Beat the Market in 2020 With These 6 Promising Tech Stocks

Technology sector’s juggernaut is expected to continue in the equity space in 2020, thanks to the robust adoption of cloud computing, infusion of AI and ML tools in almost every solution and solid demand for wearables and smart-connectivity solutions, including smart speakers.

Moreover, the emergence of hybrid cloud, which allows enterprises to maximize the benefits of both public and private cloud environments, boosts technology’s prospects.

Further, the democratization of Blockchain technology, thanks to Facebook’s endeavor with Libra, is a key catalyst.

AR/VR devices adoption is also expected to expand beyond gaming to industrial, banking & finance and healthcare sectors.

Additionally, self-driving vehicles are expected to evolve from Level-2/3 to Level-4 (almost autonomous), driving growth for chips, sensors and software. In fact, Goldman Sachs believes that the first commercially available semi-autonomous cars (Level 4) could be on the road in the next one or two years.

Moreover, the accelerated deployment of 5G technology is likely to create further growth opportunities in the telecom space for tech stocks in 2020.

Improving Semiconductor Market: A Key Catalyst

Semiconductors, which are the building blocks of most emerging technologies like AI and IoT, reported improved sales in August, September and October. The sequential improvement indicates a recovery in the chip market.

Per World Semiconductor Trade Statistics, global semiconductor sales are expected to increase 5.9% in 2020 against an estimated decline of 12.8% in 2019.

Robust demand for memory chips and other semiconductor solutions, on account of the rapid adoption of cloud computing, AI, IoT, autonomous cars, ADAS, gaming, wearables, drones and VR/AR devices, is a major growth driver.

Additionally, excess NAND and DRAM inventory, which limited growth for the most part of 2019, is expected to normalize, thereby improving ASP.

Moreover, a partial respite from the U.S.-China trade war is expected to drive technology stocks in 2020.

Strategy to Craft a Winning Portfolio in 2020

With the help of our Zacks Stock Screener, here we pick six technology stocks that have a favorable combination of a VGM Score of A or B and a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Per the Zacks’ proprietary methodology, stocks with such favorable combinations offer good investment opportunities.

Apart from having strong fundamentals, these stocks have a market cap of more than $5 billion. Further, the long-term earnings growth rate of these stocks is more than 5%.

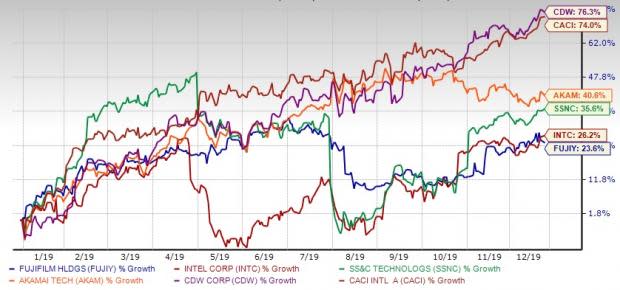

Year-to-Date Performance

Our Picks

FUJIFILM FUJIY sports a Zacks Rank #1 and has a VGM Score of A. This Tokyo, Japan-based company has a market cap of $19.88 billion.

FUJIFILM’s expanding footprint in the fast-growing healthcare sector based on acquisitions is a key catalyst. Additionally, the company’s expanding Imaging solutions product pipeline, which includes mirrorless digital cameras, is a growth driver.

The Zacks Consensus Estimate for fiscal 2020 earnings has increased 7.9% to $3.67 per share in the past 60 days.

Long-term earnings growth is pegged at 9.9%.

CDW Corporation CDW is expected to benefit from strong end markets across corporate, small business, government and healthcare sectors. Moreover, the company’s robust product portfolio and frequent product refreshes are major tailwinds.

CDW has a Zacks Rank #2 and a VGM Score of A. The Lincolnshire, IL-based company has a market cap of $20.68 billion.

The Zacks Consensus Estimate for 2020 earnings has increased 2.5% to $6.52 per share in the past 60 days.

Long-term earnings growth is pegged at 13.1%.

Windsor, CT-based SS&C Technologies Holdings SSNC is expected to benefit from an improving sales pipeline. Additionally, key management changes are expected to boost sales execution.

In fact, continuing deal wins along with the release of new solutions is expected to aid the top line. SS&C Technologies expects organic revenues to grow between 3% and 5% in 2020.

Moreover, acquisitions like Investrack (in the Middle East) and Algorithmics (from IBM) strengthen the portfolio and enhance the total addressable market.

SS&C Technologies has a Zacks Rank #2 and a VGM Score of A. The Zacks Consensus Estimate for 2020 earnings has increased 2.5% to $6.52 per share in the past 60 days.

Long-term earnings growth is pegged at 7% for this $15.37-billion company.

Cambridge, MA-based Akamai Technologies AKAM has a Zacks Rank #2 and a VGM Score of B.

Solid demand for Kona Site Defender, Prolexic Solutions, new Bot Manager Premier and Nominum Services are key catalysts. Further, increasing adoption of mobile data/apps amid growing mobile data traffic bodes well for Akamai.

The Zacks Consensus Estimate for 2020 earnings has increased 1.3% to $4.77 per share in the past 60 days.

Long-term earnings growth is pegged at 12%.

Arlington, VA-based CACI International CACI is expected to benefit from new business wins and on-contract growth, which will aid organic expansion. The company expects to accelerate organic revenue growth and continued margin expansion throughout fiscal 2020.

CACI International also has a Zacks Rank #2 and a VGM Score of B. Further, the consensus mark for fiscal 2020 earnings has increased 1.2% to $12.23 per share in the past 60 days.

Long-term earnings growth is pegged at 10%.

Another Zacks Rank #2 stock, Intel Corporation INTC, is expected to benefit from growth in the data-centric business, driven by robust adoption of high-performance products, including Xeon Scalable processors and connectivity solutions, through 2020.

This $256.43-billion, Santa Clara, CA-based tech giant has a VGM Score of B. Moreover, the consensus mark for fiscal 2020 earnings has increased 4% to $4.72 per share in the past 60 days.

Long-term earnings growth is pegged at 7.5%.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 top tickers for the entirety of 2020?

These 10 are painstakingly hand-picked from over 4,000 companies covered by the Zacks Rank. They are our primary picks to buy and hold. Start Your Access to the New Zacks Top 10 Stocks >>

Click to get this free report Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report CDW Corporation (CDW) : Free Stock Analysis Report CACI International, Inc. (CACI) : Free Stock Analysis Report SS&C Technologies Holdings, Inc. (SSNC) : Free Stock Analysis Report Fujifilm Holdings Corp. (FUJIY) : Free Stock Analysis Report Intel Corporation (INTC) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance