Bear of the Day: YETI Holdings (YETI)

Company Overview

Zacks Rank #5 (Strong Sell) stock Yeti Holdings (YETI) is a producer focused on high-end products temperature regulation products such as stainless-steel drinkware, ice chests, coolers, and similar accessories. The company’s products are built to endure rugged outdoor conditions and are prevalent in the fishing, hunting, and camping communities. Yeti products rose to prominence when the marketplace began to understand and appreciate how long the company’s products have been able to keep contents cold or warm.

Competition is Heating Up

From 2018 to 2021, Yeti products caught fire and led to an earnings growth spurt. Annual earnings per share (EPS) grew 221% in 2018, 18% in 2019, 76% in 2020, and 39% in 2021. However, though Yeti products are very popular with enjoy a loyal following, they can be replicated by the competition and are not 100% unique in the marketplace.

For example, Stanley is a company that sells a similar product to Yeti’s temperature-regulating drinkware. Though the company is more than a century old, Stanley’s water tumbler is trending on the social media platform TikTok. The Stanley cup (not the hockey one) was introduced nearly a decade ago but has garnered a cult-like following by ditching old marketing concepts and utilizing TikTok influencers to spread the word. Like Yeti’s product line, Stanley cups can keep drinks hot or cold for several hours.

Relative Weakness

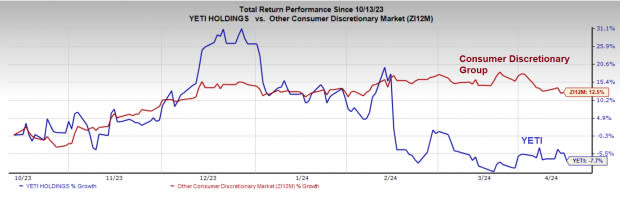

Yeti’s souring fundamental picture is leading to weakness in the shares. Not only are YETI shares negative year-to-date, but they are also underperforming industry peers over the past six months. Clearly, YETI is a laggard, and if there is one lesson I have learned over the years, it’s that weakness tends to beget weakness on Wall Street.

Image Source: Zacks Investment Research

Wall Street is Souring on the Stock

Recent analyst revisions are one of the best ways to predict a stock’s next move and are an integral part of our Zacks Ranking system. A whopping 10 analysts tracked by Zacks revised YETI EPS estimates lower over the past 60 days.

Image Source: Zacks Investment Research

Bear Flag Pattern

YETI shares were slammed lower in February and have now rebounded in a slow, weak rally to the descending 50-day moving average, setting up a classic bear flag pattern.

Image Source: TradingView

Bottom Line

Souring fundamentals, increased competition, and relative weakness are valid reasons to avoid YETI shares.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

YETI Holdings, Inc. (YETI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance