Biogen (BIIB) Q1 Earnings Beat, Stock Up on Alzheimer Drug Uptake

Biogen BIIB reported first-quarter 2024 adjusted earnings per share (EPS) of $3.67, beating the Zacks Consensus Estimate of $3.45. Earnings rose 8% year over year, driven by savings in operating costs and margin improvements. On a constant-currency basis, earnings were flat.

Total revenues came in at $2.29 billion, down 7% on both reported basis and constant-currency basis from the year-ago quarter due to lower sales of key multiple sclerosis (MS) drugs like Tecfidera and Tysabri as well as spinal muscular atrophy (SMA) drug, Spinraza. Sales missed the Zacks Consensus Estimate of $2.32 billion.

Product sales in the quarter were $1.71 billion, down 3% year over year. Revenues from anti-CD20 therapeutic programs declined 1% to $394.0 million. The revenues include royalties on sales of Roche’s Ocrevus and Biogen’s share of Roche’s drugs, Rituxan, Gazyva and Lunsumio.

Contract manufacturing and royalty revenues declined 39% in the quarter to $184.6 million. Contract manufacturing and royalty revenues include Biogen’s 50% share of revenues (including royalties) from the Leqembi collaboration with Eisai and revenues from the manufacturing of Leqembi. Eisai recorded nearly $19 million in sales from Leqembi in the first quarter compared with $7 million in the fourth quarter of 2023.

Leqembi gained full approval from the FDA for early Alzheimer’s disease in the United States and broad reimbursement from the Centers for Medicare & Medicaid Services (CMS) in July 2023. Regulatory applications seeking approval of Leqembi are under review in Europe. The Eisai-partnered drug is also approved in China and Japan.

Multiple Sclerosis Revenues

Biogen’s MS revenues were $1.08 billion in the reporter quarter, down 4% on a reported basis and a constant-currency basis year over year due to generic competition for Tecfidera and rising competitive pressure in the MS market.

Tecfidera sales declined 7% to $254.3 million as multiple generic versions of the drug have been launched in the United States and new generic launches are ongoing in several EU countries. Tecfidera sales beat the Zacks Consensus Estimate of $224 million as well as our estimate of $199 million.

Vumerity recorded $127.5 million in sales, up 18%. Vumerity sales missed the Zacks Consensus Estimate of $138 million and our model estimate of $152 million.

Tysabri sales declined 9% year over year to $431.3 million, likely hurt by increased competition and higher discounts. Tysabri's sales missed the Zacks Consensus Estimate of $434 million and our estimate of $435 million.

Combined interferon revenues (Avonex and Plegridy) in the quarter were $243.6 million, down 1%, likely hurt by a continued shift from the injectable platform to oral or high-efficacy therapies.

Rare Disease Drugs

Sales of Spinraza declined 23% to $341.3 million, primarily due to increased competition in ex-U.S. territories. Sales of the drug missed the Zacks Consensus Estimate of $421 million and our estimate of $442 million.

Rare disease drug Skyclarys, which was added with the September 2023 acquisition of Reata Pharmaceuticals, generated sales of $78.0 million in the first quarter, compared to $55.9 million in fourth-quarter 2023. Skyclarys is the only drug approved for the treatment of Friedreich’s ataxia. Sales of the drug beat the Zacks Consensus Estimate of $69 million and our estimate of $56 million.

Qalsody, which was launched for amyotrophic lateral sclerosis (ALS) last year, recorded sales of $4.6 million in the first quarter compared with $3.3 million in the fourth quarter of 2023.

Other Products

In the quarter, biosimilar revenues rose 2% to $196.9 million.

In the quarter, the collaboration profit-sharing was a net expense of $66 million, which included $61 million of net profit-sharing expense related to Biogen’s biosimilar collaboration with Samsung Bioepis and $5 million of net profit-sharing expense related to Biogen’s collaboration with Sage Therapeutics SAGE associated with the commercialization of Zurzuvae in the United States.

Zurzuvae (zuranolone) was approved for postpartum depression in August and launched in mid-December 2023. Though management did not report sales figures for the drug separately, it did mention that the drug’s uptake has been encouraging.

Biogen and Sage equally share profits and losses for the commercialization of Zurzuvae in the United States. At the same time, outside U.S. markets, Biogen records product sales (excluding Japan, Taiwan, and South Korea) and pays royalties to Sage. Zurzuvae has not yet been approved in the EU.

Costs Decline

While adjusted research and development (R&D) expenses declined 22% year over year to $447 million, adjusted selling, general and administrative (SGA) expenses were down 6% to $569 million. This decline in both expenses is attributable to the company’s cost-saving initiatives.

2024 Guidance

Management reiterated its previously issued guidance for 2024. Total revenues are expected to decline by a low- to mid-single-digit percentage in 2024 from the 2023 level. Core pharmaceutical revenues, comprising product sales plus Leqembi revenues, are expected to be flat in 2024 compared to 2023 levels.

Adjusted earnings are expected in the range of $15.00 to $16.00, implying growth of approximately 5% at the midpoint.

Operating income is expected to grow at a low-double-digit percentage in 2024, driven by lower cost of sales and lower operating costs due to the cost-saving initiatives.

Our Take

Biogen’s first-quarter results were mixed as it beat the estimates for earnings but missed the mark for sales. Earnings benefitted from the company’s ongoing ‘Fit For Growth’ restructuring program and R&D prioritization.

Biogen’s shares were up 6% in pre-market trading despite the sales miss, fueled by the better-than-expected sales performance of recently approved drugs. While management did not provide the specific number of patients on Leqembi, it claimed that the number of patients on the therapy increased nearly 2.5 times since 2023-end.

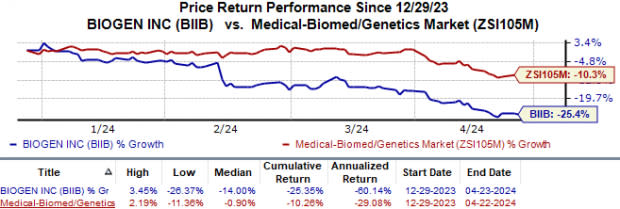

In the year so far, the stock has declined 25.4% compared with a decline of 10.3% for the industry.

Image Source: Zacks Investment Research

Apart from Leqembi, the company’s recently acquired drug Skyclarys also showed promising growth, as the reported figures beat estimates, thanks to the drug’s EU launch. Management also claimed that the launch uptakes of Qalsody and Zurzuvae have been encouraging.

With most of Biogen’s key drugs (Tecfidera, Tysabri and Spinraza) facing intense competitive pressure, management believes that the newer products have the potential to revive growth and drive the company’s top line in the long term.

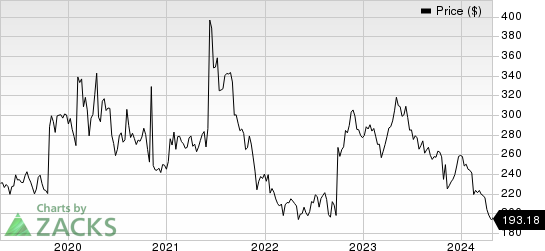

Biogen Inc. Price

Biogen Inc. price | Biogen Inc. Quote

Zacks Rank & Key Picks

Biogen currently has a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector include ADMA Biologics ADMA and ANI Pharmaceuticals ANIP, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share (EPS) have risen from 22 cents to 30 cents. During the same period, EPS estimates for 2025 have improved from 32 cents to 50 cents. Year to date, shares of ADMA have surged 44.7%.

Earnings of ADMA Biologics beat estimates in three of the last four quarters while meeting the same on one occasion. ADMA delivered a four-quarter average earnings surprise of 85.00%.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 EPS have risen from $4.12 to $4.43. Meanwhile, during the same period, EPS estimates for 2025 have improved from $4.80 to $5.04. Year to date, shares of ANIP have risen 20.0%.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters. ANI delivered a four-quarter average earnings surprise of 109.06%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Sage Therapeutics, Inc. (SAGE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance