6 Best Student Credit Cards in Singapore (2019)

If you’re a student, you’re probably feeling broke all the time, but even without a regular income you can still get a credit card. Unlike regular credit cards, student credit cards have no minimum income requirement, low annual fees and a low credit limit (the maximum amount you can charge to your card, usually $500).

Here’s a list of student credit cards in Singapore and what benefits (if any) they have:

6 best student credit cards in Singapore (2019)

Credit card | Benefits |

DBS Live Fresh Student Card | Free entry to Zouk & drink discounts. 0.3% cashback on everything |

Maybank eVibes Card | 1% cashback on everything. Sign up gift of Adidas watch |

CIMB AWSM Card | 1% cashback on dining, entertainment, online shopping, telco bills |

Standard Chartered Manhattan $500 Card | 0.25% cashback |

Citibank Clear Card | Return vouchers at Ajisen Ramen & Swensen’s |

BOC Qoo10 Platinum Mastercard | 3% to 10% Qmoney rebates with min. spend $200 |

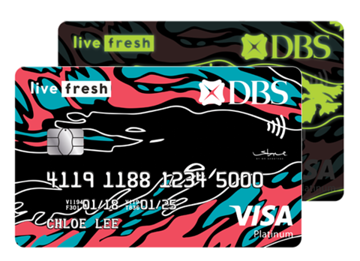

DBS student credit card – DBS Live Fresh Student Card

DBS Live Fresh Visa Student Card Card Benefits

0.3% cashback on online shopping and contactless payments

Contactless payments: Visa payWave, Apple Pay, Samsung Pay, Android Pay

Enjoy 5-year annual fee waiver

The DBS Live Fresh Student Card is one of the most attractive student credit cards out there, mainly because it gives you free entry to Zouk plus assorted discounts on drinks. See all the Zouk-related privileges here.

However, it is the most restrictive student card – it’s only for students of the 6 local universities and 5 polytechnics. Its cashback benefit (0.3% on online shopping & contactless payment) is also pretty damn measly.

DBS Live Fresh Student Card | |

Annual fee & waiver | $128.40 (waived for 5 years) |

Credit limit | $500 |

Eligibility | 18 to 27 years old, Singapore citizen or PR |

Eligible schools | NUS, NTU, SMU, SUTD, SUSS, SIT, Nanyang Polytechnic, Ngee Ann Polytechnic, Temasek Polytechnic, Singapore Polytechnic or Republic Polytechnic |

Minimum income | None |

Maybank student credit card – Maybank eVibes Card

The Maybank eVibes Card is another student credit card to consider for local students and NSFs waiting to start school. It gives you a decent 1% cashback on all spending, plus there’s a current sign-up gift of an Adidas watch.

This credit card has a quarterly fee of $5, but new sign-ups get it waived for 2 years. Subsequently, it’s easy to waive – just charge anything to your card every quarter.

Maybank eVibes Card | |

Annual fee & waiver | $5 quarterly (waived for 2 year) |

Credit limit | $500 |

Eligibility | 18 to 30 years old, Singapore citizen or PR |

Eligible schools | NUS, NTU, SUSS, SMU, NP, SP, NYP, TP, RP, NAFA, LASALLE, NIE, SUTD & SIT (or NSF) |

Minimum income | None |

CIMB student credit card – CIMB AWSM Card

The brand new CIMB AWSM (“Awesome”) Card is Malaysian bank CIMB’s entry into the student credit card space. It’s open to students and NSFs with no income, and working adults with a minimum income of $18,000.

It doesn’t quite live up to its name though, as it offers just 1% cashback on dining, entertainment, online shopping and telco bills. Meh.

CIMB AWSM Card | |

Annual fee & waiver | None |

Credit limit | $500 |

Eligibility | 18 to 29 years old, Singapore citizen or PR |

Eligible schools | Any (or NSF) |

Minimum income | None for students or NSFs. $18,000 p.a. for working adults |

Standard Chartered student credit card – Standard Chartered Manhattan $500 Card

Another no-frills student card, the Standard Chartered Manhattan $500 Card’s key benefit is 0.25% cashback on all spend, the lowest among all the student credit cards.

Also, it’s only open to students of 5 schools in Singapore. But if you qualify for this card, you also qualify for one of the better credit cards on this list – so skip this one unless you have no choice.

Standard Chartered Manhattan $500 Card | |

Annual fee & waiver | $32.10 (waived for 1 year) |

Credit limit | $500 |

Eligibility | 18 to 32 years old, Singapore citizen or PR |

Eligible schools | NTU, NUS, SMU, SIM and University of Chicago Graduate School of Business, Asia Campus |

Minimum income | None for students. $18,000 p.a. for working adults |

Citibank student credit card – Citibank Clear Card

The Citibank Clear Card used to give you a 10% rebate at Starbucks, but that privilege is no more. Boo.

Now all you get are return vouchers at Swensen’s ($10 voucher when you spend $40) and Ajisen Ramen ($5 voucher when you spend $50). There’s a promo that lets you get a one-time $20 cashback when you spend $50 on the card, though.

The Citi Clear Card has less strict requirements compared to the other credit cards. It has the widest range of schools eligible, including business schools like INSEAD and SP Jain. So if you’re a non-local student or studying outside of the major schools in Singapore, this is a card you can apply for.

Citibank Clear Card | |

Annual fee & waiver | $29.96 (waived for 1 year) |

Credit limit | – |

Eligibility | 18 years old & above |

Eligible schools | NTU, NUS, SMU, SIM, SUTD, SIT, SUSS, University of Chicago Booth School of Business, DigiPen, ESSEC, GIST-TUM Asia, INSEAD, S P Jain, Tisch, UNLV, Nanyang Polytechnic, Ngee Ann Polytechnic, Republic Polytechnic, Singapore Polytechnic, Temasek Polytechnic, LASALLE-SIA, NAFA, EDHEC-Risk Institute and Sorbonne-Assas International Law School |

Minimum income | None |

BOC student credit card – BOC Qoo10 Platinum Mastercard

If you’re an avid online shopper, you might have come across the BOC Qoo10 Platinum Mastercard, which dishes out rebates in Qmoney (i.e. Qoo10 credit) as long as you hit the minimum spending requirement of $200.

The rebates are attractive – 10% on public transport, 3% on Grab/taxis, online spending and dining – until you realise the money is just locked up your Qoo10 account.

BOC Qoo10 Platinum Mastercard | |

Annual fee & waiver | $30 (waived for 1 year) |

Credit limit | $500 |

Eligibility | 18 years old & above |

Eligible schools | Any |

Minimum income | None for students. $18,000 p.a. for working adults |

Why would you need a student credit card?

Even though students don’t usually spend a lot of money, having a card just makes life easier. Some of the benefits of credit and debit cards include:

You can make online purchases without asking your parents

You can use mobile apps that make your life better (and cheaper), e.g. bike-sharing apps

You don’t have to worry about running out of cash, since merchants like McDonald’s and Starbucks accept cards

You might be wondering if you actually need a credit card if you already have a debit card.

In terms of usage, they’re actually pretty interchangeable. Most places that accept Visa or Mastercard don’t care if you use a debit card or credit card.

The difference is in how they work. Debit cards deduct funds directly from your account. You never have to worry about paying bills, but you need to make sure your bank account has enough funds for your spending.

On the other hand, credit cards let you borrow money from a bank, which you need to return at the end of the month. Otherwise, you will have to pay interest and extra fees ON TOP of the original amount you owe. Basically, using a credit card is like borrowing from an extremely polite loan shark.

But, with a credit card, you can make purchases even when you don’t have the actual cash in your bank account. And if you’re ever unlucky enough to get scammed (touch wood) it’s easier to block the transaction with a credit card – whereas if you use a debit card, say bye-bye to your funds.

Apart from debit cards and student credit cards, you can also consider getting a supplementary credit card (supp card) which is linked to one of your parents’ credit cards, or even a prepaid credit card like the FEVO card.

Do/did you use a student credit card? Which one? Tell us why in the comments!

Related articles

The Best Debit Cards in Singapore

Should Students Have Credit Cards?

4 Money Saving Tips for Uni Students Starting a New Semester

The post 6 Best Student Credit Cards in Singapore (2019) appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

More From MoneySmart

Yahoo Finance

Yahoo Finance