Best AIM Industrial Dividend Payers

The industrials sector tends to be highly cyclical, impacting companies operating in an array of areas such as building products, aerospace and defence. As such, the position a company has relative to the economic cycle drives its level of profitability. Cash flow availability also drives dividend payout, so in times of growth, these companies could provide hefty dividend income for your portfolio. Today I will share with you my list of high-dividend industrials stocks you should consider for your portfolio.

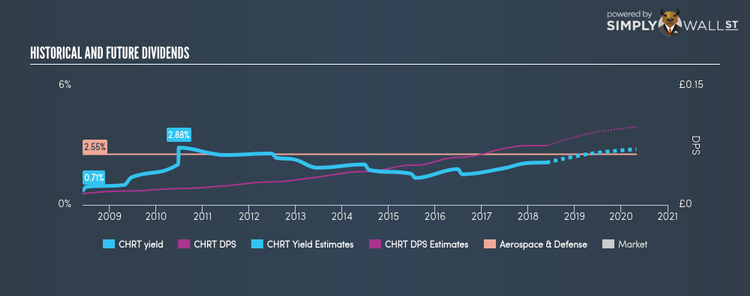

Cohort PLC (AIM:CHRT)

CHRT has a nice dividend yield of 2.13% and their current payout ratio is 49.93% . Over the past 10 years, CHRT has increased its dividends from UK£0.013 to UK£0.074. They have been consistent too, not missing a payment during this 10 year period. The company also looks promising for it’s future growth, with analysts expecting an impressive earnings per share growth rate of over 100% over the next three years. Interested in Cohort? Find out more here.

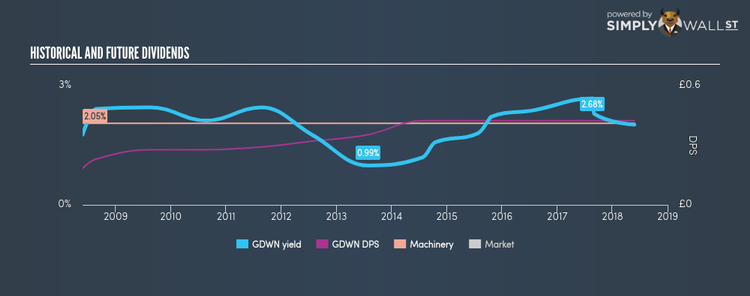

Goodwin plc (LSE:GDWN)

GDWN has a decent dividend yield of 2.02% and their payout ratio stands at 47.96% . GDWN’s last dividend payment was UK£0.42, up from it’s payment 10 years ago of UK£0.18. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. With a debt to equity ratio of 36.17%, GDWN appears to have solid financial health as well. Continue research on Goodwin here.

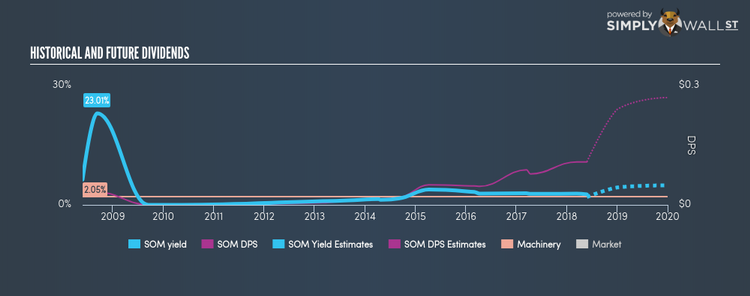

Somero Enterprises, Inc. (AIM:SOM)

SOM has a good dividend yield of 2.62% and the company has a payout ratio of 21.53% , with the expected payout in three years being 67.50%. Despite some volatility in the yield, DPS has risen in the last 10 years from US$0.03 to US$0.11. Interested in Somero Enterprises? Find out more here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance