The 7 Best Air Miles Credit Cards in Singapore (2019)

Air miles credit cards are definitely the most glamorous of all the credit cards. Who wouldn’t want to earn frequent flyer miles (i.e. free flights!) every time they spend money?

When I got my first air miles credit card, I didn’t do one shred of research. My thought process went like this: “Ooh, my colleague talks about air miles all the time. Whatever they are, they must be cool! I’ll sign up for this card.” Obviously, nothing ever came out of my card.

Don’t end up like me – read this guide instead. Here are the best credit cards for miles in Singapore, plus useful info on how they work so you can game the system. You’ll be a miles expert by the time you’re done reading this.

Contents

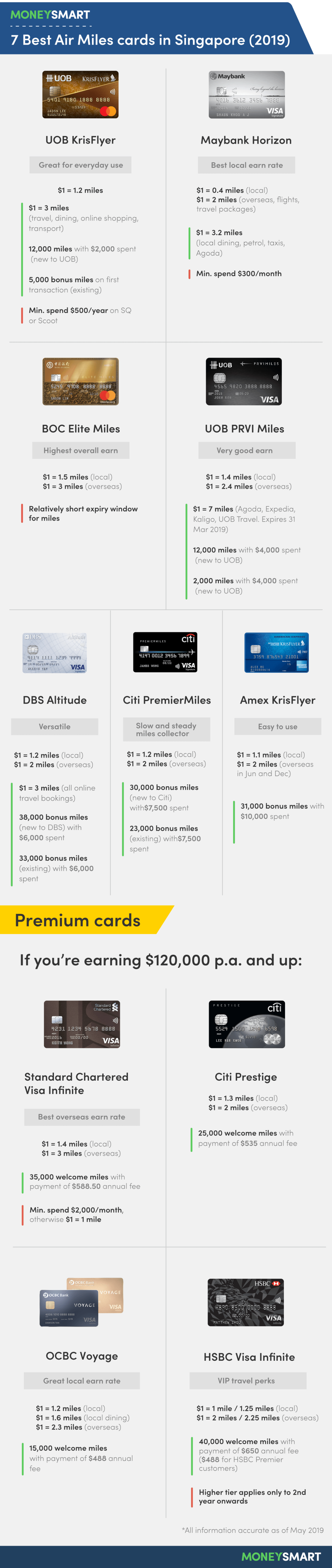

7 best air miles cards in Singapore (2019)

Best for | Best air miles credit cards |

Everyday spending | Maybank Horizon, UOB KrisFlyer |

Travel spending | OCBC 90°N, UOB PRVI Miles, UOB KrisFlyer, DBS Altitude |

One-off expenses | Amex KrisFlyer |

No expiry miles | OCBC 90°N, Citi PremierMiles, DBS Altitude |

No conversion fee | UOB KrisFlyer, Amex KrisFlyer, OCBC 90°N |

Though there are actually more air miles cards in Singapore, I’ve selected these 9 with regular people in mind, i.e. people like you and me, earning $30,000 to $50,000 a year. I’ve placed the “premium” miles cards, for those earning $120,000 and above, in a separate section below.

Also, these 7 miles cards all have first year annual fee waivers, which is now the industry standard for entry-level miles cards. That said, banks usually try to get you to pay the annual fee by dangling a bunch of bonus miles in front of you.

Another thing: Many of these air miles credit cards also have peripheral travel benefits, like airport lounge access and free travel insurance. But in order to compare the cards fairly, we’re only focusing on air miles benefits here.

Wondering what on earth 20,000 KrisFlyer miles looks like when you redeem them? Find out where you can fly for free with your miles.

Best miles cards for everyday spending — Maybank Horizon, UOB KrisFlyer

Air miles card | Benefits | Drawbacks |

Maybank Horizon Card | $1 = 3.2 miles (dining, petrol, transport, Agoda) | Min. spend $300/month |

UOB KrisFlyer Card | $1 = 3 miles (travel, dining, online shopping, transport) | Miles withheld for 1 year, need to spend $500 on SQ |

Most miles cards are set up so you can earn miles mainly with your travel spending (see next section) but wouldn’t it be so much better if you could earn miles with your everyday spending too? Just think about how much you spend on dining and pumping petrol every week.

The much-hyped UOB KrisFlyer Credit Card promises $1 = 3 miles on a whole bunch of regular spending: Dining, transport, online shopping as well as travel, which means you will use this card practically every day. However, UOB will withhold your miles for a year, during which you need to spend at least $500 on SQ or Scoot.

If you don’t like all these icky terms & conditions, an alternative is the Maybank Horizon Miles Card with fantastic bonus miles for local dining and petrol in particular. There’s a minimum spend requirement of $300, which is low, but it also means you need to remember to use this card quite consistently.

Best miles cards for travel spending — OCBC 90°N, UOB PRVI Miles, UOB KrisFlyer, DBS Altitude

Air miles card | Benefits | Drawbacks |

OCBC 90°N Card | $1 = 4 miles overseas / 8 miles on travel bookings (until 29 Feb 2020) | Short life span of promotion |

UOB KrisFlyer Card | $1 = 3 miles on travel bookings, SQ / Scoot flights | Miles withheld for 1 year |

DBS Altitude Card | $1 = 3 miles on travel bookings | Capped at $5,000/month |

UOB PRVI Miles Card | $1 = 2.4 miles overseas | High foreign transaction fee |

If you’re looking for a good miles card in preparation for your year-end travel plans, these credit cards are worthy contenders.

The freshly-launched OCBC 90°N Card, in particular, has insanely generous earn rates for travel bookings and overseas spending all the way until 29 Feb next year. If that suits your travel plans, then it’s a no-brainer to grab it while the promotion lasts.

For a more long-lasting arrangement, you may consider the UOB KrisFlyer Credit Card — though the same caveats apply above — or the DBS Altitude Card.

While the DBS Altitude‘s regular earn rates are nothing to shout about, it’s very versatile as you can earn 3 miles per $1 on practically all travel bookings, including aggregators, airlines, hotels, Airbnb, etc. That means you can still shop around for the best deal online, but just note that bonus miles are capped at $5,000/month.

For regular overseas spending e.g. shopping and dining, the UOB PRVI Miles Card has the best rate after the OCBC 90°N. But it isn’t all that great for flight and hotel bookings.

Best miles cards for one-off expenses — Amex KrisFlyer

Air miles card | Benefits | Drawbacks |

Standard Chartered X Card | 60,000 bonus miles with $6,000 spent | $695.50 annual fee |

Citi PremierMiles Card | 21,000 bonus miles with $7,500 spent | $192.60 annual fee, must be new to Citi |

DBS Altitude Card | 20,000 / 15,000 bonus miles $6,000 spent | $192.60 annual fee |

Amex KrisFlyer Ascend Card | 20,000 bonus miles with $10,000 spent | $337.05 annual fee |

Amex KrisFlyer Card | 12,500 bonus miles with $5,000 spent | Low regular earn rates |

Actually, there are TONS of miles cards offering bonus miles when you sign up and spend a specific (large) amount within the first few months, as you can see above.

But notice that most of them require you to pay a hefty annual fee to get the miles. Yup, that’s one of the most ridiculous and oxymoronic things about miles cards: “Get eleventy zillion miles for ‘free’ when you pay the annual fee!”

Screw that. I’d rather charge my LASIK bill to the Amex KrisFlyer Card, even if it means fewer bonus miles. At least there’s a first-year annual fee waiver.

Best miles cards with no expiry — OCBC 90°N, Citi PremierMiles, DBS Altitude

Air miles card | Earn rate (local) | Earn rate (overseas) |

OCBC 90°N Card | $1 = 1.2 miles | $1 = 4 miles (until 29 Feb 2020) / 2.1 miles (subsequently) |

Citi PremierMiles Card | $1 = 1.2 miles | $1 = 2 miles |

DBS Altitude Card | $1 = 1.2 miles | $1 = 2 miles |

If the thought of spending thousands of dollars in just a couple of months makes y0u blanch, these are the 3 miles card options for beginners to slowly play the miles game.

These are especially useful if you’re a fresh grad or generally frugal person without any big expenses coming up; there won’t be any pressure for you to redeem miles anytime soon. That said, the non-promotional earn rates aren’t too spectacular.

Of the 3, the OCBC 90°N Card beats the Citi PremierMiles and DBS Altitude cards in a few ways. Its overseas earn rate is higher (2.1 miles instead of 2), the minimum block of miles for conversion is lower (1,000 miles instead of 10,000), and conversion is free (instead of ~$25).

However, OCBC only has KrisFlyer miles as a partner, and you can’t get miles under any other frequent flyer programme. OCBC also doesn’t give you airport lounge access, while the other 2 do.

Best miles cards with no conversion fees — Amex KrisFlyer, UOB KrisFlyer, OCBC 90°N

Air miles card | How to earn miles |

Amex KrisFlyer Card | Miles directly credited to KrisFlyer account |

UOB KrisFlyer Card | Miles directly credited, but bonus miles are withheld for 14 months |

OCBC 90°N Card | Have to convert from Travel$, but conversion is free |

So maybe you don’t want to stay on top of stupid things like your rewards points balance and making sure they don’t expire on you. Or maybe you’re just giam and don’t want to pay the usual $25 fee to convert your rewards points to KrisFlyer miles.

These 3 credit cards allow you to earn KrisFlyer miles with minimal fuss / fees.

Both the Amex KrisFlyer Card and UOB KrisFlyer card are official SQ KrisFlyer co-branded credit cards, so the miles you earn are credited directly into your KrisFlyer account, no conversion needed. Note that KrisFlyer miles expire after 3 years though.

The UOB KrisFlyer credit card is a lot more troublesome. It requires you to spend $500 on SQ or Scoot before UOB will release the miles, at least 1 year later. Steer clear if you like instant gratification.

As for the OCBC 90°N Card, you earn OCBC Travel$ and have to convert them to KrisFlyer miles the usual way. But there’s no fee and the minimum block of 1,000 miles is very small, so it’s relatively hassle-free.

Premium air miles credit cards in Singapore

Just for fun, I’m going to touch on the premium air miles credit cards for rich people, i.e. those who’re earning $120,000 p.a. and up.

Miles card | Miles earn rate | Bonus miles |

Standard Chartered Visa Infinite Credit Card | $1 = 1.4 miles (local) / 3 miles (overseas) with min. spend $2,000 per month | 35,000 welcome miles with payment of $588.50 annual fee |

Citi Prestige Card | $1 = 1.3 miles (local) / 2 miles (overseas) | 25,000 welcome miles with payment of $535 annual fee |

OCBC Voyage Card | $1 = 1.2 miles (local) / 1.6 miles (local dining) / 2.3 miles (overseas) | 15,000 welcome miles with payment of $488 annual fee |

HSBC Visa Infinite | $1 = 1 or 1.25 miles (local) / 2 or 2.25 miles (overseas). Higher tier applies only to 2nd year onwards | 40,000 welcome miles with payment of $650 annual fee ($488 for HSBC Premier customers) |

HSBC Visa Infinite Credit Card

Card Benefits

$1 = Up to 1.25 air miles (Local)

$1 = Up to 2.25 air miles (Overseas)

Priority Pass™ Membership card will be automatically issued to the primary Cardholder and the supplementary Cardholder(s) - Unlimited access to over 700 VIP airport lounges worldwide

Access to HSBC’s Infinite Travel & Lifestyle Concierge service for personalised assistance, 24/7

Automatic travel insurance coverage of up to US$2,000,000 (annual value worth S$988)

Complimentary limousine transfer and expedited immigration clearance at key airports in Asia

These cards usually require you to pay an annual fee — no waivers! — but they will give you bonus miles. Some miles chasers actually do think it’s a good deal though. For example, if you’re an HSBC Premier customer and you pay your annual fee for the HSBC VI, your 35,000 miles work out to less than 1.4 cents per mile.

One thing you might find surprising is that the miles earn rates are, frankly, not THAT spectacular even though they’re for premium clientele. I mean, the entry-level UOB PRVI Miles card’s earn rates beat most of them.

However, owning one of these credit cards goes beyond just the miles. It’s like having VIP club membership. They really open doors to perks like unlimited airport lounge access, limousine transfers, free entry to spas and golf courses, and so on.

What are air miles and how do they work?

Air miles are part of frequent flyer programmes (FFP), the best-known one here being Singapore Airlines’ KrisFlyer programme. KrisFlyer miles can be used on many partner airlines, including all of Star Alliance.

Technically, you can buy miles with cold hard cash. That’s what some people do — buy KrisFlyer miles because they have nothing better to spend their money on.

But why do that when a credit card will help you earn them for free, right? When you spend on an air miles credit card, you can accumulate frequent flyer miles either directly or by earning points (which you then convert to miles).

Once you’ve got your miles, you can put them towards your next holiday’s airfare. Woohoo!

Here’s a look at the bigger and more well-known FFPs in Singapore:

FFP | Airline | Notes |

KrisFlyer | Singapore Airlines | Offered by all air miles cards (pay conversion fee) |

Asia Miles | Cathay Pacific | Offered by many air miles cards (pay conversion fee) |

Miles & More | Lufthansa | Europe’s largest FFP, not available through air miles cards in Singapore |

KrisFlyer miles: You can earn KrisFlyer miles with any air miles credit card in Singapore, but you’ll usually have to pay a conversion fee (typically $25) each time you change your points to miles. There are also 3 KrisFlyer co-branded cards which let you credit earned miles directly to your account without conversion.

Asia Miles: Almost all air miles credit cards in Singapore will let you change your points to Asia Miles too. The same conversion fee of $25 usually applies. Apart from its parent airline Cathay Pacific, there are many other Asian and European airlines you can use Asia Miles on.

Miles & More: The largest and best-known FFP in Europe, but not available through miles cards in Singapore currently. However, the bulk of Miles & More’s network are Star Alliance airlines, so you can try earning KrisFlyer miles instead.

In addition to these big FFPs which have a lot of airline partners, some banks also allow you to redeem miles with specific airlines’ loyalty programmes, e.g. Emirates Skywards or Thai Airways Royal Orchid Plus.

What should you look out for in a miles card?

Knowing about FFPs and how they work is only half the equation. You also need to know how to choose the right air miles card so you can earn frequent flyer miles FAST.

At the heart of it, getting a good dollar-to-mile earn rate is the key to quickly accruing miles. You’ll usually get a lower earn rate on local spend (your day-to-day spending) and a higher one on foreign currency expenditure (what you spend when you’re travelling overseas or shopping online).

But the reality is not that simple. While a few cards do credit your miles directly into an established FFP, most award points in other types of “currency” such as DBS points or Citi Miles. Be prepared to go through some hassle in order to turn those points into an actual air ticket. There’s usually a minimum amount of points you need to accrue first, then there’s a conversion fee, and a lead time of a week or so before you’ll see miles in your FFP account.

Here’s a breakdown of the common terms you need to know, plus guidelines to what counts as “decent” or “good” for that parameter:

Jargon | Explanation | Benchmark |

Earn rate (local) | How many miles you earn per $1 spent locally | $1 = 1.2 miles |

Earn rate (overseas) | How many miles you earn per $1 spent in foreign currency | $1 = 2 miles |

Bonus miles | Special earn rate when you spend on specific merchants e.g. Agoda, usually for a limited time only | $1 = 3 miles and up (can be as high as 10 miles!) |

Welcome miles | Some cards give you a bunch of miles when you pay annual fee or meet minimum spend | Varies quite wildly |

Rewards points | Though banks advertise “miles”, you actually earn them in the form of “points” (e.g. UNI$ or DBS Points) | — |

Conversion fee | The amount you pay each time you change your points to miles | $25 per conversion |

Expiry | How long you have to accumulate miles/points before they expire | 1 year (some don’t expire at all) |

Cap | Limit on how many miles/points you can earn before the bank stops giving them to you | Usually a cap for bonus miles in the T&Cs, but no cap for regular spending |

Wonder which is the best air miles credit card to get? Compare and apply on MoneySmart and you may be able get vouchers for certain cards!

A parting note on rewards credit cards

Before you rush to sign up for an air miles card, you should also know that rewards credit cards are a viable alternative to air miles cards.

So what’s the secret? I’ve talked about how you actually earn rewards points (rather than miles) with many air miles cards. You can earn those same points with a rewards card as well, and later convert them to miles. In fact, you can think of air miles cards as simply a subset of rewards cards as the points-collecting mechanism is usually the same.

Broadly speaking, air miles cards reward travel-related spending, while rewards cards reward general local spending e.g. shopping and dining.

Good rewards credit cards offer REALLY high bonus points for the latter, making it possible to earn air miles more quickly – for example, $1 = 4 miles on your online shopping spending. However there are usually caps on these. The best card (or combo of cards) really depends on your actual spending habits.

So if you want to be REALLY thorough, check out some of the best rewards credit cards in Singapore as well.

Apply for the best air miles credit cards in Singapore and get attractive vouchers for certain cards!

Related articles

The 7 Best Rewards Credit Cards in Singapore

The Best Credit Cards in Singapore for Free Airport Lounge Access

KrisFlyer Miles Redemption Guide – How to Start Playing the Miles Game in Singapore

The post The 7 Best Air Miles Credit Cards in Singapore (2019) appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

More From MoneySmart

Yahoo Finance

Yahoo Finance