Best Growth Stocks to Buy for May 24th

Here are three stocks with buy ranks and strong growth characteristics for investors to consider today, May 24th:

Avis Budget Group CAR: This leading vehicle rental operator in North America, Europe and Australasia with an average rental fleet of nearly 650,000 vehicles, it carries a Zacks Rank #1(Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 60.4% over the last 60 days.

Avis Budget Group, Inc. Price and Consensus

Avis Budget Group, Inc. price-consensus-chart | Avis Budget Group, Inc. Quote

Avis Budget Group has a PEG ratio of 0.26 compared with 1.24 for the industry. The company possesses a Growth Score of A.

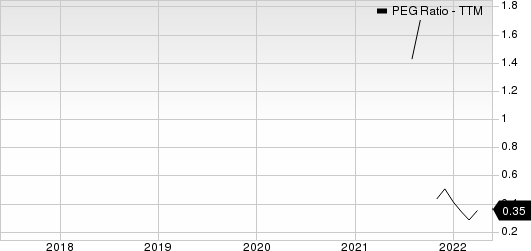

Avis Budget Group, Inc. PEG Ratio (TTM)

Avis Budget Group, Inc. peg-ratio-ttm | Avis Budget Group, Inc. Quote

Continental Resources (CLR): This Oklahoma-based company which is an explorer and producer of oil and natural gas, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 43.6% over the last 60 days.

Continental Resources, Inc. Price and Consensus

Continental Resources, Inc. price-consensus-chart | Continental Resources, Inc. Quote

Continental Resources has a PEG ratio of 0.15 compared with 0.23 for the industry. The company possesses a Growth Score of A.

Continental Resources, Inc. PEG Ratio (TTM)

Continental Resources, Inc. peg-ratio-ttm | Continental Resources, Inc. Quote

Academy Sports and Outdoors (ASO): This Texas-based retailer whichprovides sporting goods and outdoor recreations principally in the United States, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 11.8% over the last 60 days.

Academy Sports and Outdoors, Inc. Price and Consensus

Academy Sports and Outdoors, Inc. price-consensus-chart | Academy Sports and Outdoors, Inc. Quote

Academy Sports and Outdoors has a PEG ratio of 0.29 compared with 1.73 for the industry. The company possesses a Growth Score of B.

Academy Sports and Outdoors, Inc. PEG Ratio (TTM)

Academy Sports and Outdoors, Inc. peg-ratio-ttm | Academy Sports and Outdoors, Inc. Quote

See the full list of top ranked stocks here.

Learn more about the Growth score and how it is calculated here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Continental Resources, Inc. (CLR) : Free Stock Analysis Report

Academy Sports and Outdoors, Inc. (ASO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance