Bank of England maintains interest rate at 0.5pc; retail sales bounce back

Bank of England maintains interest rate at 0.5pc

May rate hike could be on the cards, BoE hints

Europe expects to escape US metal tariffs

Retail sales volumes rose 0.8pc in February

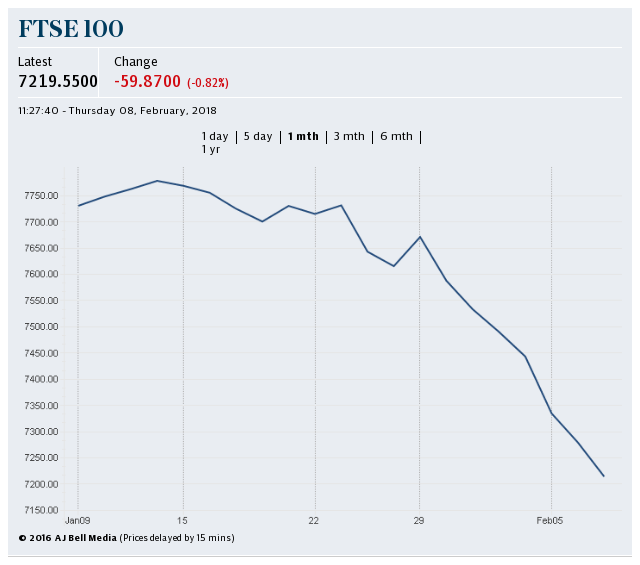

Financials drive FTSE index to 15-month low

US stocks tumble on expectations of China tariffs

Europe expects to escape US metal tariffs

Europe is expecting to be granted an exemption from punitive US tariffs on steel and aluminium later today in a move that will temporarily diffuse the mounting risk of a trade war.

Cecilia Malmström, the EU’s trade commissioner, returned from Washington overnight to tell the European Parliament that she “expects” that the US will announce an exemption later today.

The eleventh-hour reprieve for Europe and the UK comes as the US is imposes 25 per cent tariffs on steel and 10pc tariffs on aluminium from midnight tonight US time. The EU had threatened to impose retaliatory measures on iconic US products such as Kentucky bourbon and Harley Davidson motorbikes.

Read the full report from Peter Foster and James Crisp here.

US stocks tumble on expectations of China tariff announcement

US stocks tumbled on the open ahead of an anticipated announcement by the Trump administration of harsh tariffs on China, stoking concerns about a trade war.

The Dow Jones Industrial Average fell 1.3pc in early trading to 24,370.30. The broad-based S&P 500 dropped 1.1pc to 2,682.21, while the Nasdaq Composite Index, which is heavily weighted towards technology stocks, lost 1.3pc to 7,252.33.

Facebook down 2pc on open

Facebook shares were down 1.99pc this morning after falling 2.8pc in pre-market trading and down. Shares were down about 11pc this week after founder Mark Zuckerberg’s statement and an interview on CNN last night.

"This was a major breach of trust and I'm really sorry that this happened" the Facebook founder told CNN. "We have a basic responsibility to protect people’s data and if we can’t do that then we don’t deserve to have the opportunity to serve people."

US equity futures in decline

US equity futures were down early in the US morning as concerns about global trade mounted.

Stocks falling out of bed a little bit this morning. NASDAQ-100 futures leading the way down https://t.co/y8N7uMKVvSpic.twitter.com/EYc6IBlC5K

— Joe Weisenthal (@TheStalwart) March 22, 2018

'Delicate balancing act' for Bank of England

Ben Brettell, senior economist at Hargreaves Lansdown, says that the Bank of England faces a "delicate balancing act".

"Inflation seems to be falling back towards the target of 2pc, as the effect of the weaker pound starts to filter out of the calculation. But a pick-up in wage growth points to an erosion of slack in the labour market. This raises the prospect that a wage-price spiral could push inflation back up in future. Throw in a hefty dose of Brexit-related uncertainty and it’s easy to see why the committee is divided at present."

Pound sinks back down after initial spike

A classic knee-jerk reaction in markets to the MPC today. Sterling initially higher after the split rate vote, but then lower as the absence of a strong steer that they will hike in May sinks in: pic.twitter.com/1zJmSyWLQ5

— Samuel Tombs (@samueltombs) March 22, 2018

IoD: Bank is right to hold but 'must tread lightly'

Business leaders will likely welcome the Bank of England's decision not to "spring any surprises this month", says Tej Parikh, senior economist at the Institute of Directors. "But firms and households will be on tenterhooks for what comes in May."

He adds: "The Bank has been paving the way for a rate rise, but must tread lightly until there is richer evidence of growing inflationary pressures, to avoid unnecessarily placing a speed bump in the way of economic activity.

“The future path for prices has been muddied by recent developments. A dip in inflation – with the impact of weaker sterling finally washing through – alongside softer economic growth and the potentially dampening impact of snowy weather on business activity in Q1, certainly made the case for holding rates this month.

“The Bank has also been focusing in on Brexit negotiations and tightness in labour market. On the former, the transition agreement has removed a major hurdle for economic confidence, and for the latter near record lows of unemployment have seen some pick-up in earnings. While both could increase inflation, the effect is likely to be limited, as businesses still face uncertainty around the precise nature of Brexit and SMEs currently do not have the capacity to raise wages significantly, given high costs and productivity constraints.

“All in all, it’s unclear how prices will evolve from here, so it’s best to wait and see.”

Pound jumps on May rate hike expectations

GBP Intraday (Following BOE Decision): 7-2 in favor of no change, 2 wanted a hike pic.twitter.com/nRcXgtNfI4

— Michael McDonough (@M_McDonough) March 22, 2018

Bank of England maintains bank rate at 0.5pc

The Bank of England's Monetary Policy Committee decided to maintain the bank rate at 0.5pc, but has given its strongest hints yet that rates will go up in May.

Wages are rising, domestically-generated inflation is coming back to life, and productivity is still stubbornly failing to take off - all factors which mean the Monetary Policy Committee (MPC) expects to raise rates in an effort to pull inflation down to 2pc in the years ahead.

The combination of improving growth and a second rate rise - following November's hike from 0.25pc to 0.5pc - would be a further indication that the need for crisis-era policies is coming to an end.

Two members of the MPC voted to raise rates from 0.5pc to 0.75pc immediately.

But the remaining seven members overruled them, for now.

"The best collective judgement of the MPC remained that, given the prospect of excess demand over the forecast period, an ongoing tightening of monetary policy over the forecast period would be appropriate," said the minutes of their meeting.

"For the majority of members, however, that did not require an increase in Bank Rate at this meeting.

"The May forecast round would enable the Committee to undertake a fuller assessment of the underlying momentum in the economy, the degree of slack remaining and the extent of domestic inflationary pressures."

Mark Carney, the Bank's Governor and chairman of the MPC, had previously indicated that markets were underestimating the Bank's rate hike plans.

Read Tim Wallace's full report here.

De La Rue shares fall as it looks set to lose out on blue passport contract

De La Rue's shares fell as much as 6.7pc to 470p in early trade before recovering slightly to 481p, on the back of a difficult few days for the bank note and passport printer.

The firm is about to lose out on a contract to make the new iconic blue passport and its boss Martin Sutherland has demanded answers from Theresa May, as a Cabinet minister said the deal has not yet been signed.

Mr Sutherland confirmed a Franco-Dutch company is expected to win the £490m deal but called for the Prime Minister to visit its factory in Gateshead and explain to "proud" staff why the new document will be made in France, not the UK.

Earlier this week the company announced the departure of chief financial officer Jitesh Sodha and warned that profits would be at the low end of expectations, prompting shares in the business to fall more than 20pc.

Read the full report from Kate McCann here.

Financials drive FTSE index to 15-month low; EU leaders discuss trade dialogue plans

The FTSE 100 declined as traders focused on an upcoming policy decision by the Bank of England and concerns over potential trade wars weighed on sentiment, while the stronger sterling put pressure on the index.

The index was down 0.5 percent at 7,001.57 points by 10am, after briefly dipping below the 7,000-point level to a fresh 15-month low at its open, Reuters reports.

The US Federal Reserve's less hawkish than expected rate increase put pressure on financials. Banks, which are typically seen to benefit from higher rates, were impacted, with shares in HSBC, Barclays and Standard Chartered all down more than 1pc.

Elsewhere, concerns over US import tariffs were in focus as EU leaders gathered to discuss how best to enter into a trade dialogue with President Donald Trump, Reuters reports. The US tariffs on steel and aluminium imports are due to come into force on Friday, prompting concerns about increasing protectionism in global trade, as well as the impact it could have on growth.

Flybe shares plunge 25pc after Stobart scraps bid interest

The owner of London Southend Airport has withdrawn its interest in UK carrier Flybe, sending the airline’s shares plummeting by 25pc.

Stobart said that, after mulling a swoop for the regional airline in February, the pair had been “unable to reach agreement on satisfactory terms”, after Flybe's board rejected a proposal from Stobart.

The company said it was “not in its shareholders' best interests to increase its latest proposal for Flybe above the level which was rejected by the board of Flybe”.

GSK in pole position to buy Pfizer's consumer health business as Reckitt drops out

GlaxoSmithKline is in pole position to acquire US giant Pfizer’s consumer healthcare business after its fellow FTSE 100 firm Reckitt Benckiser withdrew from bidding.

Reckitt, which makes healthcare and cleaning products including Clearasil and Air Wick, said this morning that it had ended talks with Pfizer because it did not want to acquire the whole division and failed to persuade the pharmaceutical maker to sell just part of it.

Shares in Reckitt were the highest risers this morning on the back of the news, which assuaged concerns that Reckitt would need to over-leverage or consider a rights issue.

Read Jack Torrance's full report here.

Pent-up demand may have helped retailers but March could bring disappointment

Richard Lim, Chief Executive, Retail Economics says: “An element of pent-up demand is likely to have benefited some retailers, but the underlying trend remains soft. Inflation is still eroding shopper’s personal finances which is contributing to the apparent malaise on UK high streets.

“But consumer demand is just one side of the equation. Retailer are battling against spiralling costs and seismic structural changes which has become debilitating for many retailers, evidenced by a recent wave of administrations.”

UK #retail sales appear to have escaped the #BeastFromTheEast but outlook still looks challenging. Spending squeeze past the worst, but disposable incomes set to remain subdued pic.twitter.com/TKYjAOQCcn

— James Smith (@SmithEconomics) March 22, 2018

Ben Brettell, senior economist at Hargreaves Lansdown, adds: "The champagne remains on ice for now. The monthly numbers are always volatile, and the underlying trend is still one of weakness.

"There’s also a risk of further disappointment in March, with the Beast from the East bringing economic disruption and keeping consumers at home.

"In particular, non-food bricks and mortar retailers have been struggling of late, as shown by the demise of the likes of Toys R Us and Maplin. Supermarkets are faring better, and were responsible for much of February’s sales growth.

"Yet the UK consumer has been surprisingly resilient in the face of economic uncertainty, and there could be some light at the end of the tunnel for those suffering a squeeze in household budgets. Figures released this week showed inflation falling back and wage growth ticking upwards. If real wages begin to rise again this could bode well for the retail sector."

Retail sales bounce back

Tim Wallace reports that retail sales increased in February, partly reversing dips in December and January.

Volumes rose 0.8pc on the month, the Office for National Statistics said, with sales up 1.5pc compared with February last year.

Inflation had been draining shoppers’ spending power - families spent an extra 3.9pc above what they shelled out in February 2017.

But price rises are slowing and wages are picking up, adding to hopes that the poor performance around the turn of the year may be coming to an end.

Ruth Gregory at Capital Economics says: “February’s retail sales figures showed that the pace of spending growth has been pretty feeble so far this quarter.”

“However, at least the timelier survey measures suggest that spending growth is now turning a corner. And with inflation likely to continue to fall back this year and clearer signs of revival in pay growth, consumer spending should receive more fundamental support as the year progresses.”

She expects annual spending growth to rise from 1.4pc at the end of 2017 to 2pc in a year’s time, “helping the economy to re-gain a bit of momentum”.

Sterling rose as much as 0.3 percent to $1.4179, its highest level since Feb 2 after the data.

What Facebook knows about you - and how it uses your information

The Cambridge Analytica scandal has been one of the biggest crises to hit Facebook and its chief executive Mark Zuckerberg since the company was founded 14 years ago. But the episode has also led many users to re-evaluate their relationship with the social network, and question exactly what they are sharing.

Read more and try out our interactive tool to see how Facebook collects information about you and what it does with it here.

All eyes on the Bank of England meeting

The Bank of England's meeting minutes being released later today is in focus, with market participants keeping a close eye on the central bank's policy views after strong British wage data. City analysts expect that the central bank will raise rates as early as May.

The pound extended its overnight rally and rose to a six-week high of $1.4163, while the dollar was down 0.3pc at 105.715 yen after slipping about 0.5pc the previous day. The euro added 0.2pc to $1.2365 following a gain of 0.8pc overnight.

Dollar weaker on Fed rates decision

The dollar struggled against its peers on Thursday after the Federal Reserve maintained the view that it would raise interest rate three times in 2018 instead of the four that some currency bulls had hoped for, Reuters reports.

The Federal Reserve said it would raise rates for the fourth time in 12 months, this time by 25 basis points to 1.75pc on Wednesday and forecast at least two more hikes for 2018, highlighting its growing confidence that tax cuts and government spending will boost the economy and inflation and spur more aggressive future tightening.

Yahoo Finance

Yahoo Finance