Best Ways To Plan For Your Child’s University Tuition Fee

Reaching the various phases in life has a way of getting people to be more interested in personal finance. Having a child is one of those phases.

The realization that you now have to take care of a new-born both physically and financially is enough to kick most adults into starting to think about managing their personal finances more adequately.

One of the biggest ticket items you are going to have to plan for is your kid’s education. More specifically, we are referring to their university tuition fee.

How much does it cost for a local degree?

We are going to ignore the overseas education and go with the more realistic local degrees. Let’s face the fact; as much as we would want to show our endearing love towards our children, an overseas degree would be too pricey for parents of average income household. So short of a scholarship, let’s just focus on local degrees.

On average, parents can expect for a local degree to cost about $25,000 for a 4-year course at a local university. If you include in a $500 a month allowance (probably not enough without other form of income supplement), this would be another $24,000 over 4 years added to the cost. We will assume it adds up to $50,000 in total.

The danger of inflation

It is not realistic to expect that education and living expenses 20 years from now would be the same as it is today.

To take that into consideration, we will assume an inflation rate of 1.5% per annum. This is a number that could be lower than actual inflation rate in the country. However, we will set it down to a lower rate with the assumption that the government would continue to see education as a merit good, and hence, would do their best to keep education affordable.

At an assumption of 1.5% per annum for inflation, parents can expect to pay about $67,000 for university education for each child

How do you accumulate $67,000 over 20 years?

There are various ways you can accumulate $67,000 over 20 years.

Before we begin, let’s first remind ourselves that this amount to be saved is simply for university education. It does not include other child expenses that you are going to incur as well. It also does not include the financial planning which you have to do for your own retirement planning.

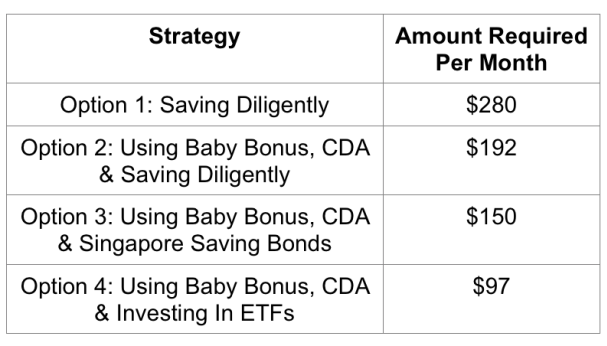

Option 1: Saving Diligently

There is a lot to admire about parents who save diligently for their child’s education. Unfortunately, it is also one of the most ineffective ways you can think of. From the 1st month your child is born, you would need to save about $280 per month for the next 20 years to accumulate $67,000.

Option 2: Using Baby Bonus, CDA & Saving Diligently

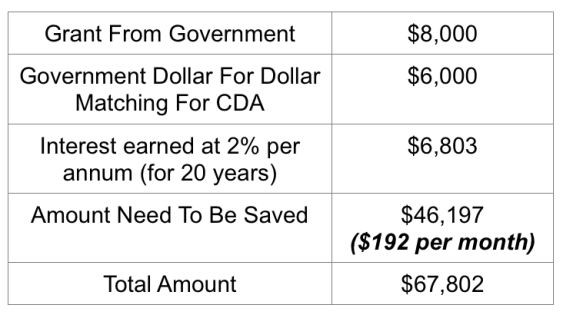

For each child that is born. The government gives a baby bonus of $8,000. The government also provides a dollar for dollar matching for money saved into a Child Development Account (CDA) up to the amount of $6,000.

What this means is that if you simply put the entire sum of money that the government gives to you into your child’s CDA, you can raise $14,000 without putting in a single cent yourself.

Interest rates on CDA are about 2% per annum. Over the next 20 years, this amount would grow to about $20,803 in total. If you intend to save the rest of the money needed for your child’s education, you would need to save about $192 per month.

Note: Upon a child reaching the age of 13, all money in the CDA would actually be transferred to the Child’s PSEA account, which earns a higher interest of 2.5%. For the purpose of this article, we will just assume that interest rate remain constant at 2%

Read Also: How You Can Maximise The Baby Bonus

Option 3: Using Baby Bonus, CDA & Singapore Saving Bonds

Instead of saving diligently at a saving account that provides hardly any interest, let’s try to make our money work harder for us without taking any additional risk.

We would still fully maximise the government’s CDA top up for our child and get about $20,803 at the end of 20 years, assuming the money isn’t used for anything else. For the remaining sum of $46,197 required, we will assume that the parents save and invest the savings into the Singapore Saving Bonds.

The Singapore Savings Bonds would give about 2.6% per annum at 10-year maturity. With that return in mind, parents would need to save only about $150 per month (or $1,800 per year) instead of $192 and $280 in the earlier two examples.

Option 4: Using Baby Bonus, CDA & Investing In ETFs

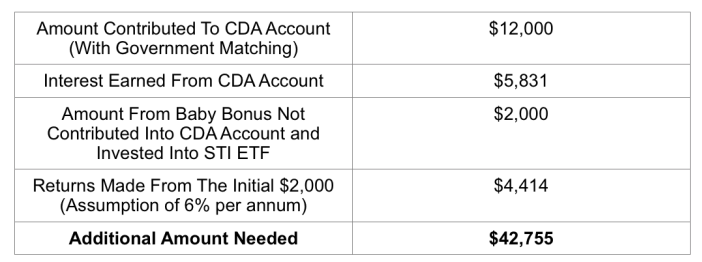

Once again, we will fully maximise the top up given by the government without using the CDA. However, we will only deposit $6,000 into the Child’s CDA since the government dollar for dollar matching is only up till $6,000. The remaining $2,000 would be invested into the STI ETF from day one.

In addition to that, we will be making small but consistent contributions into this STI ETF via monthly investment plans offered by some brokerage houses. These are investment plans that allow you to purchase stocks or ETFs from as low as $100 per month. For the STI ETFs, we will assume a return of about 6%, which by the way, is a conservative estimate.

Read Also: Invest In Stocks Using Monthly Investment Plans

Note: According to the SPDR STI ETF prospectus, up till 31st May 2015, the fund has returned 7.88% per annum over the past 10 years inclusive of dividends and net of all charges.

Here is how the amount tables out.

$42,755 appears to be a sizeable sum. However, at a return of 6% per annum from the STI ETF, how much do you actually need to invest each month to accumulate this in 20 year?

About $97 per month.

We like to give a quick shoutout to Jon from BigFatPurse, who inspired us with his ETFs for child idea. You can read his original article here.

Choose the option you prefer…

To recap, we have just provided some simple ways in which all parents can plan for their child’s education. The first three options come with no risk exposure. Yet between option 1 and option 3, we are looking at a difference of about $130 per month, over a period of 20 years.

Regardless of your preference, all the 4 strategies share something in common, and that is, to start planning earlier rather than later.

If you like what you read, subscribe to our DollarsAndSense.sg newsletter. We have more exclusive content written just for it.

The post Best Ways To Plan For Your Child’s University Tuition Fee appeared first on DollarsAndSense.sg.

Yahoo Finance

Yahoo Finance