Best Services Dividend Stock Picks

The professional services sector tends to be highly cyclical, impacting companies operating in areas such as security, consulting and support services. Hence, considering economic volatility is crucial when thinking about a professional services company’s profitability. This impacts cash flows which in turn determines the level of dividend payout. During times of growth, these companies could provide a strong boost to your portfolio income. I’ve identify the following services stocks paying high income, which may increase the value of your portfolio.

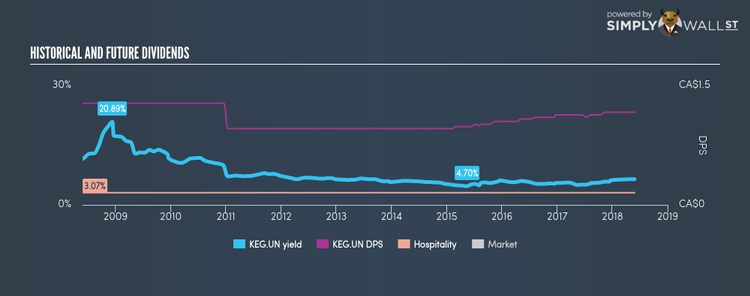

The Keg Royalties Income Fund (TSX:KEG.UN)

KEG.UN has a sumptuous dividend yield of 6.46% and the company currently pays out 61.90% of its profits as dividends . KEG.UN has been paying a dividend for the last 10 years, but shareholders have not seen an increase in dividends per share during this time. Keg Royalties Income Fund’s earnings per share growth of 197.83% outpaced the ca hospitality industry’s 13.68% average growth rate over the last year. Interested in Keg Royalties Income Fund? Find out more here.

Calian Group Ltd. (TSX:CGY)

CGY has a solid dividend yield of 3.55% and the company has a payout ratio of 54.52% . The company’s DPS have increased from CA$0.60 to CA$1.12 over the last 10 years. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend. Dig deeper into Calian Group here.

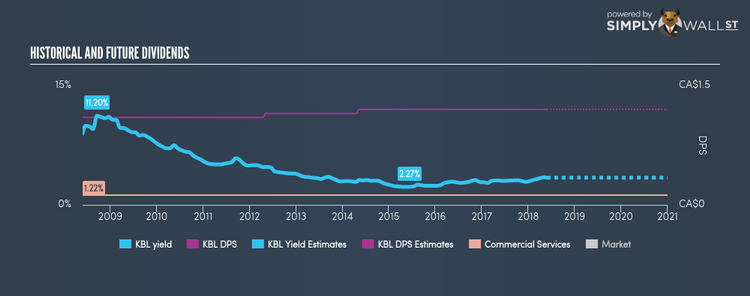

K-Bro Linen Inc. (TSX:KBL)

KBL has a decent dividend yield of 3.43% with a generous payout ratio . In the last 10 years, shareholders would have been happy to see the company increase its dividend from CA$1.10 to CA$1.20. The company has been a dependable payer too, not missing a payment in this 10 year period. The company also looks promising for it’s future growth, with analysts expecting an impressive doubling of earnings per share over the next year. Interested in K-Bro Linen? Find out more here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance