Bear of the Day: Halliburton (HAL)

Despite the broad market returning miles of smiles to investors, a handful of industries are still negative on the year. Among them, the Oil and Gas Equipment and Services industry. That industry is off 4.2% YTD. It’s made for plenty of frustration for investors in this industry. One of the stocks in this industry happens to be today’s Bear of the Day. I’m talking about Halliburton (HAL).

Halliburton Company provides a range of services and products to oil and natural gas companies worldwide. The company's Completion and Production segment offers production enhancement services, including stimulation and sand control services; and cementing services, such as bonding the well, well casing, and casing equipment.

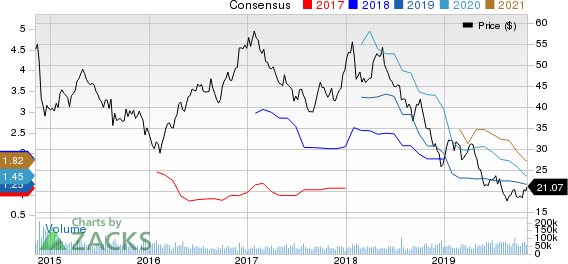

The company is currently a Zacks Rank #5 (Strong Sell) in an industry that ranks in the Bottom 9% of our Zacks Industry Rank. The reason for the unfavorable rank is the series of earnings estimate revisions coming in to the downside. Over the last thirty days, nine analysts have cut their estimates for the current year, while ten have done so for next year. That bearish sentiment has dropped the Zacks Consensus Estimate from $1.34 to $1.25 for the current year, and down from $1.84 to $1.45 for next year.

Halliburton Company Price and Consensus

Halliburton Company price-consensus-chart | Halliburton Company Quote

That sort of negative revision history has been haunting the stock for months now. The stock was trading close to $55 as recent as May of last year. Since then, prices have been spiraling downward. Shares hit a fresh 52-week low of $17.21 on August 27th, 2019. The stock is currently trading at $21.05.

If you are looking for other stocks within the same industry, there are a few companies to research further. Zacks Rank #2 (Buy) Praxair (LIN) is an idea to investigate further. There are also a handful of Zacks Rank #3 (Hold) stocks like Archrock (AROC).

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Halliburton Company (HAL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance