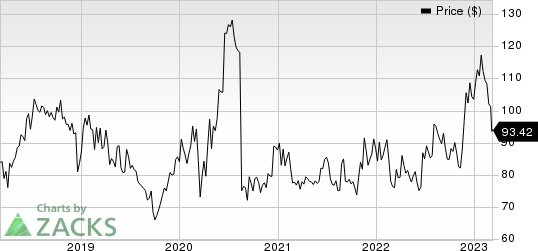

Shares of BioMarin have declined 9.7% in the year so far compared to the industry’s 4.3% fall.

Image Source: Zacks Investment Research

In a separate press release, BioMarin also announced that the FDA had extended the review period for the former’s BLA filing for Roctavian (valoctocogene roxaparvovec, or valrox) gene-therapy by another three months. The BLA is seeking approval for treating adults with severe hemophilia A. The final decision from the regulatory agency is now expected by the end of June 2023.

This extension period was due to submission of three-year follow-up safety and efficacy data from the late-stage GENEr8-1 study supporting the BLA filing for Roctavian, which the FDA deemed as major amendment to the earlier filed data. This extension was in line with previously provided company guidance as management had previously advised stakeholders that submission of the said data is likely to extend the target date.

Last September, management completed the refiling of the BLA to the FDA, seeking approval for valrox gene therapy to treat adult patients with severe hemophilia A. BioMarin previously submitted a BLA in 2019 for valrox to address hemophilia A. However, the FDA issued a complete response letter (CRL) to the BLA in 2020, citing dissatisfaction with the available data.

Roctavian received conditional marketing authorization for hemophilia A in the European Union in August 2022. The Roctavian product launch is underway in Europe.

For 2023, BioMarin expects Roctavian sales in the range of $100 million to $200 million. This guidance assumes a launch in the United States in 2023.

BioMarin Pharmaceutical Inc. Price

BioMarin Pharmaceutical Inc. price | BioMarin Pharmaceutical Inc. Quote

Zacks Rank & Stocks to Consider

BioMarin currently carries a Zacks Rank #3 (Hold).Some better-ranked stocks in the overall healthcare sector include Adaptive Biotechnologies Corporation ADPT, ADC Therapeutics ADCT and CRISPR Therapeutics CRSP, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estimates for Adaptive Biotechnologies’ 2023 loss per share have narrowed from $1.30 to $1.15 in the past 30 days. During the same period, the loss per share estimates for 2024 have narrowed from 99 cents to 94 cents. Shares of Adaptive Biotechnologies have risen 12.6% year-to-date.

Earnings of Adaptive Biotechnologies beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 10.75%. In the last reported quarter, ADPT delivered an earnings surprise of 24.32%.

In the past 30 days, estimates for ADC Therapeutics’ 2023 loss per share have narrowed from $2.69 to $2.43. During the same period, the loss per share estimates for 2024 have narrowed from $3.07 to $2.73. In the year so far, shares of ADC Therapeutics have declined 27.1%.

Earnings of ADC Therapeutics beat estimates in three of the last four quarters while missing the mark on one occasion, witnessing a negative earnings surprise of 21.98%, on average. In the last reported quarter, ADC Therapeutics’ earnings beat estimates by 38.78%.

In the past 30 days, estimates for CRISPR Therapeutics’ 2023 loss per share have narrowed from $8.21 to $7.31. Shares of CRISPR Therapeutics have risen 17.7% in the year-to-date period.

Earnings of CRISPR Therapeutics beat estimates in two of the last four quarters while missing the mark on the other two occasions, witnessing an earnings surprise of 3.19%, on average. In the last reported quarter, CRISPR Therapeutics’ earnings beat estimates by 39.22%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BioMarin Pharmaceutical Inc. (BMRN) : Free Stock Analysis Report

ADC Therapeutics SA (ADCT) : Free Stock Analysis Report

Adaptive Biotechnologies Corporation (ADPT) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance