Bearish: This Analyst Is Revising Their Blue Bird Corporation (NASDAQ:BLBD) Revenue and EPS Prognostications

Today is shaping up negative for Blue Bird Corporation (NASDAQ:BLBD) shareholders, with the covering analyst delivering a substantial negative revision to this year's forecasts. Both revenue and earnings per share (EPS) estimates were cut sharply as the analyst factored in the latest outlook for the business, concluding that they were too optimistic previously. Investors however, have been notably more optimistic about Blue Bird recently, with the stock price up a notable 23% to US$10.87 in the past week. With such a sharp increase, it seems brokers may have seen something that is not yet being priced in by the wider market.

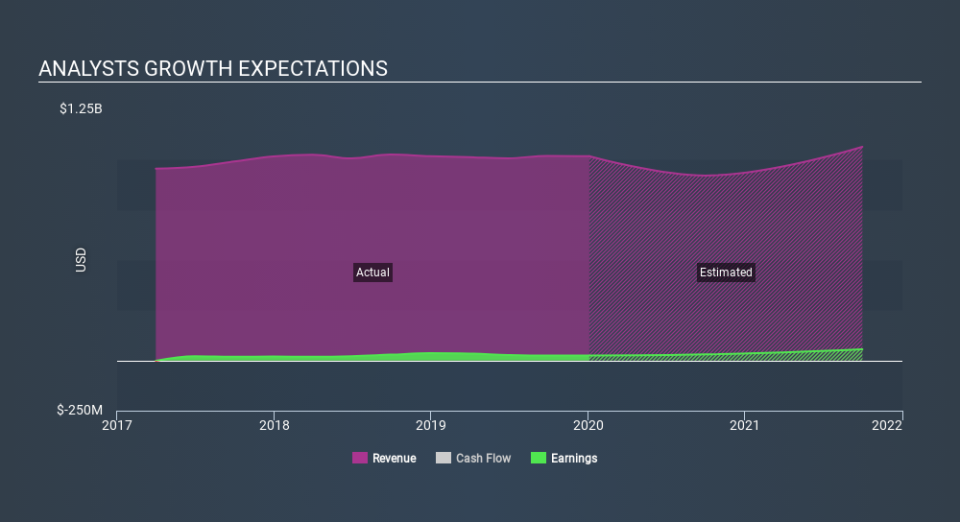

Following the downgrade, the consensus from single analyst covering Blue Bird is for revenues of US$921m in 2020, implying a definite 9.5% decline in sales compared to the last 12 months. Statutory earnings per share are presumed to ascend 18% to US$1.12. Previously, the analyst had been modelling revenues of US$1.0b and earnings per share (EPS) of US$1.63 in 2020. Indeed, we can see that the analyst is a lot more bearish about Blue Bird's prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for Blue Bird

The consensus price target fell 15% to US$22.00, with the weaker earnings outlook clearly leading analyst valuation estimates.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would highlight that sales are expected to reverse, with the forecast 9.5% revenue decline a notable change from historical growth of 3.6% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 0.6% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Blue Bird is expected to lag the wider industry.

The Bottom Line

The biggest issue in the new estimates is that the analyst has reduced their earnings per share estimates, suggesting business headwinds lay ahead for Blue Bird. Unfortunately the analyst also downgraded their revenue estimates, and industry data suggests that Blue Bird's revenues are expected to grow slower than the wider market. With a serious cut to this year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of Blue Bird.

There might be good reason for analyst bearishness towards Blue Bird, like its declining profit margins. For more information, you can click here to discover this and the 3 other risks we've identified.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance